Temu vs SHEIN vs JoyBuy: Three Chinese Players Disrupting Europe

05/11/25

10'

Amazon’s grip on European shopping is slipping. After years of unchallenged dominance, the American giant is facing its most serious threat yet – and it’s coming from China.

Three platforms in particular are turning heads: Temu, with its impossibly cheap prices and addictive gamified shopping. SHEIN, the fast-fashion juggernaut that’s become a guilty pleasure for millions of young Europeans. And JoyBuy, the lesser-known contender quietly building bridges between Chinese manufacturers and Western buyers.

They couldn’t be more different from each other. But they share something powerful: direct access to Chinese factories, lightning-fast adaptation to what customers want, and a willingness to undercut established players on price in ways that seem almost reckless.

The question isn’t whether these platforms are reshaping European e-commerce anymore. It’s whether anyone can stop them and what it means for how we’ll all shop in the years ahead.

A Market Up for Grabs

The numbers tell a startling story. By mid-2025, Temu had already hooked 93.7 million Europeans who check the app every month. SHEIN‘s done even better: over 100 million monthly users, many of them opening the app multiple times a day (source: SHEIN).

Amazon still looks unbeatable in its Western European strongholds. Two-thirds of German online shoppers use it. More than half of French consumers do too. In Italy, it’s closer to 70%.

But venture east, and the picture changes dramatically. In Poland, Amazon barely registers, less than 10% of the market. It’s in these gaps, these markets where Amazon never quite bothered to plant deep roots, that Chinese platforms are exploding. We’re talking 60% to 100% growth year after year, while homegrown European retailers are treading water.

And there’s a third player most people haven’t heard of yet: JoyBuy. It’s still finding its feet in Europe, but it has something the others don’t: the full weight of JD.com behind it, China’s second-biggest e-commerce company. That kind of backing doesn’t guarantee success, but it does guarantee they’re in this for the long haul.

| Aspect | Temu | SHEIN | JoyBuy |

|---|---|---|---|

| Parent Company | PDD Holdings (Pinduoduo) | Privately held | JD.com |

| Founded | 2022 | 2008 | 2024 (rebranded from Ochama/Joybuy) |

| Headquarters | Shanghai, China | Singapore | Shanghai, China |

| Business Model | Direct-from-factory, commission-based marketplace with heavy subsidies | Vertical fast fashion, inventory management, semi-managed model | Retail model + marketplace hybrid, local warehousing focus |

| Primary Product Categories | General goods: home, kitchen, pet supplies, electronics, fashion | Fast fashion: clothing, accessories, cosmetics, home goods | Daily essentials, electronics, cosmetics, home living, food |

| EU Market Entry | Spring 2023 | Already established (expansion focus) | Spring 2025 (UK), August 2025 (France) |

| Monthly Active Users (EU) | 93.7 million (2025) | 100+ million (2024–2025) | Early stage, data limited |

| Standard Delivery Time | 10–20 working days | 7–15 working days | Same-day to next-day (London), 1–2 days (EU) |

| Local Warehouses | Yes – Germany, France, Spain, Netherlands, Italy, Austria | Yes – Wroclaw (Poland), Stradella (Italy), additional hubs | Yes – France, Netherlands, Poland, UK |

| Merchant Commissions | Zero base commission (currently) | 4–6% (with 50% first-year discount) | 4–6% commission, modest security deposit |

| Merchant Shipping Fees | Minimal or covered by Temu | Handled by Shein logistics | Merchants manage or use Joybuy logistics |

| Key Competitive Advantage | Ultra-low prices, free shipping, gamification, massive subsidies | Fast supply chain, trend-responsive, designer collaborations | Speed (same-day/next-day), local logistics, quality focus |

| Regulatory Status | Under DSA investigation (July 2025), preliminary findings of non-compliance | €40M fine by France (July 2025), DSA compliance requests | Early stage, actively recruiting EU sellers |

Temu: Losing Money to Win Everything

Go further

Temu is barely three years old, but it’s already Europe’s fastest-growing marketplace – 63% growth year-over-year, with sales expected to hit €15 billion in 2025 (source: Cross-Border Magazine).

The model is brutally simple: connect European shoppers directly to Chinese factories, cut out everyone in between, and sell everything dirt cheap. Behind it sits PDD Holdings, the company that built Pinduoduo into a Chinese e-commerce powerhouse.

