Retrospective 2024: Key Figures of E-commerce in France

25/02/25

5'

The year 2024 has been a prosperous year for French e-commerce. With a turnover reaching 175 billion euros, representing a growth of +9.6% compared to 2023, the sector continues to assert its growth. France remains the third-largest e-commerce market on the continent, behind Germany and the United Kingdom, with more than 30 million online shoppers.

This dynamism is driven by changing shopping behaviors, the rise of second-hand commerce, the growth of social commerce, and the digitalization of services. Let’s analyze the trends and key figures that have shaped this year.

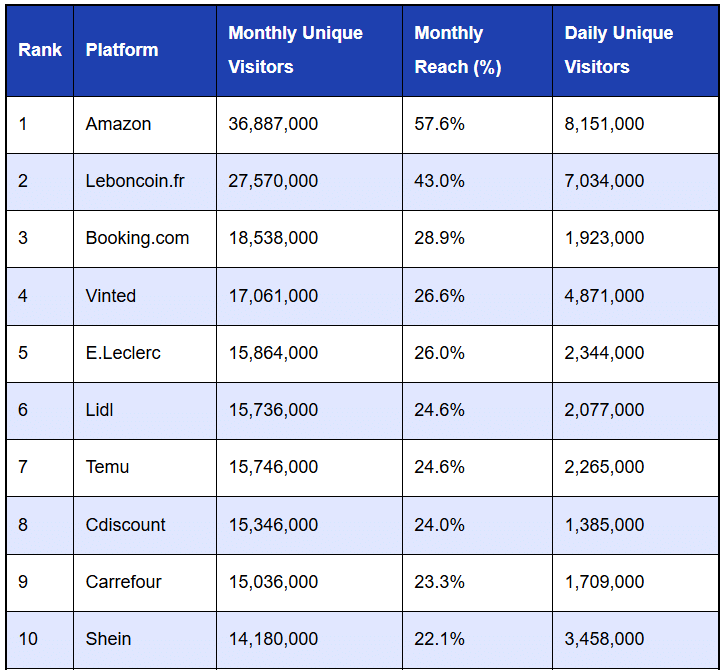

Top 10 E-commerce Platforms in France

Image credit: FEVAD.com

Growth Driven by the Diversification of Online Purchases

The French e-commerce market benefits from a wide diversification of its offerings, with marketplaces playing a predominant role. In 2024, online product sales rebounded by 6%, reaching 66.9 billion euros. This rebound is largely attributable to the ability of marketplaces to offer an unparalleled variety of products, from new items to second-hand goods, meeting the diverse needs and budgets of consumers.

These platforms, such as Amazon, Cdiscount, and Fnac, act as virtual shopping malls, where consumers can find almost everything they want.

The average e-commerce shopping cart in France remained stable at 68€ despite inflation, and online shoppers spent an average of 4,216€ online over the year. For example, the fashion and apparel sector represents 23% of online sales. Marketplaces significantly contribute to these figures by facilitating access to these product categories for a wide audience.

The Rise of the Second-Hand Market and C2C Commerce

In 2024, the most lucrative segment remains fashion, generating 16 billion dollars in revenue. However, within this market, Consumer-to-Consumer (C2C) commerce is experiencing remarkable growth. Second-hand marketplaces like Vinted, Leboncoin, and Cdiscount have established themselves as key players. Vinted, in particular, has become the most visited fashion site in France, surpassing Zalando and ASOS.

With nearly 120 million monthly visitors in April 2024, ahead of Shein, which had 14 million visitors in the first quarter of 2024, Leboncoin also reflects the growing interest in second-hand purchases, driven by the search for more affordable prices and a more responsible consumption approach.

The Rise of Social Commerce and Shoppertainment

The rise of social commerce and shoppertainment is profoundly transforming online shopping behaviors. Instagram, TikTok, and Facebook have become much more than simple social platforms; they are now essential sales channels. In 2024, this trend accelerated, with 18% of buyers influenced by content creator marketing, and the arrival of TikTok Shop in Europe in 2025 promises to further strengthen this dynamic.

To allow brands and retailers to take full advantage of these opportunities, it is crucial to adopt a solution capable of maximizing the visibility and performance of campaigns on social networks. For example, Lengow’s NetAmplify centralizes and optimizes product feed management on Facebook, Instagram, TikTok, and other platforms, improving efficiency and ROAS to ensure optimal ad performance.

