What Is Temu? All You Need to Know

26/07/23

7'

Temu, a shopping app developed by PDD Holdings Inc., has become the most downloaded in the U.S. since its launch in August 2022. It offers a similar value proposition as AliExpress and Wish, with a focus on providing inexpensive goods that can be shipped within a week or less to Western consumers.

Temu’s rapid ascent to the top of the shopping app market has largely been fueled by advertising. It remains to be seen whether the app will be able to maintain its position in the coming years. The Chinese sister company, Pinduoduo, had 868 million active buyers in China in 2021 and processed $383 billion in gross merchandise volume.

Temu, No.1 downloaded Shopping App in the US

As an e-commerce marketplace developed by PDD Holdings, a multinational commerce group, Temu was launched in the U.S. in late August 2022 and quickly gained widespread attention within three months. Temu’s popularity can largely be attributed to advertising but also to its strategy of offering free items to users who promote the app on their social networks and get their friends and family to sign up.

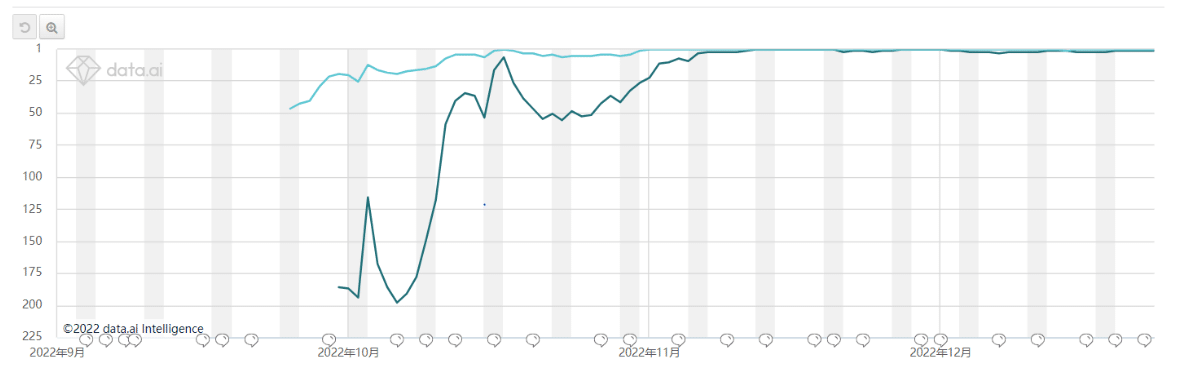

Data.ai shows that since its launch, it has become the No.1 app on the US App download list so far.

According to Sensor Tower, the United States is currently Temu’s largest market, accounting for 97% of the app’s 5.2 million global installations since its launch in August 2022. In addition to the U.S., Temu has also recently expanded to Africa, where it has reportedly performed well. As of March 22, Temu is available in the US, Canada, Australia and New Zealand.

Additionally, on April 25th Temu started being available in the following European countries: France, Germany, Italy, The Netherlands, Spain, and the United Kingdom.

