How Mature Is Your Marketplace Strategy? Here’s How to Find Out

22/01/26

5'

In 2026, marketplaces account for nearly 9 out of 10 e-commerce dollars worldwide. According to recent ECDB data, marketplaces now capture 87% of B2C physical e-commerce revenue, up 1 percentage point from 2025. Traditional online stores account for just 13% of the market.

For brands selling consumer goods, this means one thing: marketplace strategy is no longer optional. It’s the primary battleground for digital commerce growth. But here’s the challenge: not all marketplace operations are created equal. A company selling on five marketplaces with poor catalog quality will underperform against a competitor with pristine product data on just two platforms.

That’s precisely why we created the Marketplace Maturity Index at Lengow. It’s a free assessment tool that helps brands and retailers understand where they stand and what they need to focus on next.

The five pillars of marketplace success

Through analyzing hundreds of marketplace sellers across Europe, we’ve identified five critical dimensions that determine success:

1/ Coverage measures your marketplace footprint. Are you present on the platforms where your customers shop? Have you expanded beyond Amazon into category-specific marketplaces like Zalando for fashion or Decathlon for sports equipment? Cross-border expansion and niche marketplace penetration are crucial for reaching new customer segments and reducing platform dependency.

2/ Catalog evaluates your product data quality. This is where many sellers stumble. High error rates consume significant team time. Quality catalog management means minimal errors, rich product descriptions with high-quality images, and efficient data updates across all channels.

3/ Pricing examines your strategy for staying competitive. Without a clear pricing approach, you’re flying blind. Successful sellers monitor competitor pricing, adjust dynamically based on market conditions, and maintain profitability through strategic positioning rather than racing to the bottom.

4/ Operations looks at your fulfillment capabilities and process efficiency. Can you handle orders seamlessly across multiple marketplaces? Do you have systems in place to manage inventory accurately? Operational excellence separates growing businesses from those struggling to scale.

5/ Analytics measures your ability to track performance and make data-driven decisions. The best marketplace sellers don’t guess, they measure everything. From channel profitability to customer behavior patterns, analytics transform marketplace selling from guesswork into science.

Understanding your marketplace maturity stage

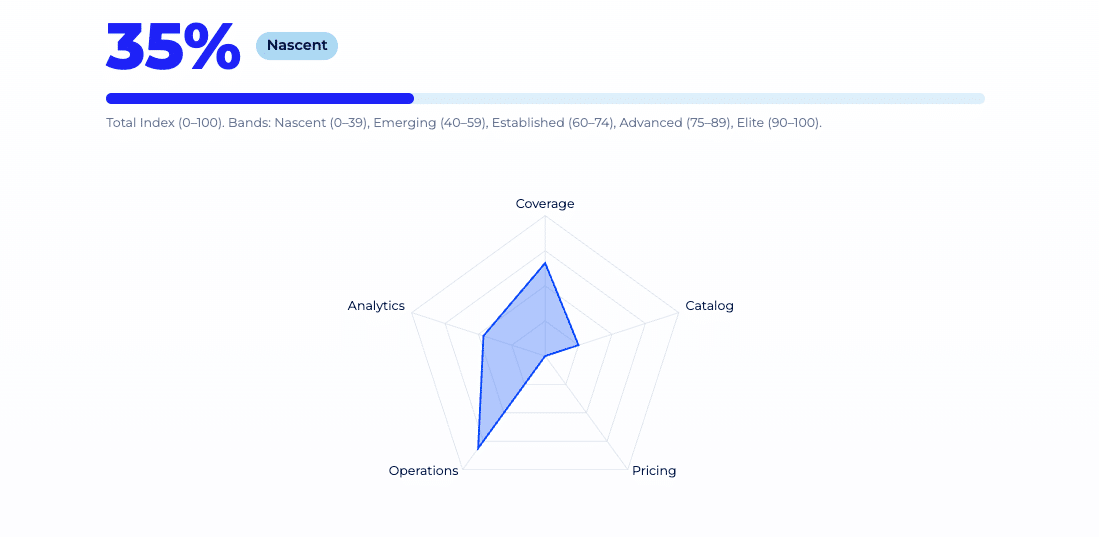

The Marketplace Maturity Index categorizes sellers into five distinct stages, each representing a different level of sophistication and capability:

- Nascent (0-39 points) characterizes businesses just beginning their marketplace journey. These companies typically operate on one or two platforms with basic capabilities. Their immediate focus should be on establishing fundamental processes and expanding platform presence.

- Emerging (40-59 points) describes sellers who’ve established a marketplace presence but face operational challenges. Catalog quality issues persist, pricing strategies remain reactive, and cross-border expansion is limited. These businesses have significant growth potential by systematizing their operations.

- Established (60-74 points) represents companies with solid marketplace foundations. They manage multiple platforms effectively, maintain reasonable catalog quality, and have basic analytics in place. Their next step involves optimization and strategic expansion.

- Advanced (75-89 points) identifies sophisticated operators who excel across most dimensions. These businesses use data extensively, maintain high catalog quality, and operate efficiently across diverse marketplaces. They’re positioned for aggressive growth.

- Elite (90-100 points) represents marketplace leaders who’ve mastered all five pillars. These companies set industry benchmarks, leverage cutting-edge tools, and continuously innovate their marketplace approach.

From assessment to action

The real value of understanding your maturity level lies in knowing what to do next. Let’s take a practical example.

Imagine a company scoring 35 overall – placing them in the Nascent category. Their breakdown reveals: Coverage at 53 (Emerging), Catalog at 20 (Nascent), Pricing at 0 (Nascent), Operations at 65 (Established), and Analytics at 37 (Nascent).

This profile tells a clear story: the company has decent operations and some marketplace presence, but catalog quality and pricing strategy need immediate attention. Without addressing these gaps, they’ll struggle to grow despite being on multiple platforms.

The recommended action plan would prioritize:

Catalog quality as the top priority. Conducting a comprehensive audit to identify missing attributes and data inconsistencies, implementing robust validation rules to reduce errors by 50%, enriching product descriptions and adding high-quality images for top-performing SKUs, and automating product data updates to marketplaces.

Pricing strategy as the second focus. The company should establish a clear pricing approach that balances competitiveness with profitability, implement competitor monitoring to understand market dynamics, and create dynamic pricing rules for different product categories and marketplaces.

Marketplace expansion to increase coverage. By identifying 2-3 new high-potential marketplaces in target geographies within four weeks, onboarding at least one new cross-border platform within two months, and analyzing competitor presence on untapped marketplaces to identify strategic entry points.

Focus: Why the European context matters

European marketplace strategy differs significantly from other regions due to market fragmentation. While American sellers can achieve massive scale by mastering Amazon and perhaps adding Walmart, European sellers must navigate country-specific champions (like Cdiscount in France or Bol.com in the Netherlands), category leaders (Zalando for fashion, ManoMano for DIY), and emerging platforms across 27+ countries with different languages, currencies, and consumer preferences.

This complexity makes maturity assessment even more critical. A “one size fits all” approach fails in Europe. French consumers behave differently from German ones. What works on Amazon.de might not translate to Bol.com. Success requires localized strategies informed by data and guided by clear maturity benchmarks.

Evaluate your marketplace performance

The Marketplace Maturity Index assessment takes approximately four minutes to complete. It consists of 25 questions covering all five key areas. Questions are designed to be straightforward, no too complex calculations or extensive research required. Most sellers can complete it using information their e-commerce or marketplace teams already have at hand.

Once completed, you receive a detailed score breakdown across all five dimensions, your overall maturity classification with benchmark comparisons based on aggregated data and expert studies, and a personalized action plan with specific recommendations to improve performance and accelerate growth.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'