Interview: Europe’s cross-border marketplaces market

31/10/19

3'

Following the release of the first edition of the “Top 20 Marketplaces Cross-Border Europe”, Carine Moitier, Founder of Cross-Border Commerce Europe, shares the latest market trends and marketplaces that stand out on the continent.

1/ How is the cross-border marketplaces market doing?

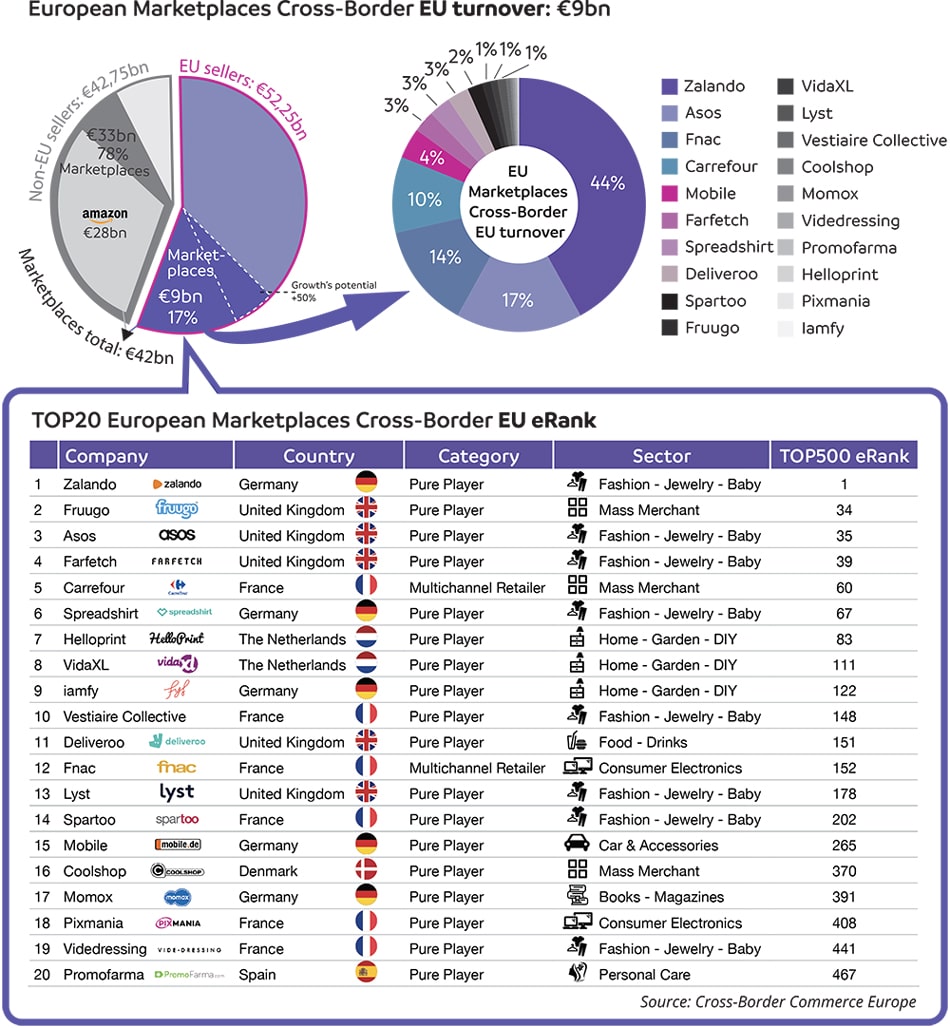

According to our estimates, cross-border sales from marketplaces operated by companies with European capital represent a turnover of €9 billion in 2018 (excluding travel), representing only 21% of the total market for cross-border marketplaces in Europe, estimated at €42 billion, with Amazon generating €28 billion. However, cross-border sales are expected to increase by more than 50% to reach €15 billion in 2020.

2/ What explains this trend?

We see two factors that explain this trend.

– – The major EU cross-border marketplaces players Farfetch, Fruugo and Asos (UK), Fnac, Pixmania and Spartoo (FR), Zalando and Mobile.de (DE), Bytbil (NO) and Coolshop (DK) will experience strong organic growth, while on average 50% of their turnover is generated by sales made by third parties. This share is expected to increase further.

– EU marketplaces which operate locally are looking for growth opportunities beyond their borders. This includes 2dehands and 2ememain (BE), Marktplaats and Bol.com (NL), On Buy and Flubit (UK), CDiscount, LaRedoute and Priceminister (France), Real.de and Otto.de (DE), eMag (Eastern Europe), Fyndiq (SE), Worten.pt and Allegro (PT), Clasohlson (SE), Wilhaben.at (AT), Gigantti and Verkkokauppa (FL) and Jofogas.hu (HU).

In France, Amazon has a market share of 14.2% excluding travel, followed by CDiscount (7.8%). Only 5% of Amazon’s e-commerce is done in France compared to 95% for CDiscount. In the Netherlands, Bol.com plans to expand into new geographical areas. Its marketplace is the main driver of growth. Today 23,000 third party e-merchants sell on Bol.com.

3/ Which marketplaces are at the top of the ranking?

The top 5 B2C marketplaces with European capital are Zalando, Fruugo, Asos, Farfetch and Carrefour.

4/ “Retail as a service”: a mandatory passage for marketplaces?

“Retail as a service” which is offered by most marketplaces is increasingly becoming a “must”, including the following services: transport, returns management, feed management, cloud computing services, payment and online marketing.

5/ How do you see this market developing?

We expect the emergence of new European niche markets by 2020. They are now very popular in the United States and the United Kingdom, for example: Newegg for the global electronics market, Reverb for musicians, Zibbet for independent artists and Houzz for interior design enthusiasts.

To learn more about marketplaces, check out our white paper:

Successfully develop internationally with marketplaces

Whether you are a retailer or a brand, optimize your presence on marke…

Learn moreImage: GregMontani / Pixabay

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'