Moreover, with the imminent arrival of TikTok Shop in Europe and the growing number of purchases made directly via social networks, embracing a high-performing omnichannel strategy is essential. Thanks to Lengow’s NetMarkets, e-merchants can directly connect to this TikTok marketplace.

Key Trends and Online Shopper Behaviors

New shopping trends confirm the importance of promotions and payment facilitation services.

Events such as sales and private sales experience peaks in traffic, while price comparison sites and cashback continue to attract more consumers. Installment payments are also seeing strong adoption, with solutions like Klarna and Alma making high-value purchases more accessible. Additionally, mobile usage is increasing, now accounting for 53% of online transactions.

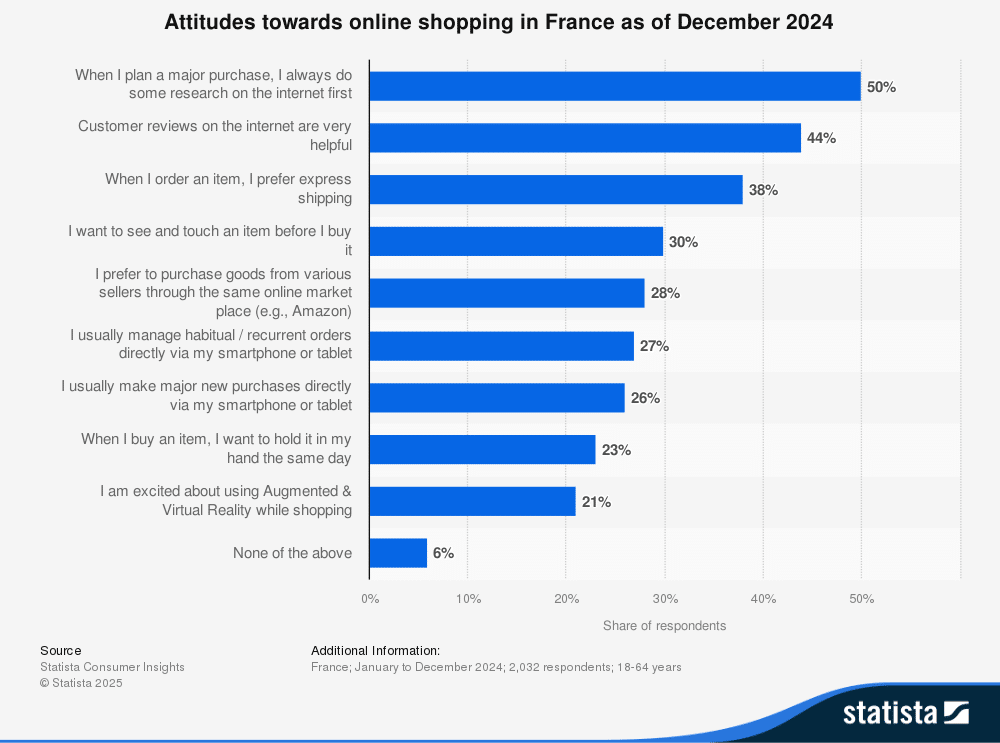

These changes in online shopping behavior align with broader trends observed in 2024. The following diagram illustrates the main attitudes of French consumers towards online shopping, highlighting their expectations and preferences.

France and Europe: Where Does French E-commerce Stand?

While France shines with an e-commerce turnover of 175 billion euros in 2024, it is crucial to position it in the European context. As the third-largest market on the continent, behind Germany and the United Kingdom, France demonstrates significant potential.

However, despite encouraging figures, significant regional disparities exist. Northern and Western European countries, such as the Netherlands and the United Kingdom, maintain high e-commerce penetration rates, where a large portion of the population regularly shops online. France ranks among the leading markets but has unique characteristics, such as a strong development of the second-hand and social commerce markets (like Vinted or Leboncoin).

Conclusion: A Rapidly Evolving Sector Ready for 2025

The year 2024 marks a key milestone for French e-commerce, with record sales, shifting consumer behaviors, and technological innovations. With the sector constantly evolving, businesses must adapt to these new dynamics and offer increasingly seamless and engaging shopping experiences.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'