Circular e-commerce | The second-hand market booms

12/01/21

9'

Sustainability and brand values are increasingly important to consumers and key issues in retail for several years now. The development of e-commerce, excess packaging, and the environmental impact of deliveries will be even more evident this year and post-pandemic.

The lockdown period triggered a mass purchase movement based on consumer conviction to buy and support local actors as much as possible. Now more than ever, consumers are committed to “voting” with their wallets—a trend that is expected to continue in 2021 and beyond.

The second-hand market is a key trend. Long represented by players such as Depop and Vinted, or more historically eBay, this model is now extending to more traditional brands and retailers. This is increasingly true in the fashion sector, which has long been decried for the damage caused to the environment by “fast fashion”.

Key figures and new consumer expectations

Are you curious to learn more about the circular economy? You should be! In 2020, the circular economy was one of the main drivers of business transformation, thanks to changing consumer attitudes that are forcing brands to evolve.

1. Why your business should go circular

Simply put, the circular economy involves the implementation of dynamic systems, without a specific endpoint in business processes, whether through the supply chain or the various points of contact with consumers.

Consumers want a circular economy not only because it is a responsible and sustainable way for brands and retailers to operate, but also because it’s a more convenient system.

Circular operations allow consumers to put a used or unwanted product back into the supply chain—either by recycling it, renting it, or reselling it. Circular companies (selling clothing, food, travel, etc.) apply best practices in manufacturing and distribution, are innovative, and fully focused on global solutions, rather than compartmentalized problems.

In a world where only 9% of the economy is circular, it is estimated that the potential benefit from converting the remaining 91% is around $4.5 trillion. The circular economy is the largest wave of business transformation since the Industrial Revolution.

Technology is seen as a gas pedal facilitating the transition to a circular economy on a global scale, but there is no need to reinvent the wheel. The technologies currently available are more than capable of delivering the desired results and more. According to world leaders in the consumer industries, the problem lies more in managing change—this is what needs to be worked on over the next decade.

2. The fashion sector is particularly impacted

A new force is reshaping the fashion industry: second-hand clothing. According to a new report, the U.S. used apparel market is expected to more than triple in value over the next 10 years—from $28 billion in 2019 to $80 billion in 2029—the market currently stands at $379 billion in the U.S. In 2019, second-hand clothing grew 21 times faster than traditional retail.

Second-hand clothing is challenging the predominance of “fast fashion” (a business model characterized by cheap, disposable clothing that emerged in the early 2000s, embodied by brands such as H&M and Zara). Fast fashion grew exponentially over the past two decades, dramatically altering the fashion landscape by producing more clothes, distributing them faster, and encouraging consumers to overbuy at low prices.

While “fast fashion” should continue to grow by 20% over the next ten years, second-hand fashion is expected to grow by 185%.

Perception of second-hand clothing has changed, with many consumers now considering second-hand clothing to be of the same or even higher quality than unworn clothing. A trend towards “fashion flipping”—buying second-hand clothes and reselling them—has also emerged, among younger consumers in particular.

Thanks to growing consumer demand and new digital platforms that facilitate the exchange of clothes between individuals (such as Tradesy and Poshmark) the online resale market is fashion’s next big business.

The market for second-hand luxury goods is also increasingly important. Retailers such as The RealReal or Vestiaire Collective provide a digital marketplace for an authenticated consignment of luxury goods. Consumers can buy and sell designer brands such as Louis Vuitton, Chanel, and Hermès. This sector reached $2 billion in value in 2019.

Ben WhitakerExpect retailers to explore more ways to take control of all stages of the secondary market process in the same way that many exert control over their retail partner processes. By controlling the condition, pricing, and sales channels through which second hand or refurbished inventory is sold, retailers can control the brand experience.

Founder – Cirqulr

Many new initiatives are emerging

Aware of necessary changes and increasing consumer demand, many marketplaces and brands are stepping into the new world of opportunities provided by the circular economy.

- LaRedoute.fr launches a space dedicated to second-hand: La Reboucle

La Redoute customers can now access a new dedicated area on the website dedicated to second-hand products. “La Reboucle” is a C2C service that aims to offer innovative and tailored solutions to customers, combining a CSR approach with increased purchasing power.

Through La Reboucle, the brand offers a new, simple, and effective service for selling and buying second-hand products (fashion, decoration, homeware). The platform accepts both La Redoute brands or others, whether or not the product was purchased on the LaRedoute.fr website. For each sale, customers can then choose to be paid in cash or to receive an e-card with a 25% discount.

Disruptual, the leader in SaaS platforms for the second life of C2C products, provides brands and retailers the opportunity to regain control of the second-hand market. Counting about fifteen online platforms for major brands (La Redoute, Promod, Cyrillus, Tape à l’oeil, Kaporal, Jacadi, Picwictoys, etc.), the company’s founder Olivier Clair indicates a strong acceleration in demand:

Olivier ClairThe second-hand market has the ability to check all the boxes related to CSR and business. Brands can extend their contact time with their customers (sale of new and used products), build loyalty, and create traffic in-store or online.

Founder – Disruptual

When a sale is finalized, the seller can choose between payment to their bank account or a gift card. 70% of sellers opt for the gift card to be used in the brand’s network of boutiques, spending on average 2.5 times the value of the gift card.

