DIY & Home: the State of Play in the UK Market

03/05/22

6'

The UK has always been a nation of DIYers, and more so since the COVID-19 pandemic. Locked down, with hours spent at home, people turned to home improvements to enhance their surroundings, both indoors and outside. DIY is a growing market, especially as working from home is becoming more common, leading to the desire for a pleasant home environment to live and work in.

The trend in DIY growth continues

According to Statista, the UK DIY retailing (decorating and DIY stores) market was worth £7.2 billion in 2019 (most recent figures available). With total sales in the UK amounting to £75.48 billion, this market represents a large chunk of online retail. The DIY figure is predicted to increase in line with changes in consumer lifestyles, such as spending more time at home, with online sales forming a large part of this growth.

Mintel market research reports that 74% of consumers in the DIY retail market did their own home improvements during the pandemic, giving them the knowledge and confidence to carry out further projects in the future. From upcycling to major renovations, many people with time on their hands wanted to try out their DIY skills. The convenience of online ordering meant no need to visit stores, which was often impossible during lockdowns.

The impact of COVID-19 has fuelled growth in DIY and home improvements, with the first two weeks of March 2020 showing a 48% increase in online sales over the previous year (Statistica). This made it one of the highest performing retail markets at this time. Whilst this increase reflects short-term demand, the growth continues as the housing market crisis in the UK is starting to end.

The main DIY retailers in the UK are:

- B&Q (301 stores)

- Screwfix (790 stores)

- Homebase (167 stores)

- Wickes (230+ stores)

Kingfisher PLC, owner of B&Q and Screwfix, reported a 20.9% increase in annual profit from 2020 to 2021 and announced plans for Screwfix to increase its number of stores from 790 to 1,000 and the launch of the B&Q marketplace.

DIY & Home marketplaces in the UK

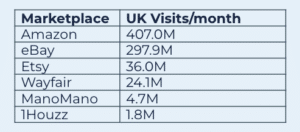

DIY marketplaces are still fairly limited in the UK, with Amazon and eBay being the most popular in terms of general purchases, however, the launch of the B&Q marketplace is set to shake up this market. In a world where online shopping for fashion and food is becoming increasingly popular, so is the purchase of DIY and home products online.

The home decor market sits alongside DIY, offering accessories and furnishings to add the finishing touches to home decor projects. Home decor sells on a selection of marketplaces, including Etsy, Wayfair, ManoMano and Houzz.

The table below shows the number of UK visits per month to the main UK marketplaces:

B&Q launches its own marketplace

Recognising the potential for more profit within e-commerce, B&Q has been proactive with the launch of its own marketplace in March 2022, aiming to put 100,000 new products on sale in the next 6 months. These products will be supplied by third-party sellers and will increase the current product range by approximately 60%. This raises the profile of the third parties that cannot afford to hold a large catalogue of products on a website and gives them exposure through the link with a reputable DIY retailer.

Customers have the convenience of returning unwanted products to a local store and the Click & Collect Service is part of B&Q’s planned marketplace strategy.

The extensive product selection will include:

- power tools

- lighting

- wallpaper

- small domestic appliances (new for B&Q)

The marketplace diy.com will take the consumer to the current B&Q website where they can browse the vast selection of products. This gives the retailer a double opportunity to offer more choice and capture more sales.

Third-party products are identified as ‘sold and shipped by X’ rather than being sold directly by B&Q. The sellers are responsible for managing their own product listings and customer interaction, after meeting the required B&Q criteria to ensure they are a quality seller.

Consumers expect immediate availability, extensive choice and fast service, which is supported by the rapid growth of marketplaces. Working in conjunction with Mirakl, the online marketplace specialists, B&Q have been quick to identify this opportunity for business growth.

Has the UK housing market crisis affected furnishings and DIY?

Prices of UK housing have increased dramatically over the last year, making owning a home impossible for many potential buyers. According to the UK Land Registry house prices increased by 11% in February 2022 compared to the previous February. The average price of a house in the UK is now £280,000 compared to £240,000 in 2020, with house prices rising 10.9% year on year. What does this mean for DIY retailers and marketplaces?

When properties don’t sell during a housing crisis people tend to do more home improvements if they can’t afford to move. This is good news for DIY retailers as people spend time and energy on making their homes more comfortable. Social media also boosts this love of home remodeling, with sites such as Pinterest and Instagram promoting inspirational images and YouTube providing videos for amateurs on virtually every DIY project that exists.

However, house prices increases are also important to DIY and home retailers as a stronger housing market leads to more DIY projects to stage and sell homes, plus renovations in newly purchased properties. When people move house, they tend to spend money on furniture and decorating to make their new home suitable for their taste.

When house prices increase people have more money to spend on home improvements if they make a profitable sale. Therefore, moving prompts purchases of items such as soft furnishings, shelves, tools, paint and fixtures and fittings. This can be seen in increased DIY and Home retailer profits. For example, home improvement company Kingfisher, (owners of B&Q and Screwfix and other international DIY retailers) saw a UK retail profit of £794m for the year ended 31 January 2022, a 16.7% increase on the previous year.

Sell with Pinterest Ads and Shopping

Improve your visibility and your sales with Pinterest and Lengow Throu…

Learn moreThe impact of the Wickes IPO

March 2021 saw the demerger of DIY retailer Wickes from owner Travis Perkins, and an IPO (initial public offering) of shares on the stock exchange. This saw shares increase their value by 11.3%, i.e. from 24.2p to 239.2p immediately, with Wickes reporting a profit of £85 million in the year ending January 2022.

This move allows Travis Perkins to focus on its core business – builders merchant sales and makes Wickes a stand-alone business with new shareholders.

As a retailer that targets the more ‘hard-core’ DIYer, with three segments – Local Trade, Do-It-For-Me and DIY Retail – this allows Wickes to drive its growth through online and in-store sales.

In conclusion, there is a major opportunity for DIY retailers within the UK market, especially with online marketplaces, which can cut costs, improve efficiency and minimise the risk of a large stock holding.

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'