From ‘Made in China’ to ‘Created by China’: How Merchants are Revolutionising Manufacturing in China

19/12/22

6'

There is no secret that products from China already dominate the pages of many major e-commerce marketplaces in the world. “Made in China” was once a synonym for lower quality and cost products, however, with the upgrading of traditional manufacturing in China, the concept of “Created by China” has evolved, meaning that goods from China will continue to flow in the global market, incorporating more technology and innovation, while retaining their price advantage.

In this article, we will look at how Chinese sellers have grown internationally and which methods they are currently using to conquer markets overseas.

The growth of Chinese sellers abroad

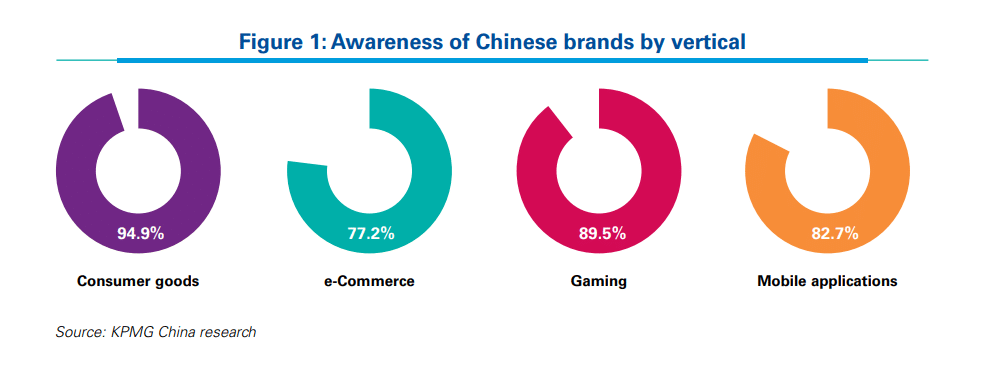

According to the research “Leading Chinese Cross-border Brands” by KPMG China, in the consumer goods sector, Chinese electronics brands (including mobile phone manufacturers) have the highest brand recognition at 94.9% among international consumers.

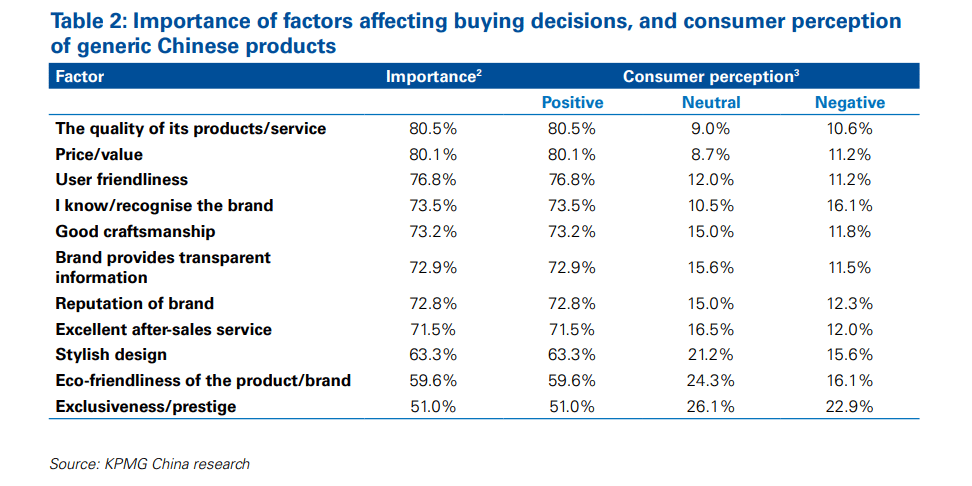

Respondents in the research also identified factors influencing purchase decisions, with the top 3 being quality, price, and user-friendliness, Chinese products were considered mostly positive in all 3 aspects.

Although Chinese products are overall well-received in recent years by international consumers, retail giants like Amazon have penalised a certain number of vendors from China in the past two years as a result of their unethical sales activities.

Earlier this year, it was reported that Chinese sellers started to “de-Amazonise” due to Amazon’s closure spree against Chinese sellers. However, Amazon’s series of moves hit the market, but it has reshuffled the Chinese cross-border seller community, allowing quality merchants to gain a higher market share, while other non-compliant sellers who were not large enough were gradually eliminated from the stage.

