What is JoyBuy? Everything You Need to Know

27/10/25

6'

After Temu, Shein, and Aliexpress, another major Chinese player has stepped onto the international e-commerce scene: JoyBuy, the new platform launched by JD.com, one of China’s largest and most technologically advanced retailers.

Already a powerhouse in Asia, JD.com has now chosen France as the first European market for JoyBuy; a symbolic and strategic move that marks the group’s broader ambitions to expand across Europe, with Germany, the Netherlands, Belgium, and other countries next on the roadmap.

JoyBuy sets itself apart from the usual low-cost import platforms. Instead of relying on a network of third-party sellers, JD.com aims to offer a premium marketplace, closer to Amazon’s model: one that focuses on product quality, reliability, and speed of delivery.

Europe becomes the new battleground

JoyBuy’s arrival in France comes at a tense but transformative moment for European retail. With Shein under public scrutiny and Temu expanding aggressively through partnerships with local postal services, the landscape is shifting fast.

Meanwhile, Amazon has been testing its own discount platform, Haul, to counter the influx of Asian competitors.

Amid this shake-up, JD.com’s entry through JoyBuy is not just another foreign launch. It’s a signal of how Chinese e-commerce giants are reshaping global competition, pushing for a balance between affordability, trust, and logistics excellence.

JoyBuy interface

From Beijing to Berlin: JD.com’s global strategy in motion

Founded in 1998, JD.com has become a $50 billion behemoth built on speed and control. In China, the company owns its inventory and manages deliveries in a matter of hours, thanks to a vast network of AI-powered warehouses and robotic fulfillment centers.

This same model is now being exported to the West. JD.com’s acquisition of Ceconomy, the parent company of German electronics retailers MediaMarkt and Saturn, for about €2.2 billion, marks a major step in establishing a physical and logistical footprint in Europe. The deal gives JD.com access to nearly 1,000 stores and 50,000 employees: a foundation for long-term European growth.

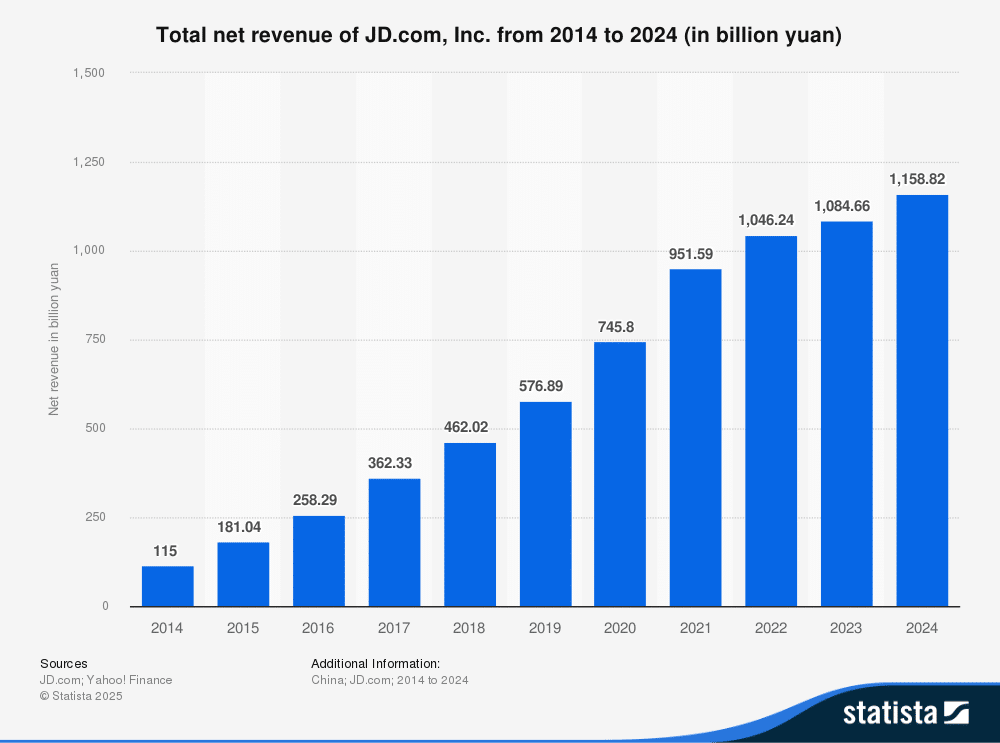

High growth, heavy investment

The timing of JoyBuy’s launch also reflects JD.com’s broader financial trajectory.

In the second quarter of 2025, JD.com’s revenues surged by 22.4%, reaching nearly $49.8 billion, while marketing costs more than doubled (+127%) and fulfillment expenses jumped 28.6%. These figures show the scale of the company’s investment in international expansion, and its willingness to sacrifice short-term profitability for long-term market share.

JD.com posted a small operating loss of around $0.1 billion, compared with a $1.5 billion profit a year earlier. Yet its core division, JD Retail, remains profitable, with operating income climbing to $1.9 billion. The group’s message is clear: it’s prepared to spend big to build a global infrastructure capable of matching Amazon on service quality, not just price.

Chart showing JD.com growth over the ten past years, from Statista

JoyBuy: a new kind of marketplace

JoyBuy’s strategy is to merge Chinese efficiency with Western expectations. Initially tested in the Netherlands and the UK under the name Ochama, the brand has evolved into a unified global platform designed for scalability and trust.

Its catalogue spans electronics, home appliances, toys, fashion, and beauty, but what truly sets it apart is JD.com’s in-house logistics. Every product listed on JoyBuy benefits from centralized inventory management and delivery control, ensuring a more reliable and premium shopping experience.

Beyond retail, JD.com also wants JoyBuy to serve as a gateway for Chinese brands going global, providing an ecosystem where quality and branding are as central as price and speed.

Challenges and ambitions

JD.com’s international journey hasn’t been without obstacles. Failed takeover attempts of UK retailers like Currys and Argos have highlighted the complexity of integrating into Western markets, where regulatory and cultural differences remain substantial.

Still, the company continues to invest heavily in logistics and infrastructure across Europe, with warehouses in Milton Keynes, Preston, and other strategic hubs. Each investment signals the company’s determination to build a truly global retail ecosystem.

A new phase in global e-commerce

With JoyBuy, JD.com is redefining what it means to be a global marketplace. Its arrival in France may be just the first step, but it represents something bigger, a shift in the balance of power in online retail.

The age of ultra-cheap marketplaces is evolving into one of hybrid platforms, where scale, speed, and service quality converge.

Whether JoyBuy will become a true rival to Amazon remains to be seen. But one thing is certain: the competition is intensifying and consumers around the world will be the first to witness… and benefit from this new global e-commerce rivalry.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'