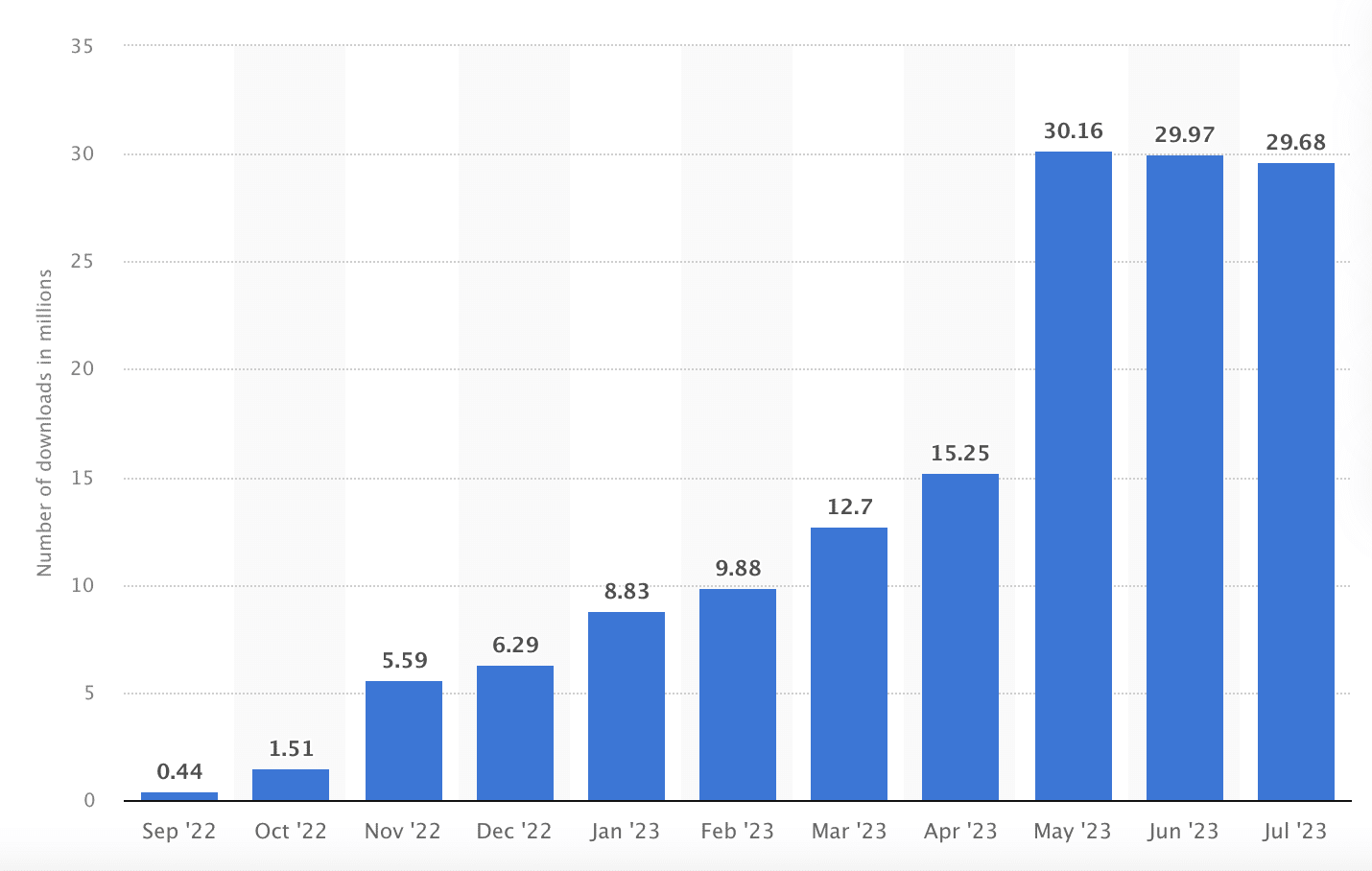

Below you can see the global downloads of the Temu Shopping App from September 2022 to July 2023, measured in millions (source: Statista).

Pinduoduo, the sister company of Temu, has become a dominant force in the domestic e-commerce market in China, but it remains to be seen whether it can replicate this success abroad. Some believe that the concept of bringing Chinese supply chains to overseas markets could be successful, but there are also many skeptics who have doubts about the Temu platform, which is similar to other “low-cost” marketplaces such as Wish and AliExpress.

Customer profile: Who is shopping at Temu?

Which consumers does Temu attract? Surprisingly the Chinese e-commerce app is drawing significant interest from Baby Boomers and Generation X shoppers. That is against previous findings that pointed more to young people from Generation Z.

In its inaugural year of operation in the United States, data from the Chicago-based research firm Attain reveals that these older generations not only shopped on Temu more frequently but also spent more than their younger counterparts. Notably, price-savvy Baby Boomers, aged 59 and above, demonstrated remarkable loyalty to the platform. They placed approximately six orders in a span of 12 months, which is double the amount of orders placed by Gen Z shoppers, who fall within the 18 to 26 age range.

