TikTok Shop: What’s Selling Across Europe in November 2025

01/12/25

10'

TikTok Shop continues to solidify its status as Europe’s most dynamic social commerce channel. With Black Friday profoundly reshaping shopper behavior, November sales displayed significant shifts compared to October, new market leaders, unexpected category surges, and sharper contrasts between European countries.

Our updated TikTok Shop analysis across five major markets; France, Germany, Italy, Spain, and the UK highlights the most notable evolutions month-over-month and the product categories that gained momentum during this decisive period.

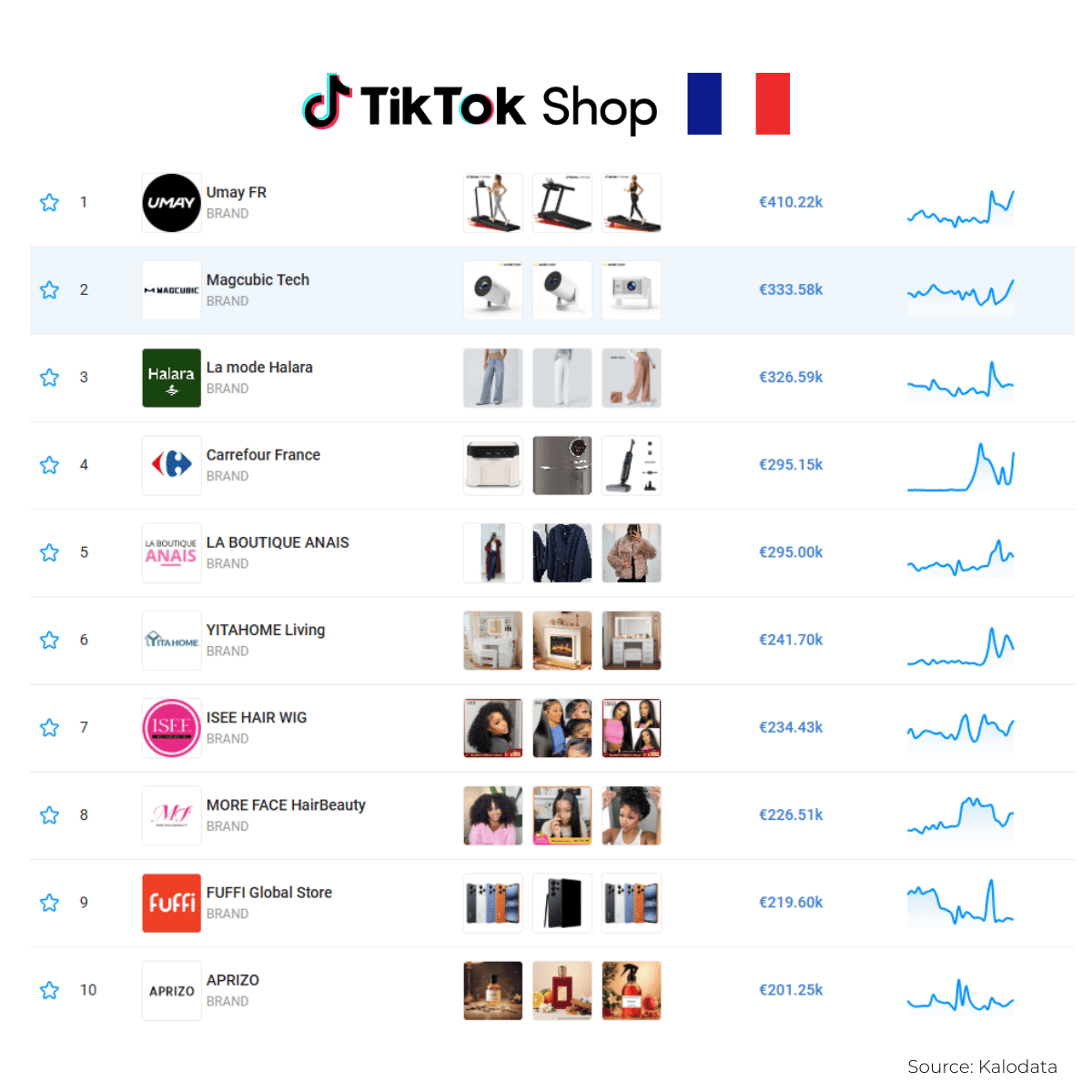

Show 🇫🇷 TikTok Shop France Chart