But here’s the thing: Temu is hemorrhaging money, possibly $950 million a year. In 2023 alone, it spent nearly $2 billion on advertising, losing roughly $30 on every order. Goldman Sachs calculated the company paid about $5 just to acquire a customer who’d spend $39. It’s a gamble: grab users now, worry about profits later.

The strategy is already shifting. After initially shipping everything from China (meaning weeks-long waits), Temu pivoted hard in late 2024. It opened its platform to European sellers and started operating local warehouses across Germany, France, Spain, and beyond. Delivery times dropped from weeks to days. The company says it wants 80% of European orders fulfilled locally soon.

There’s a catch, though. European regulators aren’t amused. In July 2025, Brussels preliminary ruled that Temu violated EU law by failing to stop illegal products (dangerous toys, dodgy electronics) from flooding its marketplace. If confirmed, fines could reach 6% of global revenue.

Temu’s bet is that none of that will matter once they’ve locked in enough customers. Whether European authorities – or competitors – will let them get that far is another question.

SHEIN: The One That’s Actually Making Money

SHEIN isn’t the scrappy newcomer, it’s the established player. Founded in 2008, it pulled in somewhere between €30-45 billion in 2023 and, crucially, it’s profitable.

The secret is speed. SHEIN’s Guangzhou hub coordinates over 3,000 suppliers who pump out 10,000 new styles every week. Instead of gambling on huge production runs, the company makes small batches, watches what sells in real-time, then scales up the winners. It’s Zara’s model turbocharged for the internet age, with prices 50-70% cheaper than traditional retailers.

In Europe, SHEIN’s already dug in deep. Over 100 million monthly users. Warehouses in Poland and Italy. More than half of Spanish online shoppers have used it. In France, according to Marketplace Universe, it’s pushing 40% penetration. Oxford Economics calculated that SHEIN’s operations supported 6,100 jobs and added €1.1 billion to EU GDP in 2023.

The company’s also playing nice with European regulators, at least on paper. It’s launched programs to bring on 600 EU designers and help local small businesses sell through its platform. The pitch: we’re not just competing with you, we’re helping digitize European retail.

But regulators aren’t buying it entirely. France slapped SHEIN with a €40 million fine in July 2025 for misleading environmental claims. Brussels is demanding transparency on its algorithms and how it protects minors online. Critics say a business model built on ultra-fast fashion and rock-bottom prices fundamentally clashes with EU sustainability goals, no matter how many designer incubators SHEIN funds.

Still, unlike Temu, SHEIN’s not bleeding cash to gain market share. It’s already won it.

JoyBuy: The Third-Time-Lucky Wildcard

Go further

JoyBuy is JD.com’s third swing at Europe. The Chinese e-commerce giant – number two in China behind Alibaba – tried twice before and failed. First with the original Joybuy (2015-2021), then with Ochama, a quick-commerce experiment that never caught fire. In August 2025, they rebranded and relaunched as JoyBuy.

This time feels different. JoyBuy isn’t trying to out-cheap Temu or out-fashion SHEIN. Its bet is on speed and quality, leveraging JD.com’s legendary logistics to deliver same-day or next-day in key markets. Early London pilots reportedly hit 6-hour delivery times, matching what JD.com pulls off in China.

The product mix skews practical: groceries, electronics, cosmetics, household essentials. It’s targeting the everyday shopping Amazon dominates, not the impulse-buy chaos of Temu or SHEIN’s latest trends. The platform combines JD.com’s own inventory with a marketplace for third-party sellers, charging 4-6% commissions, higher than Temu’s zero, but competitive with established European players.

JoyBuy soft-launched in the UK in April 2025, expanded to France by August, and has been building out warehouses across France, the Netherlands, and Poland. The company’s pitching itself as the compliant alternative: built from day one around GDPR, EU consumer protection, and product safety standards. That’s a direct jab at Temu’s regulatory troubles.

The challenge? Almost nobody’s heard of them yet. JoyBuy has JD.com’s $159 billion war chest and logistics expertise, but it’s entering a market where Amazon owns the high ground and Chinese competitors already have massive user bases. Early seller recruitment looks promising, but turning that into consumer awareness is the real test.