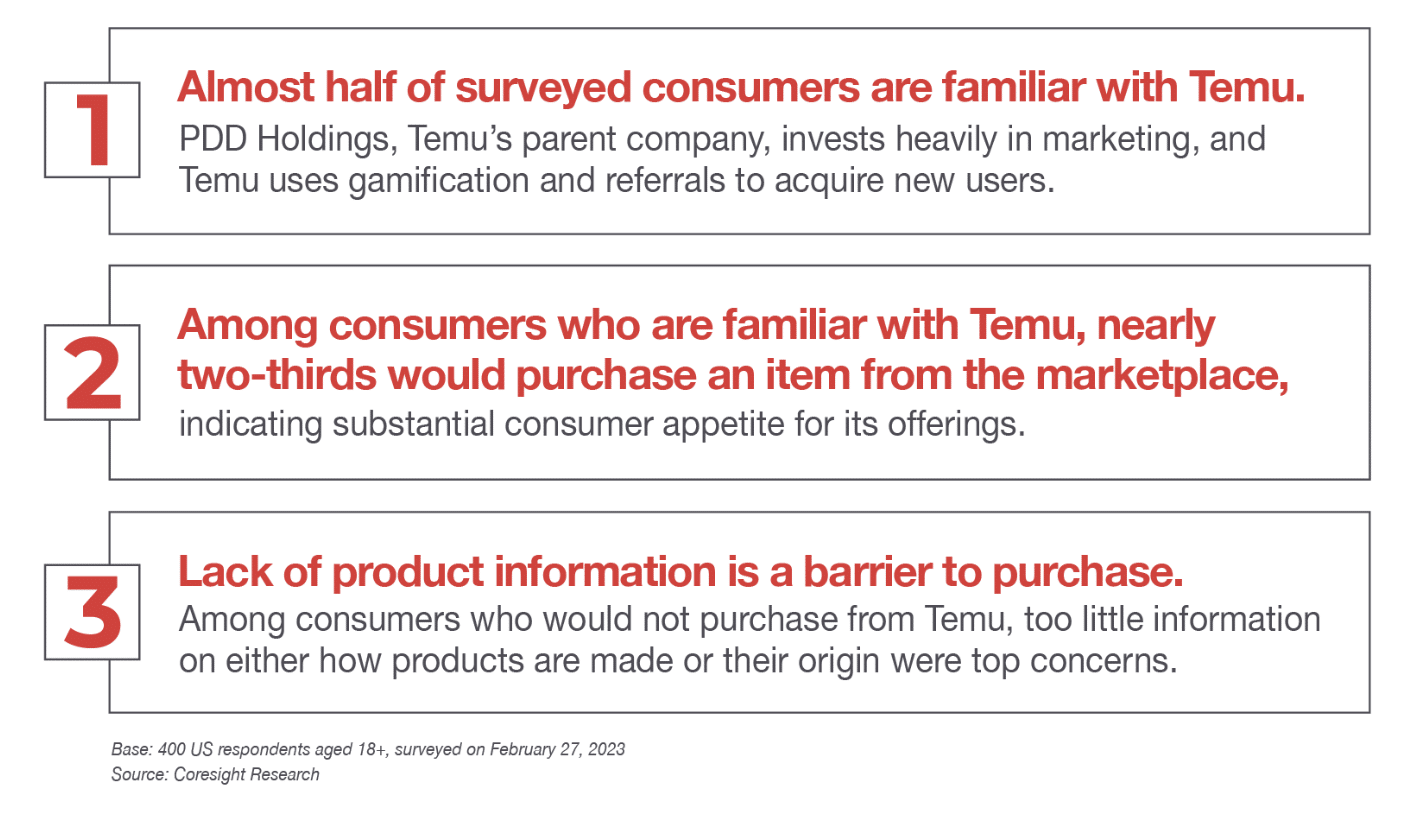

An initial 2023 U.S. study by Coresight Research on the relationship between U.S. consumers and Temu also found:

Image credit: Coresight Research.

