European E-Commerce report: 621 billion euro turnover in 2019

27/06/19

3'

The 2019 edition of the Ecommerce Foundation’s annual report on the European market has been published. The report delves into the details of Europe’s B2C e-commerce market, including consumer behaviours and trends. While the European e-commerce market continues to grow with sales of 621 billion euros expected for 2019, there are many other figures are also worth listening to. Discover the e-commerce trends in Europe below.

NB: The Ecommerce Foundation includes countries such as Russia, Turkey, Iceland and Ukraine in its report on Europe.

Good but uneven e-commerce conditions in Europe

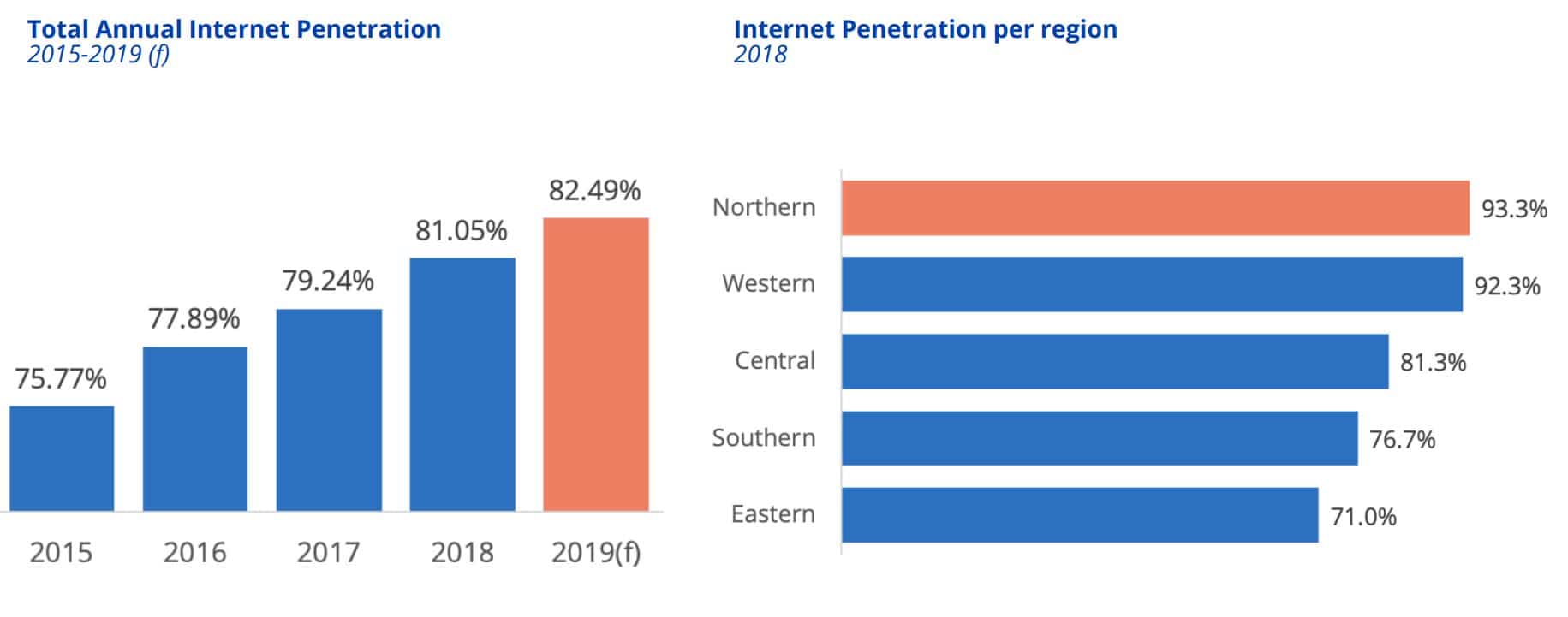

According to the report, internet penetration in Europe is expected to reach 82.49% this year, a slight increase from 2018. Since 2016 (77.89%), internet penetration has increased by almost 6%. This is good news for online trading in Europe. It should be noted, however, that the rate of internet penetration varies from region to region. Northern (93.3 %) and Western Europe (92.3 %) have high rates, while Southern (76.7 %) and Eastern Europe (71 %) continue to lag behind.

In 2018, Iceland (99%), Denmark, Norway and Switzerland (both 98%) had the highest rates of internet usage. Croatia (69%), Bulgaria (67%) and Ukraine (64%) lagged behind.

In turn, these figures affect the proportion of internet users who order products online. Countries such as Switzerland (88%), the UK (87%), Denmark (86%) and the Netherlands (84%) are among the leaders for online shoppers. European countries with the least online shoppers are Bulgaria (31%), Romania (26%) and Ukraine (22%).