What This Means for Europe

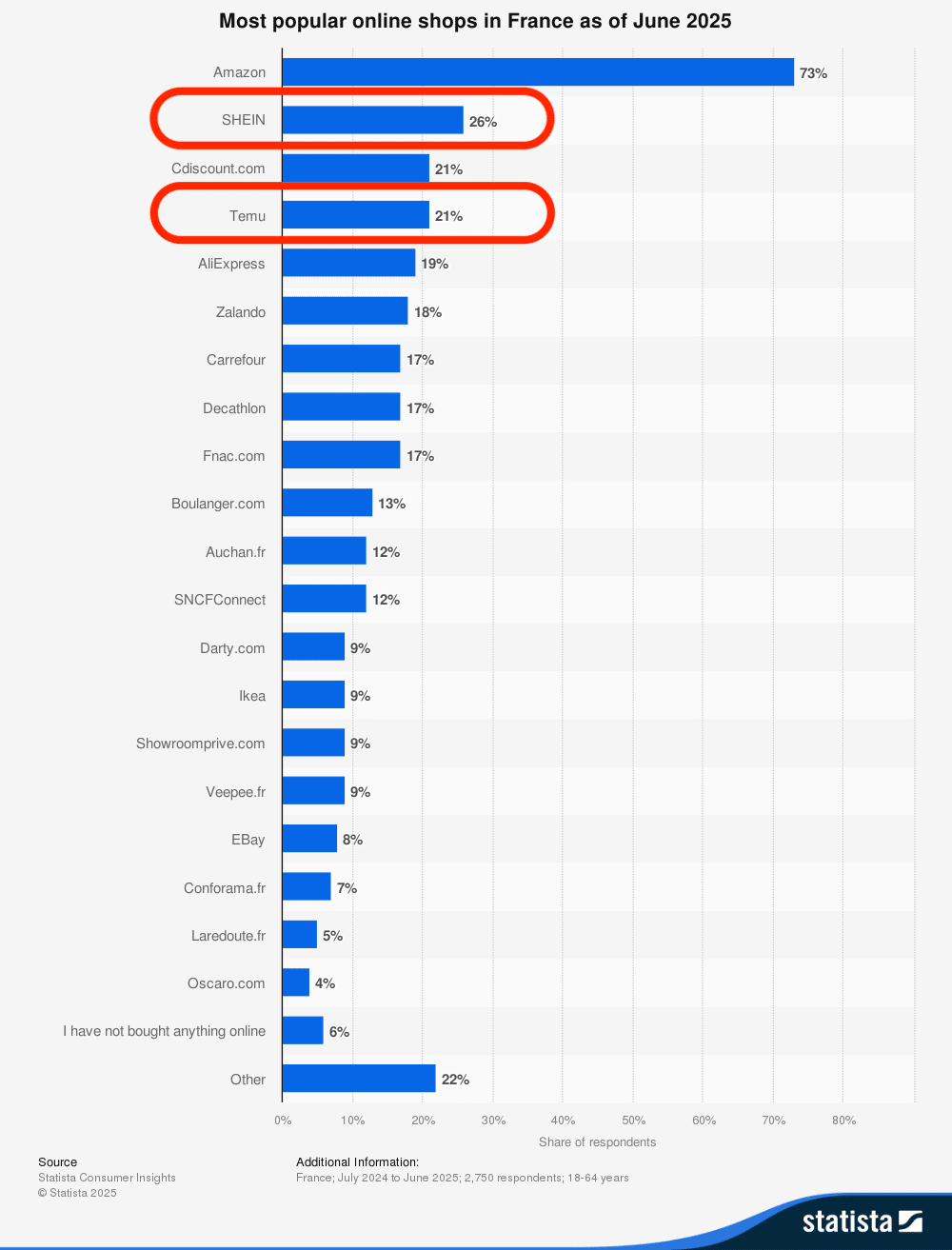

Most popular online shops in 🇫🇷 France (incl. Temu & SHEIN)