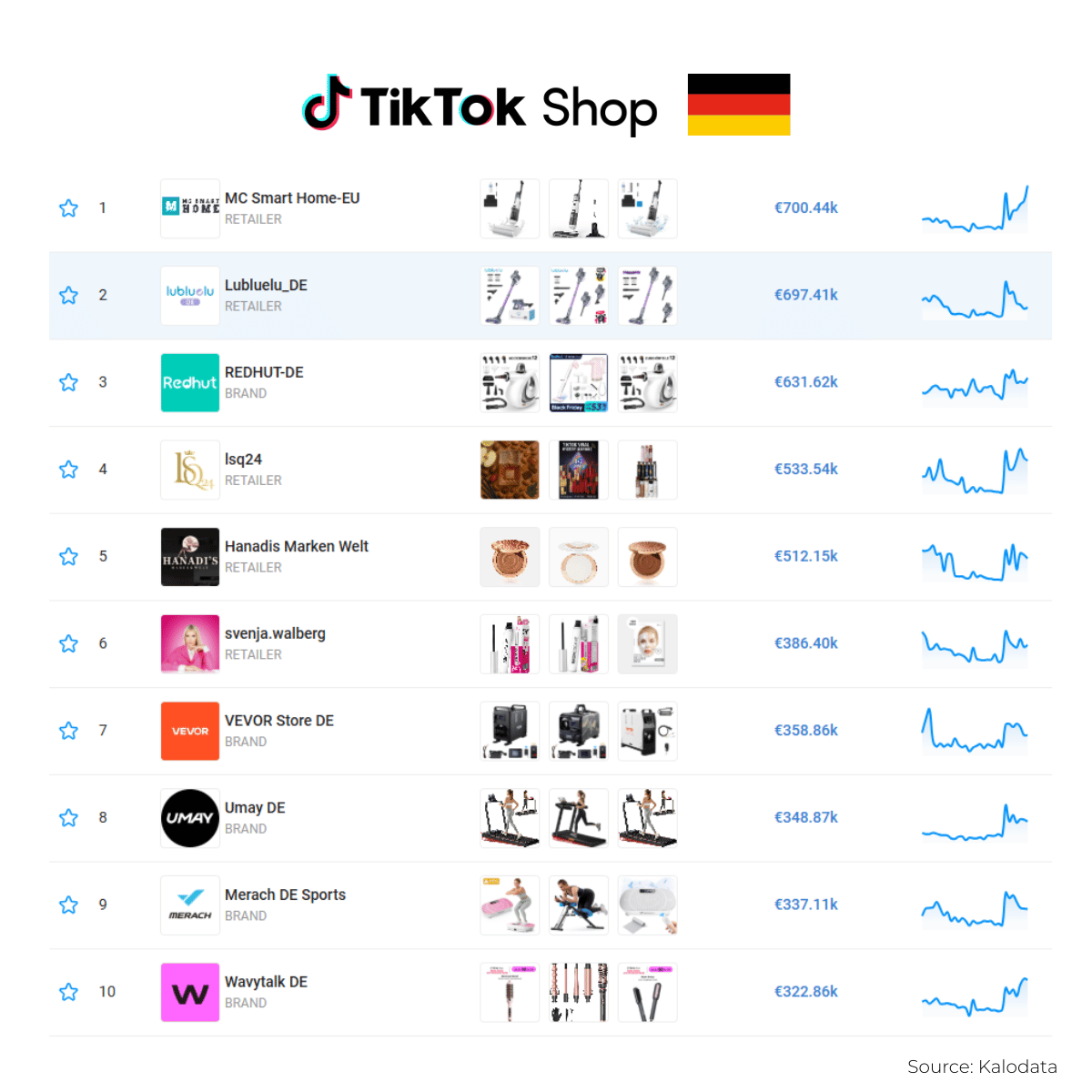

Show 🇩🇪 TikTok Shop Germany Chart

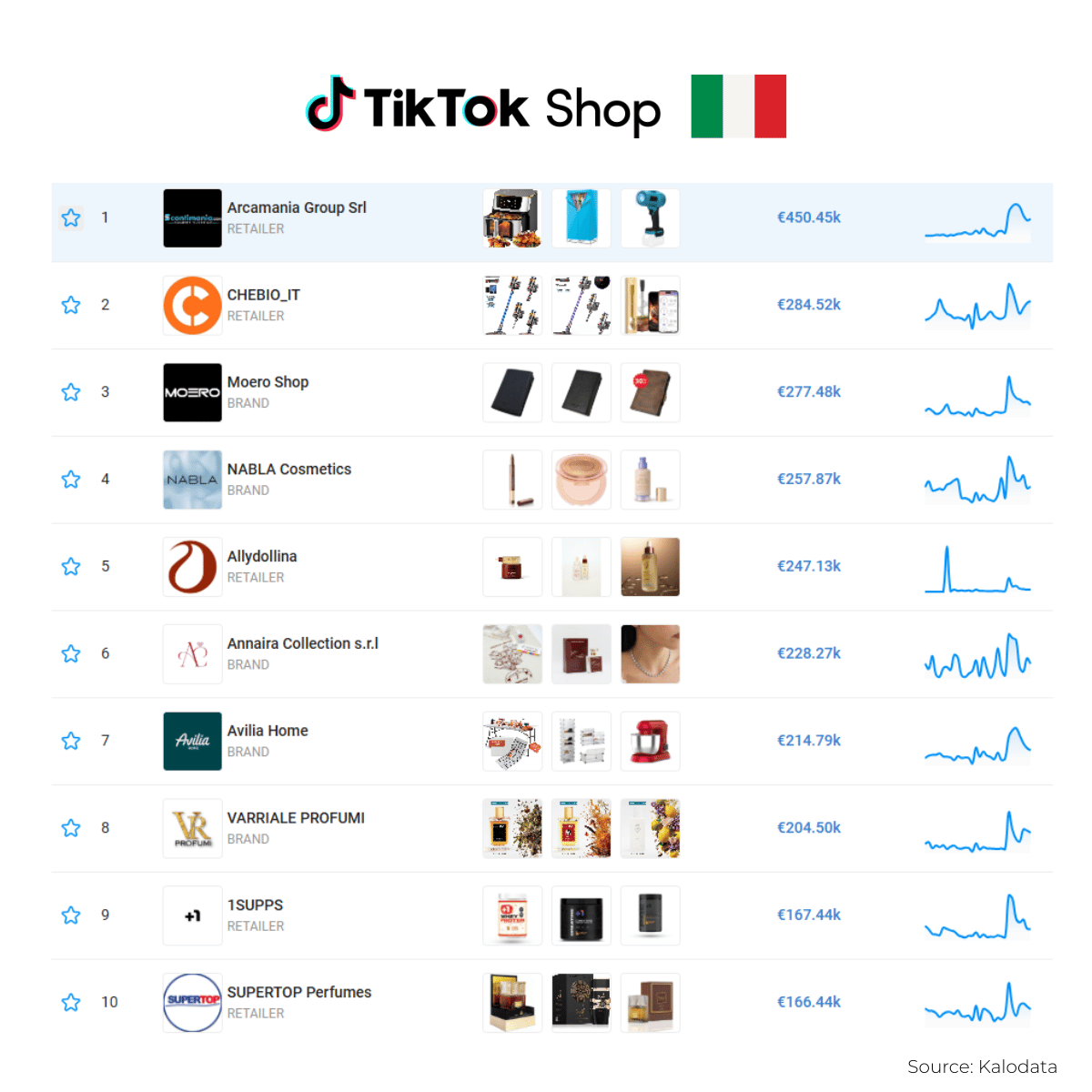

Show 🇮🇹 TikTok Shop Italy Chart

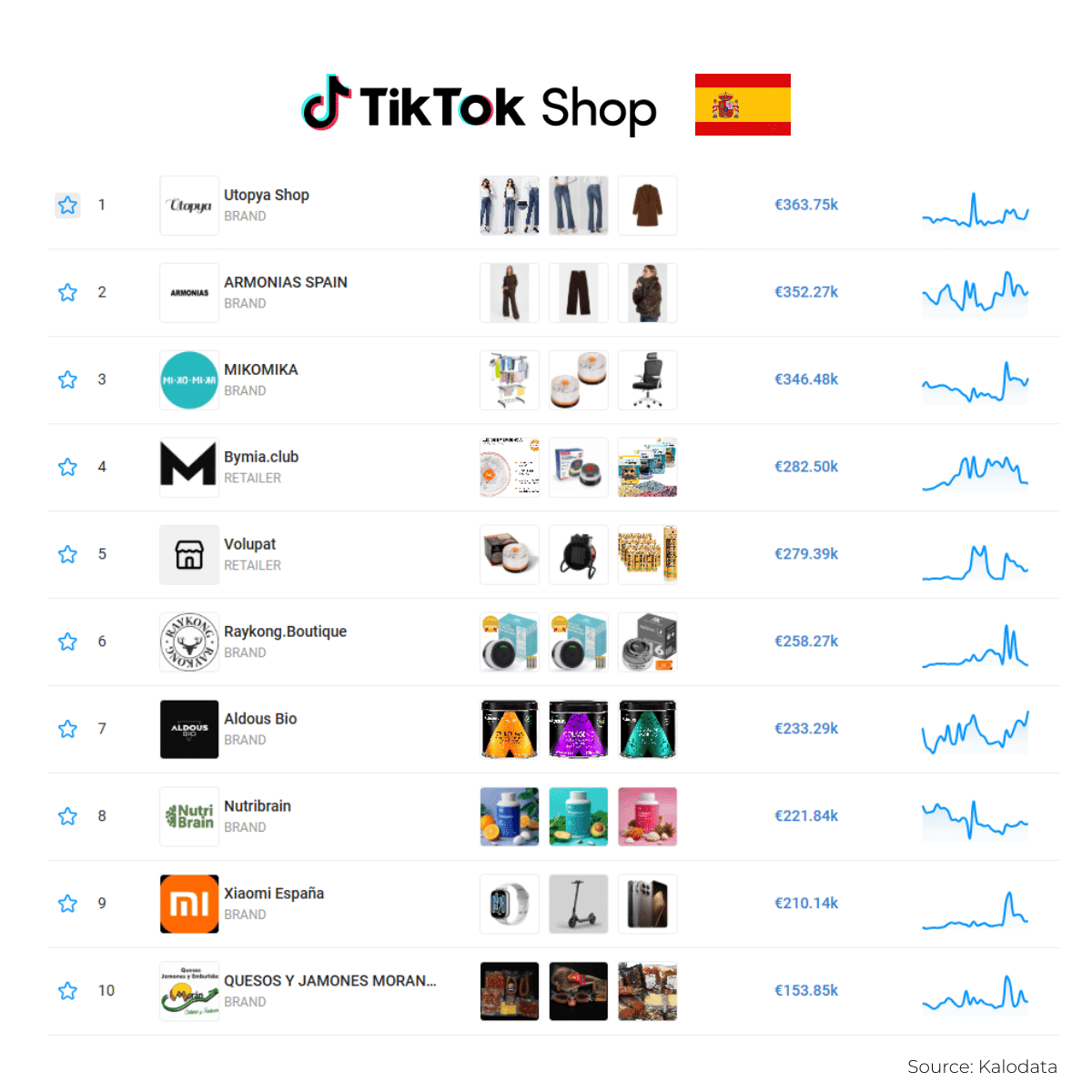

Show 🇪🇸 TikTok Shop Spain Chart

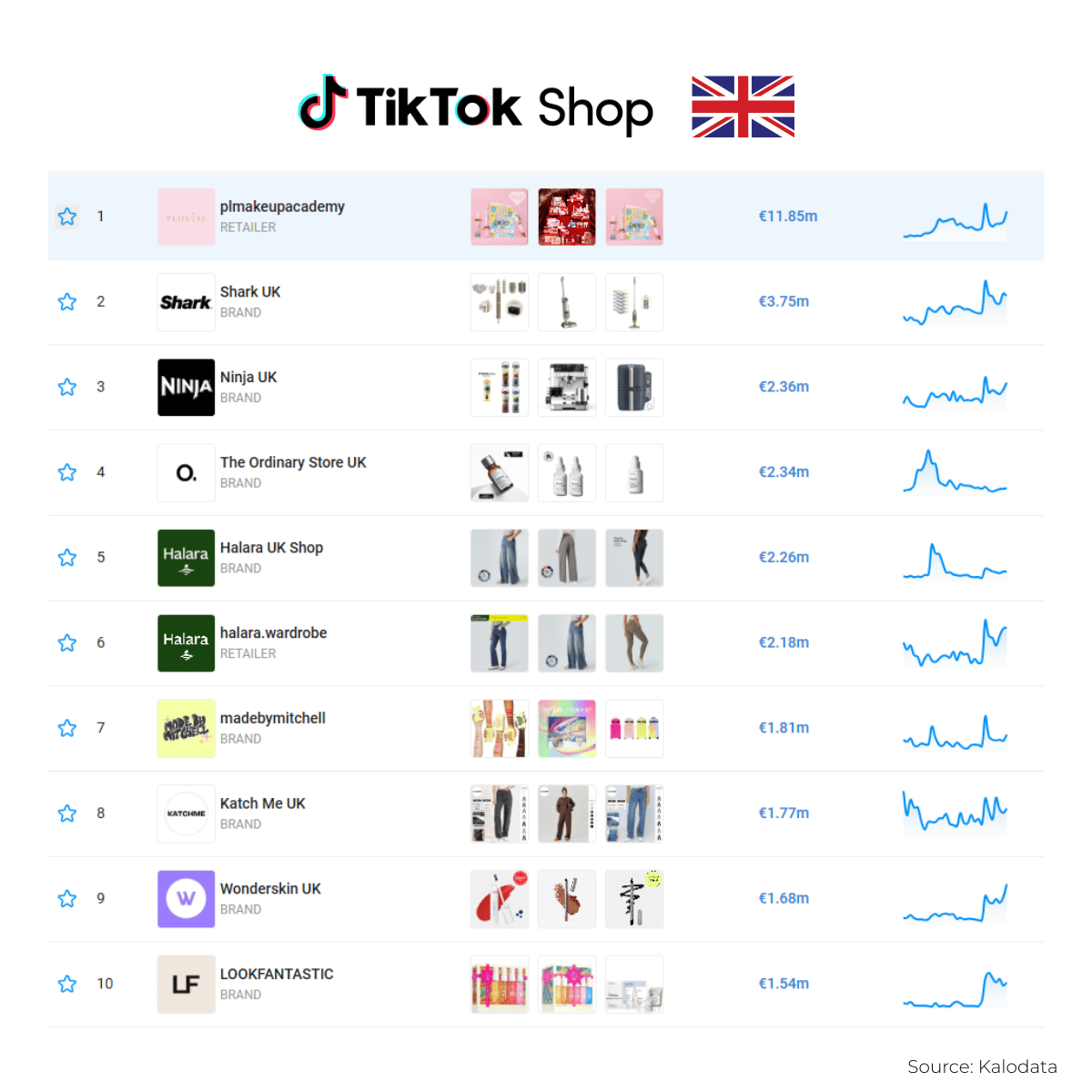

Show 🇬🇧 TikTok Shop UK Chart

Key Findings: TikTok Shop Trending Products Across Europe (November vs October)

Fashion Dominates… but Black Friday Boosted Tech & Beauty

In October, fashion led the rankings in most countries (especially France, Spain, and the UK).

November, however, broke that pattern.

What changed?

- Tech surged strongly in France and Germany thanks to Black Friday appliance deals.

- Beauty exploded in the UK, reaching record-breaking revenue.