Focus: the top three e-commerce markets in Europe

Western Europe is home to the continent’s three most important e-commerce markets where 81.4% of the population are e-shoppers: the UK, Germany and France.

In the UK, 87% on the population shop online, while in Germany and France the shares are 83% and 76% respectively. While credit card payments are particularly popular in the UK and France, Paypal and invoicing are the most popular in Germany.

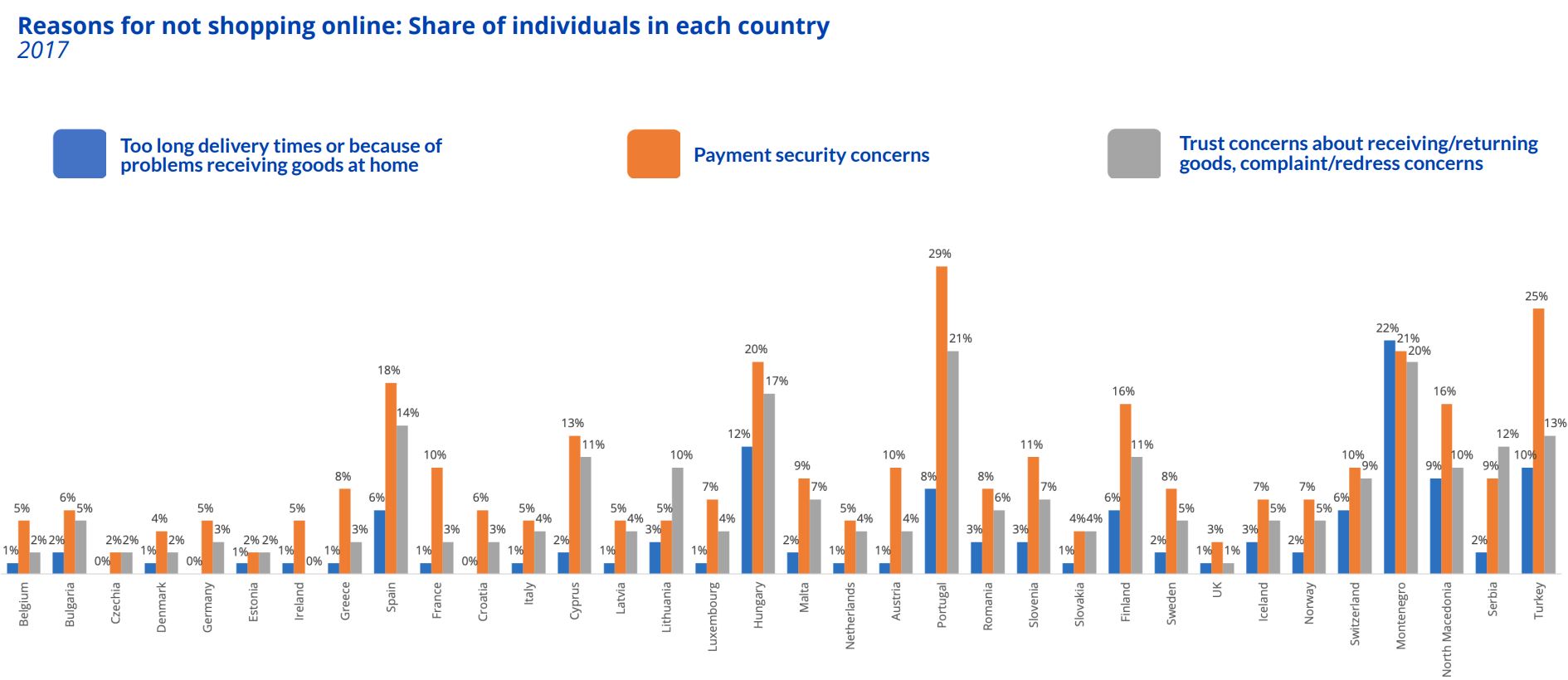

In France, 10% of e-shoppers have concerns about the security of payments, in Germany this halves to 5%. This percentage significantly drops in the UK, at just 3% of shoppers concerned about security when making payments online.

Cross-border and online marketplaces

The European market is expected to grow by 13% in 2019, with an anticipated 621 billion euros of e-commerce sales. The largest share of this growth is attributable to Western Europe accounting for 66% of sales. Cross-border purchases by e-shoppers, which have a positive impact on growth, should also not be neglected here.

41.5% of consumers in Europe stated that they had made orders online from other EU countries in 2018. Most consumers from Malta (89%), Luxembourg (82%) and Austria (81%) ordered products from other EU countries. One explanation for this could be that supplies in the respective countries’ are limited. In addition, these nations speak several languages, making ordering in neighbouring countries much easier.

