Amazon and the Garden & Outdoor market

16/06/22

4'

The online Home, Garden and DIY market is becoming one of the most popular sectors in European e-commerce with the highest turnover, just after the online fashion market.

Lengow joined forces with Datahawk, an Amazon data analysis tool, to conduct a study on this key market for the Amazon marketplace. We closely examined the UK (“Garden & Outdoors”), German (“Garten”), French (“Jardin”), and Italian (“Giardinaggio”) Amazon marketplaces. Which brands perform best? Which products sell best?

In 2020 furniture, home accessories and gardening products (29%) were the second most purchased physical product category in the EU27, right after the uncontested leading category “Clothes” (including sportswear), shoes and accessories” (63%).

In 2022, revenue in the DIY, Garden & Pets segment is projected to reach US$28.92bn in the EU27, with the following revenue breakdown for our key markets:

- DACH: US$11.09bn

- France: US$6.66bn

- Italy: US$1.5bn

- The UK: US$4.57bn

Covid-19 positively impacted the Home & Garden market

Revenue across European markets in the Home & Garden market has climbed dramatically when compared with pre-Covid-19. By 2025, revenue is estimated to accelerate by 4.88% annually, culminating in a market volume of US$33.36 billion.

The Covid-19 pandemic contributed to this favourable trend in the market: during the lockdown, outdoor furniture, garden equipment, and DIY were highly popular categories. In May 2020, web traffic on Home & Garden online shops soared, as consumers tethered to their houses, browsed for inspiration for home modifications and created work-from-home spaces. Early in 2021, while several European countries were back in lockdown, web traffic also saw an increase.

This experience is likely to translate into an increased willingness to consider e-commerce as a viable channel for future gardening purchases. What role does Amazon play in the booming online garden and outdoor market? The growth of the category “Garten” on Amazon DE is typical and shows the important rise of this product type: sales climbed by 60% year over year in 2020 and by more than 80% year over year in 2021 (source: Metoda).

Key learnings from the analysis

Whenever brands sell in a category on Amazon – whether it’s their first category or just an expansion of existing business – a common question is the level of competition in that category. When optimising your SEO & advertising, it is important to map the competitive landscape, especially in a highly disputed key category such as “Garden & Outdoor”. It can help frame how aggressive a brand will need to be not just during a new product launch, but also as the product matures.

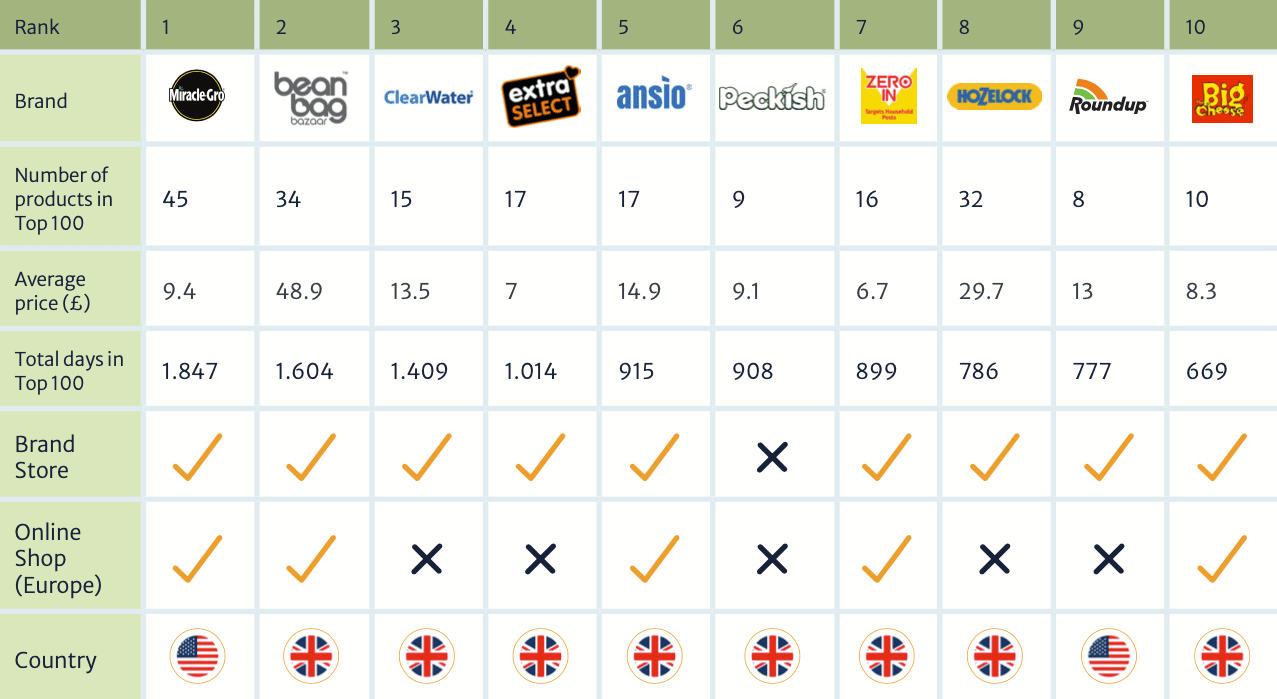

Top brands on Amazon UK in the category “Garden & Outdoors” (April 2021 – April 2022)

On the Amazon marketplaces in the UK and Germany, the top 10 are dominated by national brands. On Amazon UK eight out of the ten brands are actually from the UK, on Amazon DE the number is seven. However, the picture is slightly different for Amazon IT (five Italian brands) and Amazon FR (only two French brands). In countries where Amazon is extremely influential, such as DE (53% market share) and the UK (over 30% market share), national brands seem to put more effort into a strategy that bears fruit.

Basic products dominate the Top 10 ranking on Amazon. Similar product types, such as rat poison (UK, DE, FR, IT), bird food (DE, FR, UK), moth traps (DE, FR, IT) and means against vermin (DE, FR, IT). Amazon is therefore unmissable for the sale of basic products.

Download the report for more key learnings!

European marketplaces: Key for your Garden, Home & DIY products

You have access to a large range of European marketplaces in addition to Amazon. From generalist marketplaces such as Allegro (largest market share in the category home and garden in Eastern Europe) or Fruugo to specialised ones such as Leroy Merlin, ManoMano (Amazon’s big European competitor in the Garden & DIY category) or Maisons du Monde, open your market to new audiences.

Marketplaces offer very high visibility to sellers thanks to their reputation in the e-commerce market. This is a real opportunity for all retailers in the home, garden and DIY sector. Have you thought about the following marketplaces? ManoMano, BricoMarché, Delamaison, Leroy Merlin, Distriartisan, Wayfair, home24, yatego, Bricoprivé, Greenweez, Maisons du Monde, Nature et Découvertes…

Garden brands and products on Amazon

These “Garden & Outdoor” brands and products perform best …

Learn moreYour e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'