- Fashion remained dominant only in Spain, where two apparel brands reclaimed the top positions.

- Italy shifted further into beauty and giftable lifestyle items, a typical pre-holiday trend.

Below is a country-by-country comparison of what changed from October.

TikTok Shop Guide for Online Sellers

All you need to know about TikTok Shop TikTok Shop is a unique type of…

Learn more🇫🇷 France: Tech & Fitness Replace Fashion at the Top (Big Switch vs October)

In October, France was fashion-driven (ARMONIAS & Utopya led). November reversed this hierarchy.

November Leaders

- Umay FR – €410.22k

- Magcubic Tech – €333.58k

- La mode Halara – €326.59k

What changed since October?

- Tech jumped to the top, Magcubic wasn’t even in France’s top 3 last month.

- Umay FR overtakes all fashion players after sitting lower in October rankings.

- Fashion slipped: Halara moves from leading positions in October to third place in November.

- Carrefour enters the top tier, thanks to Black Friday appliance promotions, a category absent from France’s October podium.

➡️ France is the country where Black Friday changed consumer behavior the most on TikTok Shop.

🇩🇪 Germany: Tech Was Strong in October but November Made It Dominant

Germany was already tech-first in October (Lubluelu & MC Smart Home led). November intensified this trend even more.

November Leaders

- MC Smart Home-EU – €700.44k