The biggest obstacle to online shopping in Europe seems to be related to the security of the payment process. The Portuguese (29%), Turks (25%) and Spaniards (18%) are particularly concerned about this topic.

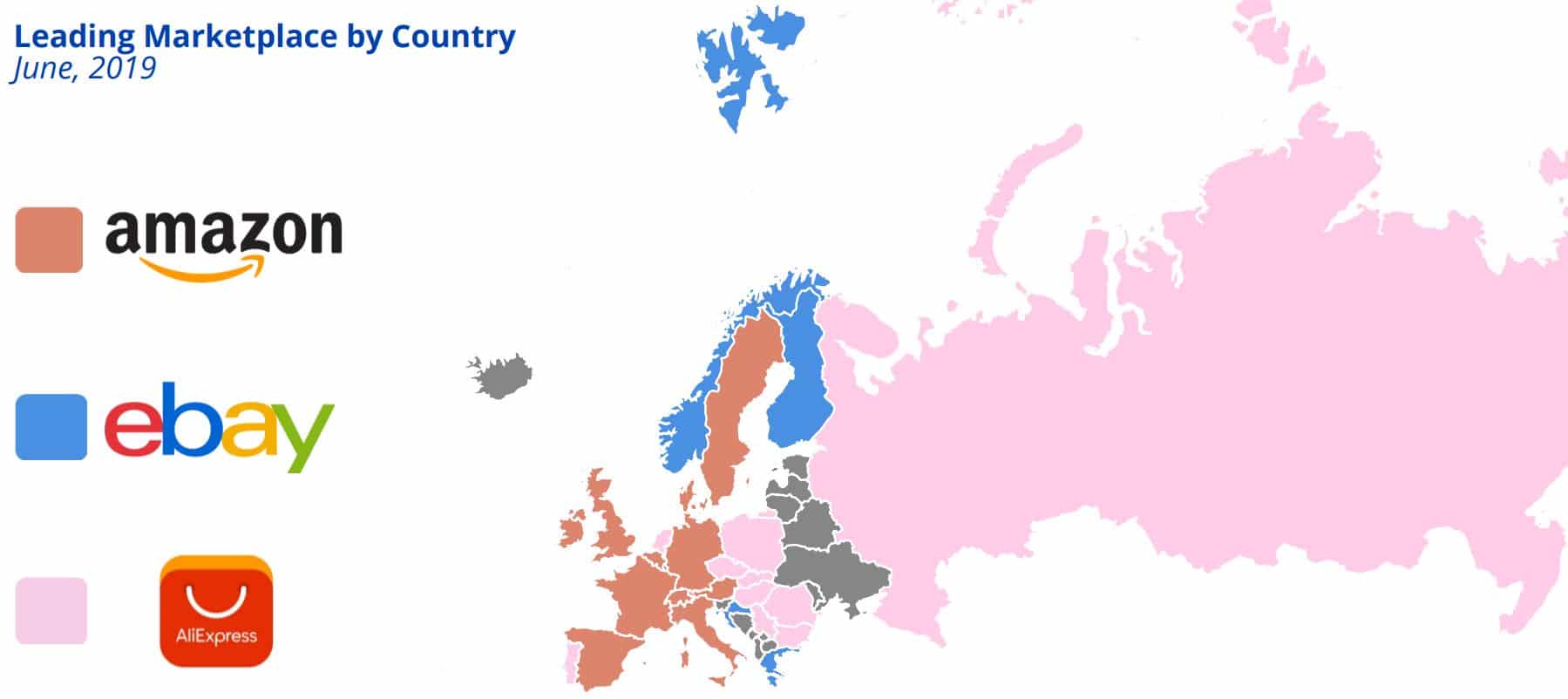

The importance of online marketplaces is growing in Europe. The range of marketplaces is particularly diverse, thanks to countries offering a range of marketplaces such as France and the UK. In spite of this diversity, three (global) leaders reign in Europe – Amazon, eBay and AliExpress. Amazon is most successful in Western and Southern Europe (UK, France, Germany, Spain, Italy, Austria, etc.), eBay in Northern Europe and Greece, and AliExpress in Eastern Europe (Poland, Czech Republic, Russia, etc.).

Important regional marketplaces in Europe are Willhaben.at (Austria), bol.com (Belgium), Otto.de (Germany), Cdiscount (France) or also bazos.cz (Czech Republic), emag.ro (Romania) and verkkokauppa.com (Finland).

Image 1: Pixabay/MichaelGaida

Image 2, 3, 4: ECommerce Foundation/European Ecommerce Report 2019

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'