Chinese sellers go abroad after the global epidemic

Amazon’s control of non-compliant sellers has accelerated the upgrading of manufacturing in China and the “go aboard” strategy. In fact, especially in the second half of 2022, Chinese exporters from various industries visited Europe for inspection, while many of the traditional B2B manufacturing in China has been transforming into B2C e-commerce, driving Chinese brands to achieve outbound through an ”O2O“(Online to Offline)push in order to reduce the impact of the epidemic control on cross-border business.

In the “China Cross-border Export E-Commerce Report (2022)” released March 2022, it is said that 1.98 trillion RMB was imported and exported from China’s cross-border e-commerce in 2021. The exports from China alone accounted for 1.44 trillion RMB, which represents over 70% of all e-commerce transactions and an increase of 24.5% compared to the previous year.

The localization methods of Chinese cross-border sellers

- Product agility. Product is the prerequisite of everything. In recent years, whether it is large home appliances and electronics or kitchenware and tools needed in daily life, Chinese sellers have been able to capture the needs of the European market no matter how it is changing. In the post-pandemic period, consumer demand for intelligence and convenience has never been stronger.

- Operating and manufacturing in China while registering as European identities. There are hundreds of third-party agencies that are helping with legal registration, tax, and EPR compliance for Chinese cross-border sellers. Some of the European marketplaces are open with Chinese business licences, but most of the local ones only accept EU entities or EU-registered brands, such as Leroy Merlin. Therefore, qualified Chinese brands will enter the local market by registering as European identities. However, large brands such as Huawei, OPPO, and Xiaomi have already established offices in Europe to get a large market sharonline and offline.

- Choosing local warehouses and fulfilment. The fact that more and more Chinese sellers are using overseas warehouses or fulfilment of the marketplaces, such as Cdiscount and Allegro, not only reduces shipping costs but also improves delivery time and customer satisfaction.

- Applying an “Omni-channel” strategy and benefitting from live shopping with local influencers. Chinese domestic marketplaces like Tmall, JD, and Pinduoduo have a monopoly on market penetration. When Chinese sellers start to enter the European market, they usually start with their own DTC websites, and many of them brand themselves as European, making it hard for consumers to distinguish the merchant behind. In terms of marketing, Chinese brands have been increasing their exposure on social media, search engines, and even offline pop-ups. For example, DJI for drones and ICICLE for fashion have opened physical stores to cultivate local awareness in Europe.

As we know, China is the fastest-growing country for live shopping. In 2020, the GMV generated from live shopping in China amounted to 1237.9 billion RMB. On the just concluded Single’s Day shopping festival in China in 2022 – although Alibaba and JD no longer announce GMV figures, the figures for live shopping are still staggering. It is reported that there were 62 live streams with a turnover of over 100 million RMB and 632 live streams with a turnover of over 10 million RMB.

Although this new shopping phenomenon has been working well in China, a country that has been positively impacted by the popularization of this direct sales technique, the Live Commerce trend is still fresh in Western e-commerce. In the West, it is still in its early stages, but it is definitely gaining traction. L’Oréal and Tommy Hilfiger are two notable examples of brands that have recently experimented with this new trend by live streaming their beauty and fashion products.

- Developing in-house e-commerce solutions. Large Chinese brands have been trying to develop their own digital solutions and then trying to be compatible with external systems. The main reasons for this are cost and autonomy, with Chinese sellers preferring an ‘all-in-one’ service. On the other hand, SaaS companies like Lengow, Shopify, Magento, and Bigcommerce are having a stronger presence in this market.

Conclusion: From “Made in China” to “Created by China”

At a time when the global market is slowing down, we are consistently seeing an increase in the desire of Chinese sellers to go abroad. That being said, we believe that the innovation of manufacturing in China will continue.

If you are a Chinese seller, applying all the methods above will surely help with your growth overseas. However, if you are a European brand or retailer experiencing rising costs and competition, being visible on multi marketplaces and marketing channels will ensure your growth and market share. Most importantly, do not forget about applying price intelligence solutions, like Netrivals and defining effective strategies for marketplaces and marketing channels. Lengow is the right partner for you to achieve all these goals and bring your e-commerce business to the next level.

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'