Second life is also an opportunity to discover a brand, to test a product at a lower cost, and ultimately to become a “new product” customer.

- Tous gives a second life to jewelry pieces

TOUS has been present in the jewelry industry since 1920. Developing the art of giving a second life to jewelry, the brand excels in restoration, reuse, and recycling. 40% of the brand’s collections are produced in a workshop of 90 multidisciplinary craftsmen specialized in electroforming and micro-casting. The establishment has adopted a rigorous waste management policy that has enabled the recycling and recovery of metals and raw materials. It has a treatment plant that treats contaminated wastewater to have no impact on the environment.

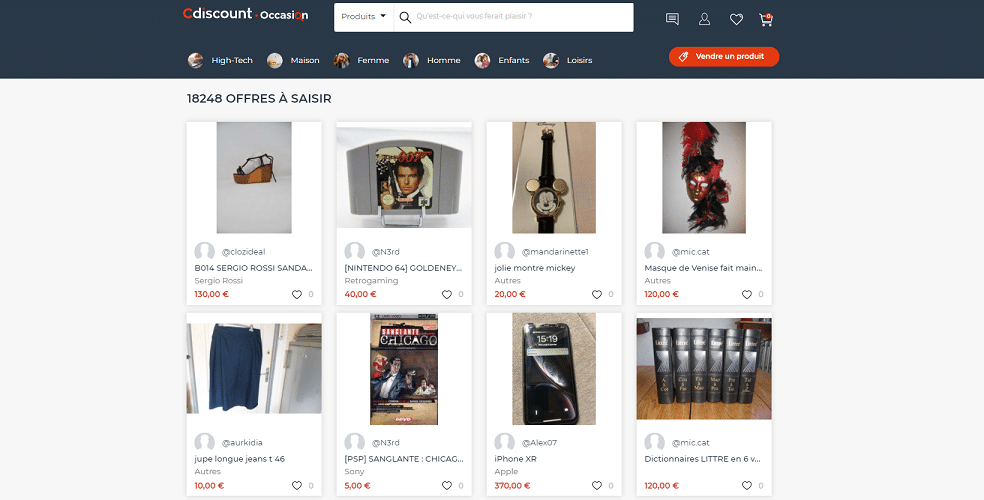

- Cdiscount launches a C2C resale website: Cdiscount Occasion

Cdiscount has made its entry into the world of second-hand with Cdiscount Occasion. This is a new strategic activity for the group, providing customers the possibility to buy and sell second-hand products (high-tech, video games, DIY, toys, fashion, books, etc.). The platform promises to connect 10 million people who will be able to purchase while saving money. This is a new illustration of the group’s commitment to a more responsible digital model.

Cdiscount joins sites such as Leboncoin and Vinted, two major players in the exchange of second-hand items. Cdiscount Occasion’s functions much like Vinted. Each member is assigned a wallet, where the money is deposited with each sale. This can be used to make purchases. Sellers take care of their own shipping. A 5% commission (excluding delivery costs) is applied to each transaction, as well as a service charge of €0.70.

- Asics analyzes the life cycle of its products to reduce CO2 emissions

Through Life Cycle Assessment (LCA), ASICS studies the environmental and social impacts of its products at every stage of their life cycle, from material sourcing to recycling or disposal. The results of these assessments are then used to improve ASICS’ approach to product design and development. For example, in 2018, ASICS performed an LCA on its GEL-KAYANOTM 25 running shoes and compared the results with a previous model of this style. The analysis showed that ASICS reduced CO2 emissions per pair by approximately 24%.

- Veepee and the brand Aigle give products a second life with Re-cycle

With Re-cycle, Veepee has designed a circular initiative to support the challenges of its partner brands in the fashion industry, with high-quality products that are designed to last and be passed on.

At the first “Re-cycle” event, members could send unwanted clothes and boots from the brand Aigle to Veepee. For each product, members received a voucher worth between 10 and 30€ to be used at Aigle. Shipment is facilitated by the provision of a prepaid return label and a list of local stores to drop off the parcel.

This solution is offered to all partnered brands to enable them to meet the challenges of the life cycle of their products.

For each of these events, Veepee will collect all returned products and sort them. Heavily used products will be recycled by specialist partners; the rest will be repaired. Following this step, several options will be considered to give a second life to these refurbished products.

Ben WhitakerExpect to see the major marketplaces, like Amazon and eBay, fight for their share of the refurbished and second-hand market, as they leverage available capital, proven technology, existing relationships with long-standing buyer bases and logistics channels to offer retailers a consistent flow of revenue, and buyers a consistent experience.

Founder – Cirqulr

There are many other examples of circular options and companies working with the objective of serving a real purpose, but the story that attracts media attention is often of a different nature: either speculating on solutions that cannot be implemented on a larger scale, or focusing solely on the problem, inciting panic.

However, the important thing to remember is that businesses and consumers are ready to change and that many actions are already being taken. Companies with a sustainable business and a voice will make a difference over the next few decades. Making the right choices almost always pays off for individuals and companies alike!

Find out more by listening to our expert panelists share their opinion on the “Circular e-commerce: embracing a new model to stay relevant” round table at Lengow Day:

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'