5 innovative e-commerce trends from China to follow in 2022

03/05/22

5'

Over the years, the Chinese e-commerce market has become a source of inspiration for Western brands and retailers. Known for its innovative and dynamic nature, the market is estimated to be worth more than 1150 billion dollars by the end of 2022. Let’s look at five e-commerce trends that will mark the Year of the Rat.

1/ Towards the end of Key Opinion Leaders?

Extremely popular in China, Key Opinion Leaders (KOLs) regularly collaborate with brands and agencies operating in the fashion, luxury and beauty sectors. Solicited as part of influencer marketing campaigns, these opinion leaders regularly promote new products to their community of thousands—or even millions—of subscribers.

In recent months, KOLs have been rubbing shoulders with a new generation of influencers: Key Opinion Consumers (KOCs). Unlike KOLs, KOCs are “real” consumers. They test and write opinions on products that interest them and share their feedback with potential buyers.

Although they have fewer subscribers than KOLs (some 100), KOCs have a strong influence on consumers’ purchasing decisions because of the credibility, authenticity and reliability of their content. This is something KOL subscribers put into question because of the paid nature of the partnership between the influencer and brand.

This phenomenon, which is booming in China, is pushing marketing teams to gradually integrate this new generation of influencers into their strategy.

NB: Little Red Book (Xiaohongshu) is the ideal social network for KOC marketing.

2/ From individual purchase to collective consumption

Extremely popular in “lower-tier” cities and rural areas, group buying enables consumers to purchase products and services at attractive prices, provided they join forces with other consumers. This model is at the heart of Pinduoduo’s strategy, and other platforms such as Jingxi (JD.com) and Juhuasuan (Alibaba) are gradually offering this mode of consumption to Chinese e-shoppers.

For example, at the 2019 Global Shopping Festival, Alibaba said that in the first two hours after the launch of the Double Eleven, over 10 million orders were placed on Juhuasuan. JD.com said that 40% of its new customers came from Jingxi.

Given Chinese consumers’ enthusiasm for this new mode of consumption, group purchasing will intensify in 2022 on Chinese online sales platforms.

3/ Second-hand en route for success

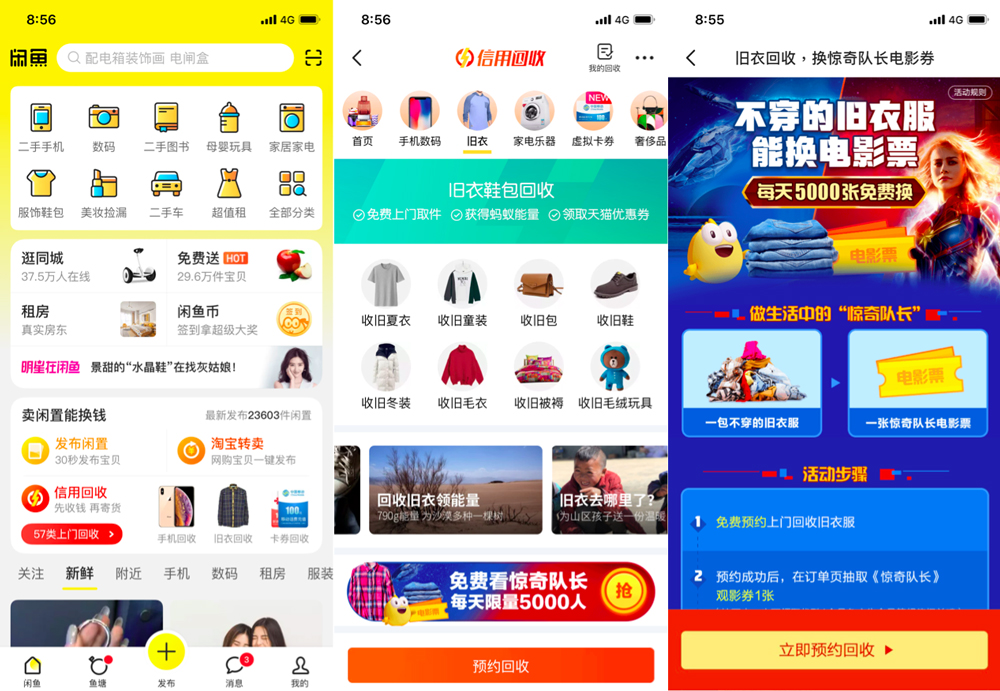

According to the China Center for Internet Economy Research, China’s second-hand market is expected to be worth more than 1 trillion yuan by 2020. Buyers are increasingly attracted to second-hand products, as revealed in a survey conducted by Mintel in 2019. More than half of consumers say they rent or buy second-hand products as part of an environmental approach.

While the second-hand market is gradually taking off in China (compared to Western countries), the popularity of second-hand online shopping is growing in the country, especially among Chinese millennials. Most millennials go to Idle Fish (Xianyu) and Zhuan Zhuan, two essential second-hand applications in China. Idle Fish platform, which belongs to the Alibaba Group, has 200 million users, 60% of whom were born after 1990.

4/ On-demand consumption with C2M

The Consumer-to-Manufacturer (C2M) model will continue to evolve in 2020 to best meet market demand. Adopted by many manufacturers in the Chinese market, C2M aims to produce custom-made items based on data collected on consumer purchasing habits.

In addition to improving the shopping experience for buyers, this model allows manufacturers to make several cost savings by providing buyers with products at attractive prices.

The marketplace JD.com, which announced at the end of 2019 the launch of around 100 million new products over the next three years, is using this model to develop new best-selling products. According to Xu Lei, the CEO of JD.com, this approach reduces the time required to study a product by 75%, and the time required to launch a new product on the market by 67%.

5/ O2O (online-to-offline) continues to grow

Initiated by Alibaba as part of its New Retail strategy in 2016, the online-to-offline (O2O) phenomenon enables Chinese consumers to benefit from an omnichannel and connected shopping experience, using new technologies. After Alibaba’s Fresh Hippo stores, it is competitor JD.com’s turn to strengthen its O2O strategy.

At the end of 2019, JD.com opened “JD E-SPACE”, a fully digital 50,000m² store (equipped with 5G), featuring over 1,500 brands and 200,000 products that visitors can test before buying online. In this space, each item has an electronic price label accompanied by a QR code. If a customer wishes to order a product, they simply scan the QR code, pay for their purchase via the WeChat application and then have it delivered or pick it up directly. These dynamic labels are connected to the JD.com platform to guarantee identical prices online and in-store. By opening this store, JD.com wants to offer a unique and immersive experiences to its customers.

Zisheng YangEquipped with the most advanced technologies and cutting-edge products, JD E-Space offers consumers not only the convenience of shopping, but also an immersive and interactive experience.

Head of Offline Business, JD Home Appliances

In 2022, the key challenge for Chinese players will be to offer a unified shopping experience to consumers and to avoid poorly designed experiences, which are a source of frustration for customers and loss of revenue for these players.

Sources: JingDaily, Statista, Coresight, Warc, Mintel, China Daily, JD.com.

Mockup: The Inspire Design Studio

Image: Nattawara

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'