COVID-19: What can Western e-commerce learn from China?

05/05/20

7'

In every crisis there lies opportunity. SARS was a turning point for China’s e-commerce market in 2003. Today, COVID-19 is driving innovation as the industry adapts to the health crisis.

The impact on retail so far has been significant: as most of China was on lockdown in January and February, the total sales of consumer goods fell by 19%. Chinese New Year is typically the peak season for consumption.

However, following the resumption of work in March, various indicators show signs of recovery. As the COVID-19 crisis spreads in new epicentres in Europe and the U.S., we take an overview of China’s e-commerce market survived confinement.

Key trends

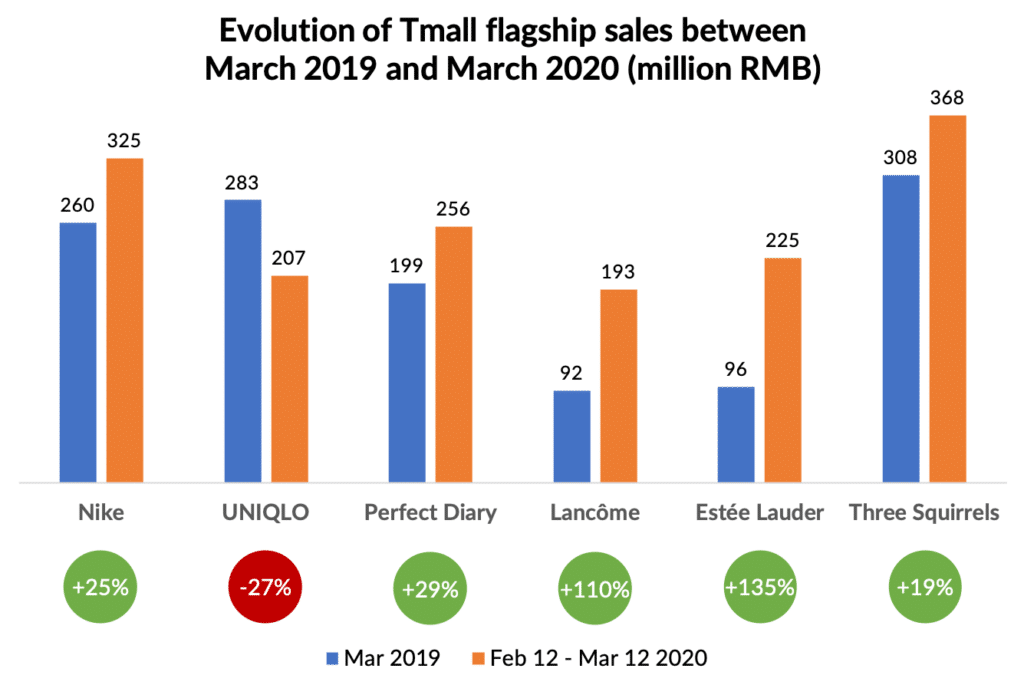

While retail sales saw a heavy blow, tumbling by 19%, China’s e-commerce industry saw sales increase by 5.9% YOY in the first quarter. China’s e-commerce giants including Alibaba, Suning and JD.com made every effort to maintain and, in some cases, even surpass previous performance. This is demonstrated by the performance of retailers on key player Tmall.

Sales slump for fashion, while e-commerce remained strong

Much like in Europe, as China went into quarantine, sales in fashion significantly dropped for brands such as UNIQLO who suffered their lowest selling month in the past year. This trend impacted sportswear brands such as Nike since gyms closed, and people had less opportunity to work out.

Beauty booms

COVID-19 has pushed more traditional brands such as Lancôme to take further steps towards digitalisation as it saw sales shift online.

Fashion was the exception and not the rule as other sectors of the Chinese e-commerce landscape remained extremely strong through the crisis. Much like data from IMRG in the UK, research shows a surge for health and beauty. The Chinese cosmetics brand Perfect Diary, a heavily online-focused brand, maintained steady sales through both January and February, while more traditional omnichannel cosmetic brands such as Lancôme also performed well through the crisis, with online sales during January and February 2020 showing a YOY growth over 100%.

COVID-19 has pushed more traditional brands such as Lancôme to take further steps towards digitalisation, as many companies saw offline sales shifting to online platforms such as Tmall, generating this significant YOY growth during the crisis. Pure players such as Perfect Diary saw only a moderate increase, as they did not see a migration of sales from offline to online.