Baby Boomers are 73% more inclined to use Temu for their shopping needs compared to Gen Z, outpacing all other age demographics.

Be careful of reviews on Temu

Temu employs customer reviews as a sales strategy, much like other marketplaces and platforms. However, it appears to make it challenging for customers to locate and read negative feedback. Generally, one would find very few such reviews available.

If you’ve ever tried submitting a review on Temu, you’ll notice that the platform seems engineered to only accumulate positive feedback, effectively discouraging negative comments.

While this approach may boost sales, it hampers a genuine evaluation of customer experiences with a product.

Go further

Benefits of and for Temu

- Temu has stricter controls on merchants. There are a couple of ways in which Temu appears to have an advantage over AliExpress and Wish. First, the products on Temu are required to match the product listing closely, so what you see in the pictures is what you get. Second, merchants are not allowed to add exorbitant shipping fees to cheap products, which can help prevent consumers from feeling deceived and frustrated with the app.

- More customer friendly. Temu is available for both iPhone and iPad, and the payment process is very convenient. If you’re using an iPhone, Apple Pay is automatically supported, making it easy to place orders quickly.

- Reasonable delivery time. The time from order to receipt of goods is much faster. Currently the average product is delivered in 5-7 days, compared to sometimes a month on AliExpress or Wish.

- Different business models between merchants and the marketplace. One aspect of Temu’s business model that sets it apart from some other marketplaces is that it does not allow dropshipping, which is the practice of merchants purchasing from suppliers only after a consumer has placed an order. This approach to fulfillment may help prevent the long delivery times that contributed to Wish’s closure in some countries, as delivery times are not reliant on the relationship between the marketplace and merchants.

Hurdles and Challenges for Temu

PDD Holdings has said that Temu will not blindly replicate what worked for its sister platform Pinduoduo in China in the markets it operates in, but would rather start from the needs of the customers. One of the reasons for Shein’s success, a Chinese online fast fashion retailer, is that it is focused on women’s apparel and lifestyle, whereas Amazon is at a disadvantage. In contrast, categories on Temu are not very much different from Amazon, AliExpress, or Wish.

Below you can find some of Temu’s challenges:

- Consumer’s doubts about a foreign marketplace. Amazon is by far the most established platform in the United States. Consumers tend to go to Amazon or a local marketplace when they are looking for a specific product with a certain brand and model, or when they need to purchase a large piece of furniture. Since Amazon offers products ranging in price from a few dollars (!) to thousands of dollars, some consumers may not be convinced by the low prices on Temu. AliExpress has sponsored a lot of events in recent years, which has turned off some consumers who view the company as a retail brand and find frequent marketing to be intrusive. In China, people may be more accustomed to and accepting of frequent marketing activities, but this may not be the case in other countries where there needs to be an acceptance process.

- Compliance issues. The West has robust laws and regulations in place to protect originality and consumer rights, which may impact Temu’s business. Additionally, some consumers may have difficulty accepting the presence of white-label merchants on the platform.

- The logistics infrastructure is still at an early stage. In the Chinese cross-border e-commerce market, the cost of goods is small while the cost of logistics and warehousing matters more. Temu chooses J&T Express as the third-party logistics provider which is cheaper and has grown rapidly in the past few years. However, J&T Express is still very young in the US market. Fanno, incubated by TikTok (ByteDance), has previously suffered from a lack of logistics infrastructure which affected the margins of both sellers and the marketplace itself.

Conclusion

Reviewing the above positive and hesitant opinions on Temu, we have to admit that Temu is still at a very early stage in the global market. The success of low-cost players like AliExpress and Shein has made us aware of the global downgrading of consumption. Temu should continue to learn from the lessons of other similar marketplaces and improve its sustainability to avoid just becoming a flash in the European and US markets.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'