- Lubluelu_DE – €697.41k

- REDHUT-DE – €631.62k

Month-over-month differences

- MC Smart Home overtakes Lubluelu, reversing October’s order.

- Revenues increased significantly across all three tech leaders due to Black Friday deals.

- Fashion nearly disappears from the top 10, whereas in October Halara Damenmode was still competitive.

- Household devices show some of the strongest YoY and MoM growth in Europe.

➡️ Germany stays the most “functional-first” TikTok Shop market, but November widened the gap with non-tech categories.

🇪🇸 Spain: Fashion Reclaims #1 After Losing Ground in October

In October, Spain had a diverse mix: fashion, fitness, and home goods all performed similarly.

November Leaders

- Utopya Shop – €363.75k

- ARMONIAS SPAIN – €352.27k

- MIKOMIKA – €346.48k

How this compares to October

- Fashion comes back to #1 and #2, after being overshadowed by Halara in October.

- Utopya jumps ahead of Halara, which dominated earlier months.

- Home organization (MIKOMIKA) grows steadily, moving from mid-table in October to top 3 in November.

- Supplements and wellness brands grow ahead of the holiday season, reflecting shifting consumer priorities.

➡️ Spain is the only market where fashion strengthened in November instead of declining.

🇬🇧 United Kingdom: The Most Dramatic Growth Month-over-Month

October was already huge in the UK , plmakeupacademy hit €4.41m. November nearly tripled that figure.

