Iceland & Online Shopping: How is the Nordic Island Country Doing?

30/11/23

3'

In recent years, the digital landscape has significantly altered the way people shop, and Iceland is no exception. With its picturesque landscapes and a population that enjoys a high standard of living, the Nordic island country is embracing the convenience of online shopping.

The e-commerce market in Iceland has been on a steady rise, with projections indicating a promising future. But what are the factors propelling this growth, and how is the market evolving to meet the needs of the Icelandic consumer?

E-commerce Growth Trajectory

Iceland’s e-commerce market is poised for promising growth, with projections showing a revenue of approximately US$677.4 to US$678.4 million in 2023. The market is expected to continue expanding, with an annual growth rate (CAGR) of around 9.37% to 9.5% from 2023 to 2027, forecasting a market volume of about US$976.3 million by 2027. A more optimistic prediction suggests a CAGR of 14.8% throughout 2022-2027. (Source)

Internet Penetration and Urbanization

Almost every Icelander, with an internet penetration rate close to 99%, has access to online shopping. This widespread connectivity, coupled with the growing use of smart devices, makes online shopping increasingly accessible and convenient across both urban and remote areas.

With 94% of its population residing in urban areas, Iceland’s urbanization significantly influences its e-commerce sector. Urban residents often seek convenience, a demand that online shopping fulfills well. Moreover, the dense population in these areas allows for more efficient and cost-effective delivery logistics for e-commerce businesses.

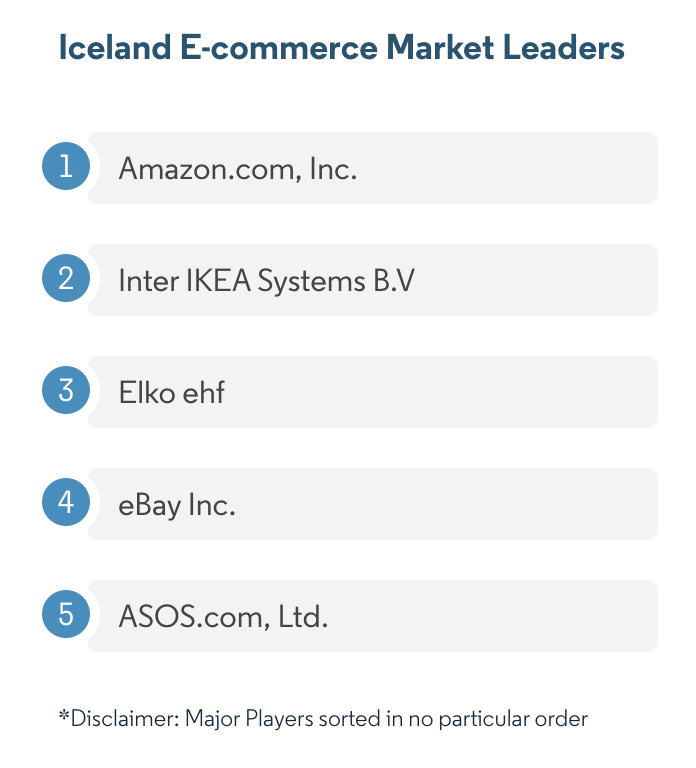

Main Players in the E-commerce Market

Image credit: Mordor Intelligence.

The market is populated with various players, including international giants and local enterprises. Some of the major players include Amazon, eBay, Inter IKEA Systems B.V., Elko ehf, and ASOS.com. These entities contribute to a competitive and vibrant e-commerce landscape, offering a plethora of options for Icelandic consumers.

Evolving Consumer Behaviors

Icelandic consumers have shown an increasing preference for online shopping, both locally and from abroad. The attraction towards foreign e-commerce platforms, offering a variety of low-cost products, is evident. Consumers are particularly keen on purchasing fashion-related products, baby and beauty products, and electronic equipment from American and European retailers.

Challenges

The journey is not without hurdles. High shipping costs, Value Added Tax (VAT), and handling fees imposed by local postal services are among the challenges that could potentially impede the market growth in Iceland.

Mobile Commerce on the Rise

With high mobile and internet penetration, digital wallets and mobile commerce are gaining traction. Many Icelanders prefer shopping and conducting banking activities via their smartphones, making mobile commerce a significant player in Iceland’s e-commerce landscape.

Conclusion

Iceland’s online shopping scene is a blend of robust growth, high internet penetration, evolving consumer behaviors, and digital marketing strategies. Although challenges like high shipping costs and tax fees pose hurdles, the country’s e-commerce market continues to thrive, reflecting a positive outlook for the future.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'