Sector Focus: Online Beauty Retail & Its Changing Buying Behaviour

07/03/17

2'

In 2015, the e-commerce market for beauty products represented 6% of the global market and grew by 20%. It’s a market that has a lot of potential: beauty is one of the top 3 most searched terms on Google.

An international presence

In Europe, the beauty sector is worth up to 5 billion euros – and its firmly establishing itself in the world of ecommerce, too. According to A.T Kearney, online beauty sales are expected to grow by 8% per year until 2019, which is 4 times larger than the global market.

It’s also a very successful industry in Asia, especially in Japan, South Korea and China – 68% of mobile purchases made during Alibaba’s Singles Day were beauty products. In South America, beauty occupies a varied range of market shares, from 11% in Argentina to 47% in Chile.

Changing buying behaviour

The majority of customers in the beauty sector are women, with 54% of online cosmetics sales being female, as opposed to 34% male. An integral part of the shopping process is research – which is something retailers need to be aware of and cater to. Just like the fashion sector, the beauty sector has to compensate for the fact that these products should ideally be tested before buying. But the buying process is evolving to address this concern: physical stores are becoming the place to test the products, only to be bought online afterwards.

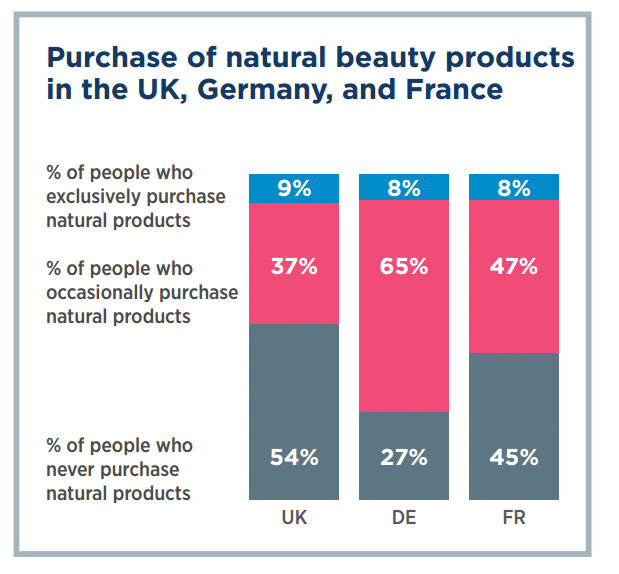

There is also a strong trend emerging for natural and organic products. About 50% of European online shoppers have already brought a natural/organic beauty product.

To find out more about the beauty sector, including more stats and figures, the role of mcommerce in beauty, and more, take a look at our free guide to the online beauty sector:

Your e-commerce library

4 Top Tips for Selling on Marketplaces (Home and Garden)

Learn moreMarketplace Horror Stories

Learn moreMaster Intelligent Google Campaigns

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

9 essential tips for selling on marketplaces (2024)

In 2024, selling on marketplaces is a real challenge. Rivalry between sellers is intensifying, and the range of marketplaces is…

18/01/24

7'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Google Shopping

4 Must-have Google Shopping Optimizations [2024]

Google Shopping isn't just another advertising channel; it's the undisputed titan of paid e-commerce advertising channels. And why is that?…

11/01/24

9'

Price Intelligence

Winning with Pricing Strategy on Marketplaces

Selling successfully on marketplaces like Amazon and eBay hinges on how well you price your products. It's a balancing act:…

24/11/23

7'