Sales surge for groceries online

Since grocery stores were closed and consumers were advised to stay inside, consumers turned online to purchase food essentials. Alibaba’s Hema—a supermarket combining online and offline using big data and automation—saw online orders surge 220% compared with the same period last year. Food and beverage brands such as Three Squirrels, Tmall’s leader in the category, performed even better during January 2020 than it did during Single’s Day 2019.

Best practices to survive COVID-19

Increase brand affinity via cause marketing

A brand must be very careful about promoting and having campaigns being perceived as taking advantage of a crisis. Marketing budgets of brands dropped by 11.5% YOY. It’s never been more important to deploy the right brand communication during a crisis like the COVID-19 outbreak.

At the time of the outbreak, players from every corner of China’s e-commerce sector displayed solidarity when it came to fighting the epidemic. China’s e-commerce giants supported brands and retailers by introducing platform fee reductions, brand support programs, and low-interest loans.

Meanwhile, retailers took care to enhance their brand’s image in the minds of consumers in order to promote the steady and rapid growth of online shopping after the epidemic. “Profit means nothing in the face of a disease outbreak,” states Zhang Jindong, the founder of Suning, one of China’s largest e-retailers. Suning donated over one million masks to Italy among other actions, and this demonstration of solidarity helped the retailer acquire new market share and customers.

Luxury players were at the forefront of this movement, with brands such as Louis Vuitton launching the “Love has no fear” marketing campaign on Weibo with Chinese celebrity brand ambassadors. The campaign generated 4.2 billion views in its first week. Other leading luxury groups expressed solidarity by form of donation, with LVMH, Richemont and Kering donating over $4.5 million to the Red Cross Society of China.

Sustain business by moving sales and events online

E-commerce live streaming sessions topped 4 million in the first quarter of 2020 in China.

China’s live streaming e-commerce market is projected to grow by $129 billion in 2020. Albeit far from a new trend in China, since consumers are confined in their homes because of the pandemic, shopping on live streaming apps is booming. The number of e-commerce live streaming sessions topped 4 million in the first quarter, according to China’s Commerce Ministry. In early February, Taobao’s live broadcast volume increased by 110% year-on-year.

During the epidemic, live commerce megastar Li Jiaqi co-promoted a live broadcast “Thank you for joining the bill for Hubei” to promote the sale of local products in China’s hardest impacted province. According to data released by Li Jiaqi’s team, the broadcast attracted 10.91 million viewers and 160 million likes, and the two-hour live broadcast sold 660,000 Hubei local products worth 40.14 million yuan.

Faced with the crisis, retailers increasingly turned to live commence. For what would traditionally be an offline conference, Adidas turned to live streaming on Taobao to release the 50th anniversary Superstar. More than 2.23 million people participated in the event, and the sales in 10 hours reached 200 million yuan.

French luxury brands LVMH and Givenchy held their first live streams on the app last month. Shanghai Fashion Week was live streamed for the first time on Tmall during the lockdown in late March, presenting not only a fashion show, but an opportunity to turn inspiration into purchases by allowing consumers to sit front-row and buy what they saw.

As digital services become more embedded in consumers’ everyday lives, luxury brands will have to create more online-to-offline experience strategies in order to connect consumers to real-time events and provide inspiration to purchase.

On the road to recovery

An Hermès boutique in China made after reopening, although wary consumers prefer to stay at home and use online channels to purchase goods.

From April onwards, China has been rolling out a series of policies to boost consumption. Labor Day, the first national holiday after the lockdown, has been extended to five days to encourage consumers to go out and shop. Many local governments have even announced plans to give out vouchers for use in shopping malls and online on platforms such as Alipay, UnionPay and Tencent. Shanghai announced it would hold a shopping conference to boost consumers’ confidence over the Labor Day holiday, already generating 7.7 billion yuan of spending with coupons used on Pinduoduo, Suning.com, Alibaba and Meituan. An Hermès boutique in China even made $2.7 million in one day after reopening.

As China’s coronavirus outbreak eases, wary consumers stay at home and use online channels to purchase goods. This is good news for e-commerce, as for the foreseeable future, the ratio of online retail sales to total retail sales will be higher and higher. European brands and retailers should take note that, even post-confinement, consumers will prioritise purchases online.

COVID-19 has accelerated the digital transformation in China, and European brands and retailers should follow suit and optimise the consumer experience, marketing via social media and online streaming platforms. The greatest implication of COVID-19 on Chinese consumers’ buying behaviour is that they have been pushed to embrace e-commerce, and the market is anticipated to continue its growth exceeding previous forecast levels.

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'