FMCG in the European e-commerce market

25/06/22

4'

The items most ordered online in Europe in 2021 were clothing, shoes, and accessories (sporting goods included) and household goods (furniture, home accessories, gardening products etc.) (statistics from February 2022). But how about online sales of daily consumer goods (FMCG)—in particular food—in Europe? What place does this product group have in e-commerce and which trends are there to watch out for? How has the COVID-19 pandemic impacted the market? Read on to find out all the important facts and figures on the FMCG market in Europe.

What is FMCG?

Fast Moving Consumer Goods (FMCG) is the term used to describe merchandise that rotates quickly. They sell quickly and can be swiftly replaced in the warehouse. This product category mainly includes consumer goods for daily use (i.e. relatively inexpensive goods), such as food, hygiene products, cosmetic products, etc.

FMCG in selected European e-commerce markets

According to the Kantar Worldpanel, FMCG online sales account for 7.6 % of all FMCG in the United Kingdom, 6.2 % in France and just 2.4 % in Spain. This puts European countries far behind their Asian counterparts. In South Korea (20.3 %) and China (15.2 %), the shares are much higher.

FMCG statistics for Europe look better when looking at the share of FMCG in total e-commerce. There, Germany came to 8.7% in 2019, an increase of 16% over the previous year. This equates to sales of 5.2 billion euros, making FMCG the fastest-growing category in German e-commerce. In other European countries, too, fast-moving products are one of the fastest-growing categories in online retailing. This can be explained by the fact that the other categories previously grew rapidly and FMCG has some catching up to do here.

One reason for the still relatively weak demand of FMCG online in Europe is the deep-seated habit of consumers, who buy everyday items spontaneously without much planning. A limitation of purchasing such products online is the lack of the possibility to check the freshness of the products before purchasing.

Covid-19: A game-changer for the online purchase of groceries and FMCG?

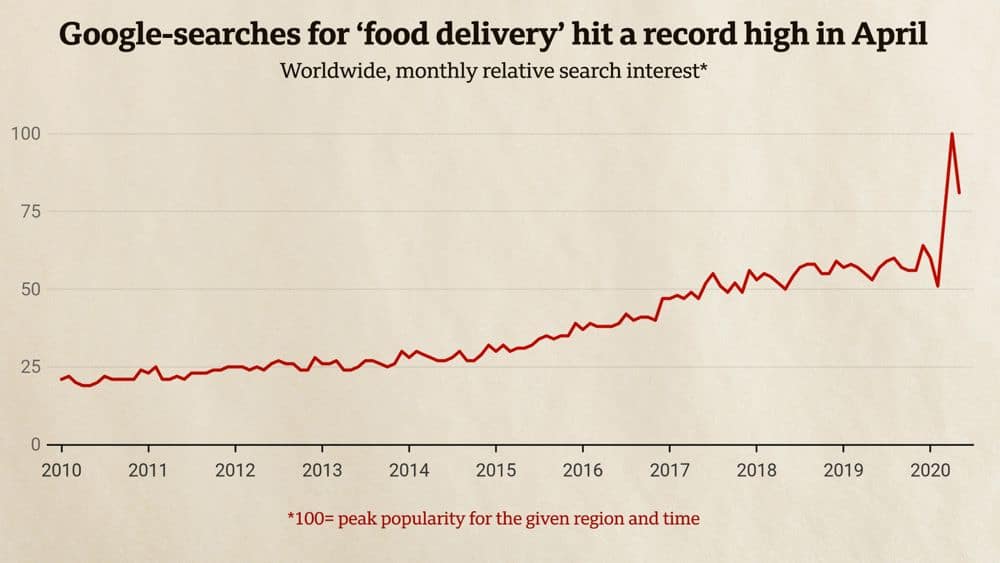

Since February 2020, the Corona crisis has changed the field of online FMCG sold in Europe, especially in the food sector. In the UK, the population buys around 7% of their food online in normal times, but in recent months the figure has risen to well over 10%. During lockdown, Britons were six times more likely to look for “veg boxes” than a year ago. Google searches achieved a record high in April 2020, as demonstrated in the graph below (Credit: Krystina Shveda / Datawrapper Source: Google Trends / BBC).

The same can be observed in European countries. According to a recent Bitkom survey, 3 out of 10 consumers in Germany now (also) order their food online. Before Corona, only 7% of those surveyed said they used online services such as rewe.de or bringmeister.de – since the pandemic, the figure is now 19%. The sale of food in April 2020 had doubled compared to the previous year.

While online trade in food appears to be declining post-lockdown, a few studies indicate that more consumers will be willing to order FMCG online in the future. A study by McKinsey, for example, showed that a large proportion of digital first-time users will remain online.

Online sales channels for FMCG

As in China, where Alibaba dominates FMCG online sales with its different marketplaces, marketplaces are an important sales channel for fast-moving products in Europe. In general, pure players, which also include marketplaces, account for 71.8% of FMCG e-commerce sales in the world (2018 figure).

Amazon is the leading marketplace for FMCG in the UK. IDG predicts that, by 2021, the online grocery market in the UK will have grown by 68%, with Amazon Fresh being a key driver.

In France, a similar picture is emerging: Amazon is one of the leaders in personal care, but when it comes to food and drink, the picture is quite different. Here, the marketplace is far behind classic bricks-and-mortar retailers, who have enjoyed great success and gained popularity with their Click & Collect service. The French supermarket chain E.Leclerc, for example, has left Amazon far behind in the online sale of food, thanks in part to its many DRIVE pick-up points. Marketplaces are therefore an option for many FMCG categories, but not (yet) for food.

Another possibility is direct sales from manufacturers of fast-moving products. The top 30 German e-commerce companies in the FMCG sector therefore also include some manufacturers such as bofrost, Nespresso or Yves Rocher. Good marketing and good service are an important prerequisite here. If direct sales are too far-reaching, however, it may be enough for FMCG manufacturers to sell directly on marketplaces. Manufacturers can set the market price of their products and stop automated price adjustments on these platforms, which will provide a better insight into their customers’ profiles.

Image: pxhere.com

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'