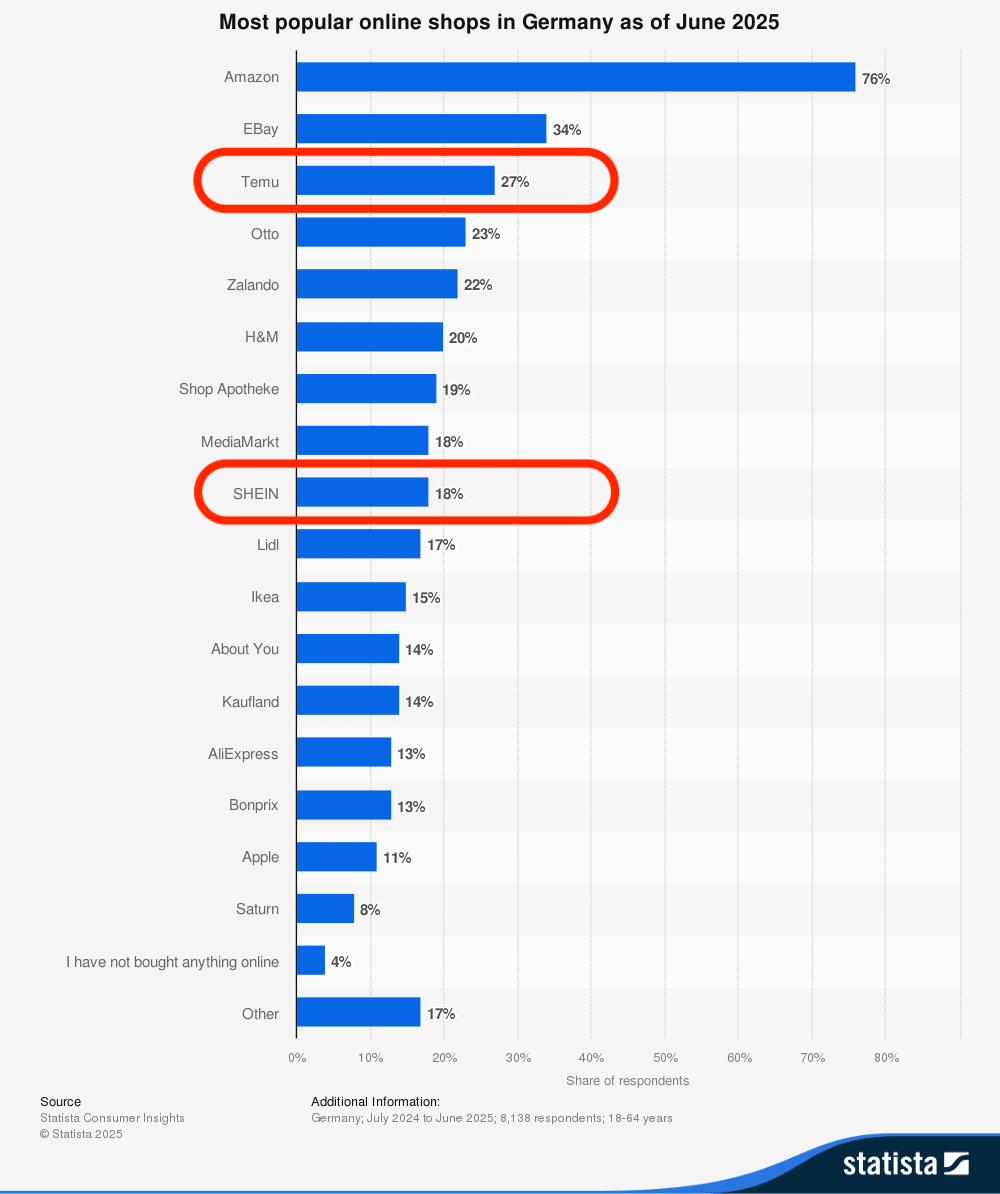

Most popular online shops in 🇩🇪 Germany (incl. Temu & SHEIN)