November Leaders

- plmakeupacademy (P.Louise) – €11.85m

- Shark UK – €3.75m

- Ninja UK – €2.36m

Changes vs October

- P.Louise delivers the biggest MoM jump in all Europe (from €4.41m → €11.85m).

- Shark UK doubled thanks to Black Friday appliance bundles and cleaning hacks.

- Ninja UK jumped strongly, moving from mid-ranking positions in October to top 3 in November.

- Beauty remained extremely strong, but appliances rose sharply ahead of Christmas.

➡️ The UK is now TikTok Shop’s undisputed European mega-market, with the highest revenue ceiling.

🇮🇹 Italy: Beauty Becomes the New #1 Category (Clear Break from October)

October’s top sellers in Italy were an eclectic mix of perfumes, food, and small lifestyle brands. In November, beauty took over, driven by holiday demand.

November Leaders

- Arcamania Group Srl – €450.45k

- CHEBIO_IT – €284.52k

- NABLA Cosmetics – €257.87k

Month-over-month observations

- Arcamania widens its lead massively, up from €178k in October.

- Cosmetics brands climb higher than in October, where perfumes were more visible.

- Giftable items (jewelry, home products) rise as holiday shopping begins.

- The shift from artisanal > beauty signals a pre-Christmas buying pattern.

➡️ Italy leans into emotional, sensory, and gift-ready products more strongly than any other market.

Home, Health, and Lifestyle: Multi-Country Winners Compared to October

Across Europe, these categories showed strong month-over-month growth:

Supplements (France, Spain, UK)

Grew compared to October due to:

- holiday wellness content

- creator-led educational videos

- increased gifting potential

Home Appliances (Germany, UK, France)

Massive Black Friday lift:

- cleaning devices

- smart home tools

- kitchen appliances

Beauty (UK, Italy, Spain)

The category with the strongest MoM improvement across Europe.

Fitness Equipment (France, Spain)

Pushed by “winter prep” creator narratives.

What Sells Best on TikTok Shop

- Visual transformation products, even more dominant in November

Because Black Friday accelerated before/after content. - Mid-priced items (€20-€150), still the conversion sweet spot

But November showed that high-ticket appliances can explode when paired with strong creator pushes. - Cross-market brand consistency remains crucial

The brands performing well in multiple countries in November:- Halara

- Umay

- Wavytalk

- Arcamania

October had a similar pattern, but November amplified the performance gap between strong multi-market players and local niche sellers.

Country-Specific Consumer Behavior: November vs October

| Country | October Trend | November Trend | What Changed |

| France | Fashion first | Tech + Fitness | Black Friday reversed category order |

| Germany | Tech strong | Tech dominant | Even fewer fashion brands in top 10 |

| Spain | Mixed categories | Fashion returns | Utopya + Armonias regain top spots |

| UK | Beauty leader | Beauty explodes | Record-breaking month |

| Italy | Artisanal + perfumes | Beauty + gifting | Strong pre-holiday shift |

Lessons for Brands (Updated With November Learnings)

1. Black Friday creators drive exponential gains

Brands that activated affiliates early saw MoM growth of +50% to +200%.

2. Seasonal storytelling matters

“Winter fitness”, “holiday beauty boxes”, and “Black Friday cleaning hacks” were top converting narratives.

3. Market localization is now non-negotiable

November widened the behavioral gaps between countries.

4. Operational readiness determines whether brands can scale in peak season

Stock issues, slow catalog updates, or pricing delays cost brands significant revenue during Black Friday.

This is where platforms like Lengow help streamline TikTok Shop operations:

- catalog synchronization

- multi-country product distribution

- stock management

- cross-market performance tracking

Darty Success Story

How Darty became a pioneer of social commerce by launching on TikTok S…

Learn moreAbout the Data:

This analysis is based on Kalodata’s tracking of TikTok Shop performance across France, Germany, Italy, Spain, and the United Kingdom for the period October 31-November 28, 2025. Revenue figures represent estimated gross merchandise value (GMV) in euros.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'