Amazon vs Temu: The Great E-commerce Convergence

14/01/26

9'

For thirty years, Amazon dominated Western e-commerce with lightning-fast logistics and its Prime ecosystem. But since 2023, a new challenger from China has been rewriting the rules: Temu, with prices up to 40% lower than Amazon and a shopping experience designed to be addictive.

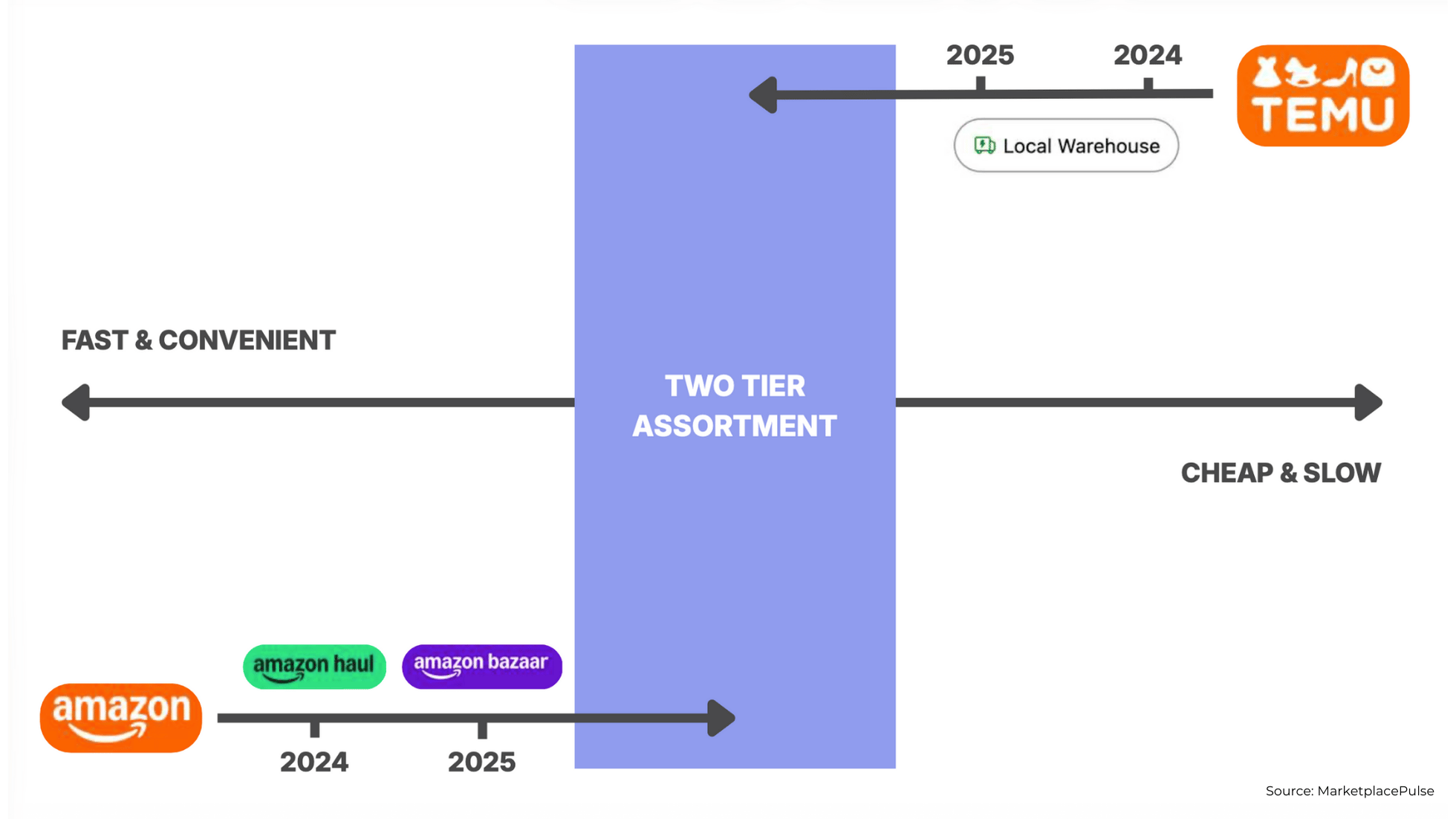

Here’s where it gets interesting: both platforms are now doing something unexpected. Amazon is launching direct-from-China shipping programs (Haul and Bazaar), while Temu is rapidly deploying local warehouses across Europe. This strategic reversal marks a turning point in global e-commerce.

The numbers tell the story

Amazon, founded in 1994, offers around 600 million products with 9.7 million active sellers, generating more than 575 billion dollars in annual revenue. In Germany and Italy, the platform captures up to 70 percent of the e-commerce market.

Temu, launched just four years ago, already claims 93.7 million users in Europe and shows year-on-year growth of 63 percent, with sales expected to reach 20 billion euros by 2026. In Poland, Temu holds a 36 percent market share.