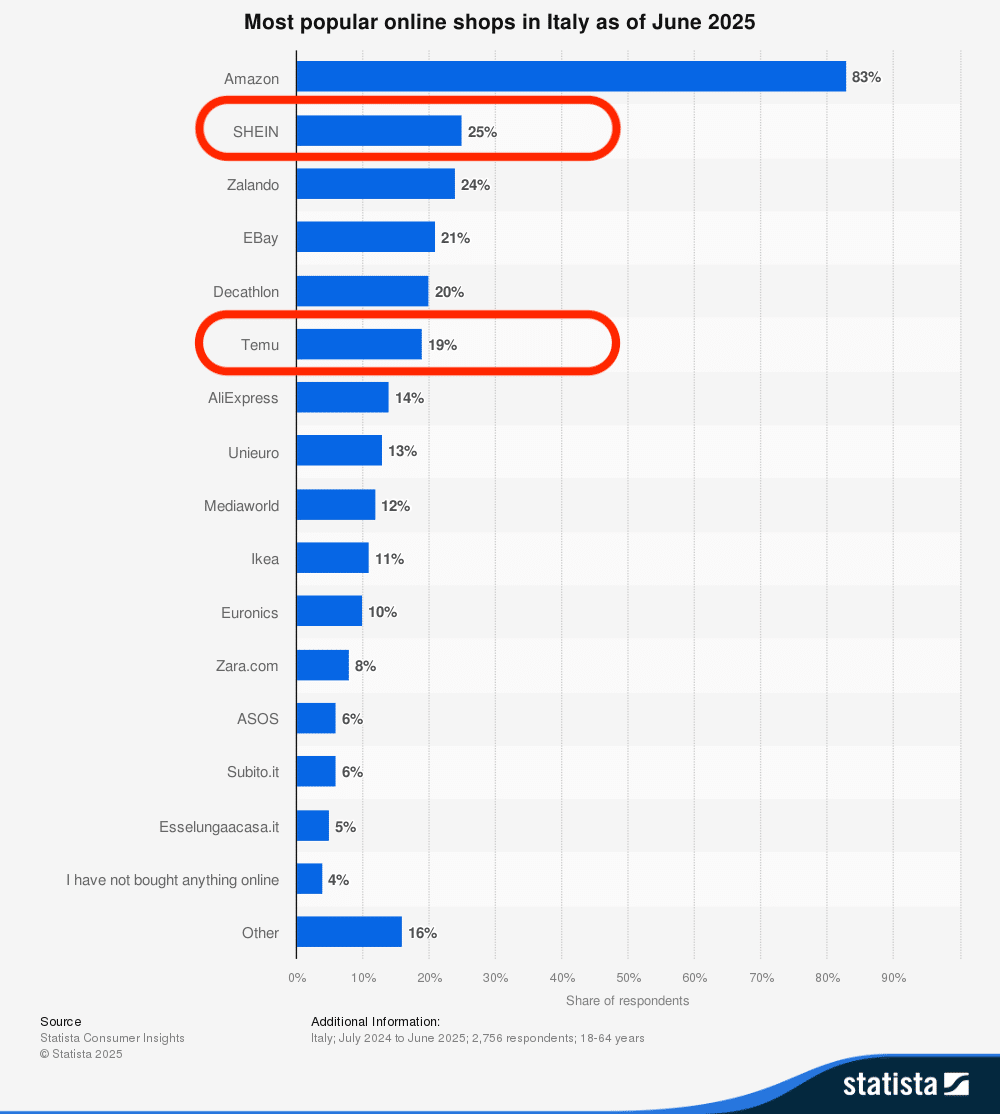

Most popular online shops in 🇮🇹 Italy (incl. Temu & SHEIN)

