CB Commerce Europe report: Top 16 Countries Cross-Border Europe

05/07/22

4'

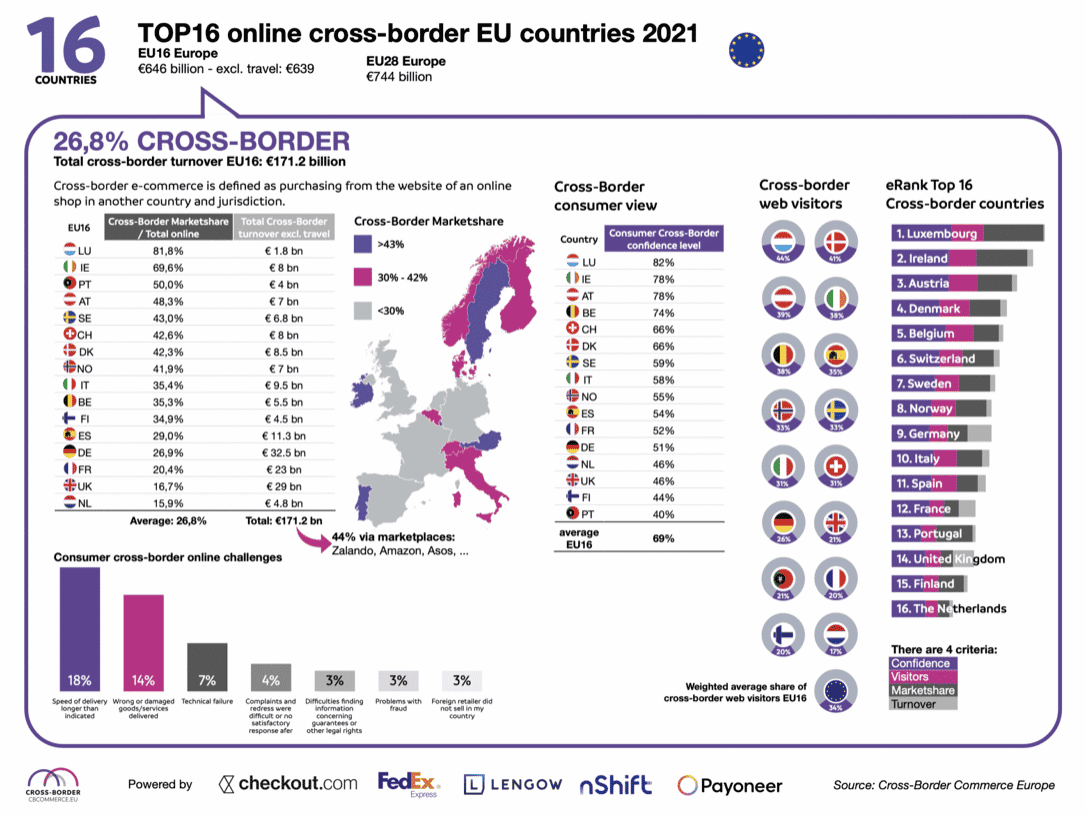

The total online EU cross-border market represents a turnover of €171 billion in 2021 (excluding travel), a YTD increase of 17%. Cross-Border Commerce Europe’s annual report ranking the 16 strongest European countries in terms of cross-border performance has just been released, with the support of Lengow, alongside Checkout.com, FedEx Express, Lengow, nShift and Payoneer. A preview of some key learnings from the annual report.

The research paper focuses on brands and retailers’ cross-border performance both from the consumer perspective and the business approach. Four factors are weighted in the ranking:

- Online cross-border sales in Europe (16 countries within Western Europe, Scandinavia and the UK)

- Cross-border online market share

- Cross-border consumer confidence

- Percentage of cross-border website visits

Luxembourg has once again been elected as the EU’s top cross-border market, with Germany maintaining its lead as the market that produces the greatest cross-border internet stores and marketplaces. Online cross-border B2C sales from the UK decreased to €29 billion, a historically low level (-12%).

The TOP 16 Countries for 2021:

- Luxembourg

- Ireland

- Austria

- Denmark

- Belgium

- Switzerland

- Sweden

- Norway

- Germany

- Italy

- Spain

- France

- Portugal

- United Kingdom

- Finland

- The Netherlands

Denmark, Belgium, Sweden, Germany, Italy, France, Finland, and Portugal are among the climbers. Luxembourg, Ireland, Austria, Switzerland, Norway, Spain, and the Netherlands haven’t moved. The United Kingdom is the only country descending in the ranking.

Focus on the UK (#14 TOP Cross-Border Country)

The UK (eRank 14) dropped 10 positions in the ranking due to Brexit. The lack of confidence and cross-border visitors resulted in 12% lower turnover, resulting in €29 billion.

Brexit has a negative impact on cross-border trade to and from the UK. UK customers lose faith in cross-border commerce (-35%).

Brexit will essentially result in additional taxes and bureaucracy for online retailers. Nobody can dispute the operational and logistical difficulties that Brexit is bringing for online merchants of all sizes and in all industries. For EU e-tailers selling to UK clients and vice versa, rising shipping costs, delivery delays, new rules, and more paperwork are creating previously unheard-of obstacles.

TOP 10 Countries from a business perspective

Counting 84 million residents, Germany attained the top spot in the list in 2021. This is thanks to cross-border webshop champions including brands such as Hugo Boss, Hello Fresh, Zooplus, Zalando, Lidl, About You, Adidas and Westwing. Germany counts 112 international web stores included in the TOP 500, compared to “just” 74 in the UK. Germany is in first place because it has the most international web stores, of which 55 (or 49 percent) are lone players and nine are marketplaces.

Pan-European Holdings are major drivers for European cross-border e-commerce, including Inditex, Richemont, Kinnevik, Heartland, Signify, Mulliez, Otto, Schwarz, LVMH and Nestlé.

For more insights and key learnings, download the full report today.

Photo: Ollie Craig (Pexels)

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'