The contrast is striking: Amazon offers Prime delivery times of 1 to 2 days with seller margins of 25 to 30 percent. Temu provides delivery in 5 to 10 days, increasingly faster, with extremely thin margins of 2 to 5 percent.

| Aspect | Amazon | Temu |

|---|---|---|

| Founded | 1994 | 2022 |

| Parent Company | Amazon Inc. (public) | PDD Holdings (Pinduoduo) |

| Headquarters | Seattle, United States | Shanghai, China |

| Product Catalog | ~600 million SKUs | ~10 million SKUs |

| Active Users (Europe) | Dominant (varies by country) | 93.7 million (2025) |

| Share of cross-border orders (%) | 24% (2025) | 24% (2025) |

| Business Model | Hybrid marketplace + retail + services (AWS, Prime Video) | Managed marketplace, direct-from-factory, heavily subsidized |

| Standard Delivery Time | 1–2 days (Prime) | 5–10 business days |

| Delivery with Local Warehouses | Same-day to 2 days | 2–5 days (expansion ongoing) |

| Seller Commissions | 6–45% depending on category (avg. 8–15%) | 0–5% (conflicting sources) |

| Typical Seller Margins | 25–30% | 2–5% (very tight) |

| Key Competitive Advantage | Speed, trust, Prime ecosystem, AWS | Ultra-low prices, gamification, massive subsidies |

| Regulatory Status (Europe) | Compliant, environmental oversight | Under DSA investigation, risk of fines up to 6% of global revenue |

Amazon’s unexpected pivot

Amazon’s dominance rests on unmatched infrastructure: over 400 fulfillment centers in 40 countries, 200 million Prime members worldwide, and 82% of sellers using FBA. Trust is its invisible asset – the Prime badge increases conversions by 25%, and 50% of consumers prefer Amazon’s return policy over Temu’s.

But facing Temu’s rise, Amazon made a surprising move. In 2024, it launched Amazon Haul and Bazaar, offering products under $20 shipped directly from China with two-week delivery. Before Amazon removed Haul data from product pages in May 2025, Haul items represented 5-15% of top 100 bestsellers – up from just 1-2% at launch.

The message is clear: Amazon refuses to cede the ultra-discount segment. But this risks diluting its premium brand image.

Temu’s rapid evolution

Temu built its reputation on impossible prices (phone cases under €2, t-shirts under €5) thanks to direct factory connections in China. 76% of consumers find Temu cheaper than Amazon, though on identical branded products, the difference is only 1%.

The business model is intentional loss-making. In 2023, Temu reportedly lost around $950 million, with advertising spend approaching $2 billion. This “blitzscaling” strategy aims to acquire users today for profitability tomorrow, analysts predict Temu will reach profitability in 2026.

The platform uses a “managed marketplace” model: it negotiates directly with factories, sets prices, and manages logistics. Sellers accept 2-5% margins (versus Amazon’s 25-30%) for massive volumes and international access.

Now comes the big shift. After building its reputation on direct-from-China shipping with 10-20 day delivery, Temu opened its first European warehouses late 2024 in Germany, France, Spain, Netherlands, Italy, and Austria. The goal: process 80% of European orders via local warehouses by end of 2025. Some products now arrive in 2-5 days.

This isn’t just about customer satisfaction. The US suspended its $800 customs exemption for Chinese imports in May 2025, and the EU agreed to gradually eliminate its €150 exemption by 2028. Without duty-free shipping, the direct-factory model loses its pricing edge.

Two philosophies, one convergence

Amazon builds loyalty through consistency: AI-powered personalization, one-click ordering, predictable service. Prime Day 2025 generated $24.1 billion in sales over four days.

Temu transforms shopping into a game: fortune wheels, countdown timers, flash deals. “Temu is as addictive as sugar,” says retail analyst Neil Saunders. Professor Mark Griffiths of Nottingham Trent University confirms the platform has “blended shopping and gamification very well.”

The demographics are revealing. Amazon dominates across all ages, among US teens, Amazon is the favorite shopping site (55%) while Temu ranks fifth (2%). But Temu’s appeal crosses generations: users 59+ make 5.6 transactions per year versus 2.6 for 18-26 year-olds.

Despite these contrasting uses, the balance is striking when it comes to cross-border trade. According to data from Ecommerce News, Amazon and Temu now show the same share of cross-border orders, at 24% each.

In other words, despite very different average basket values and opposing purchasing logics, the two platforms now carry equal weight in cross-border commerce. Further proof that convergence is no longer driven solely by the user experience, but by the ability to orchestrate global logistics models at scale.

What this means for sellers and consumers

For sellers, the equation is evolving. Amazon offers better margins (25-30% vs. 2-5%) but charges 8-15% commission plus FBA fees. Temu’s fees remain opaque – ranging from 0% to 30% depending on sources – but volumes are massive with 1.7 billion monthly visits.

The winning strategy? Most sellers need both. Amazon for building brands and reaching premium buyers. Temu for moving volume at tight margins.

For consumers, 96% of Temu customers also shop on Amazon, proving they alternate based on needs. Need something reliable fast? Amazon. Hunting bargains on non-essentials? Temu.

But this prosperous period may be temporary. When Temu reaches profitability in 2026, prices will likely rise. And as Amazon invests billions in infrastructure, those costs get passed on.

The future is hybrid

Neither platform is abandoning its core model. Amazon keeps FBA as priority while testing ultra-discount. Temu maintains factory-direct while localizing logistics. Both admit that modern e-commerce requires mastering speed AND price, trust AND discovery, global AND local simultaneously.

The great supply chain reversal isn’t just a logistics story, it’s proof that e-commerce has become multidimensional. The winners won’t be those with the perfect model, but those who can orchestrate multiple models without losing their identity.

For European sellers and consumers, that means more choice, more complexity, and a market where adaptability matters more than ever.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'