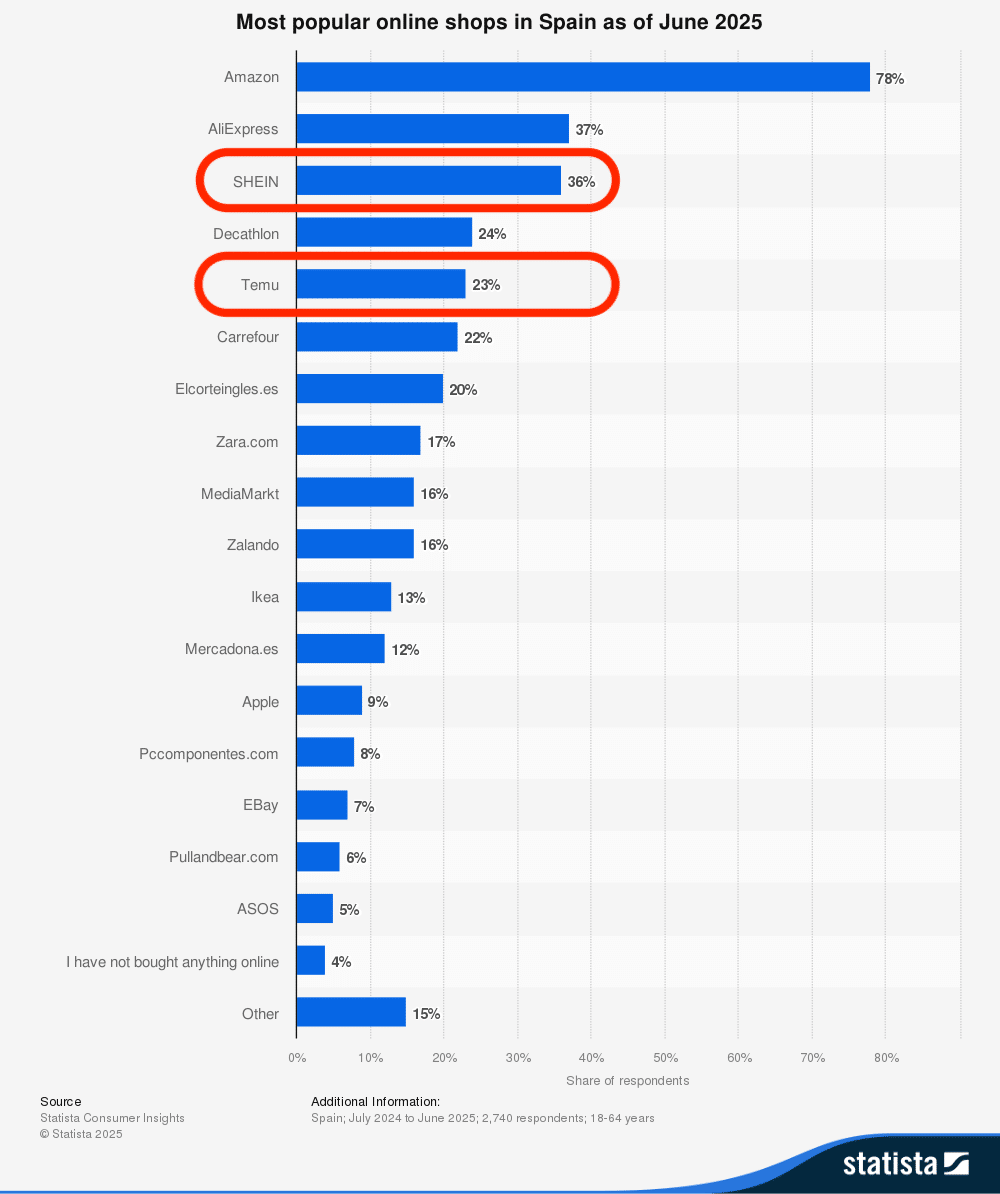

Most popular online shops in 🇪🇸 Spain (incl. Temu & SHEIN)

The Cracks in Amazon’s Armor

The pattern is unmistakable: Chinese platforms are surging where Amazon never bothered to dominate. In Poland, Amazon has less than 10% of the market. AliExpress sits at 40%, Temu at 36%, SHEIN at 24%. In Spain and Italy, SHEIN and AliExpress have cracked 50% and 33% penetration respectively (source: Marketplace Universe).

Temu’s growth is particularly stunning, up to 100% year-over-year in some EU markets, with Poland seeing penetration jump 37.5 percentage points in a single year. SHEIN’s holding steady at 50-60% annual growth, strongest in Southern Europe.

Brussels Is Watching

All three platforms are now under the Digital Services Act’s microscope. With over 45 million monthly users each, they’re designated “Very Large Online Platforms” – meaning strict compliance rules and serious penalties for violations.

Temu’s facing the biggest heat: potential fines of 6% of global revenue for letting illegal products flood its marketplace. SHEIN’s already been hit with €40 million in France and is fielding ongoing compliance demands from Brussels. JoyBuy’s betting its clean-slate, compliant-by-design approach will keep it out of trouble, but that’s untested.

Three Platforms, Three Different Shoppers

These aren’t interchangeable competitors, they’re carving up the market by consumer type. Temu owns the bargain hunters who’ll wait weeks for a €2 phone case. SHEIN belongs to Gen Z fashionistas chasing the latest trends. JoyBuy’s aiming for the quality-conscious crowd that wants Amazon’s reliability without Amazon’s prices.

By 2026, according to Cross-Border Magazine, Temu expects to turn profitable – about $775 million in operating income – as its local warehouses kick into gear. SHEIN’s already profitable and optimizing. JoyBuy’s just getting started with its European rollout.

The endgame isn’t one platform crushing the others. It’s a fragmented ecosystem where Europeans hop between apps depending on what they’re buying – fast fashion here, cheap gadgets there, reliable essentials somewhere else. For European retailers and sellers, that means both opportunity and chaos: millions of new customers, but razor-thin margins and regulatory minefields everywhere.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'