TikTok Shop: Bestsellers Across Europe in January 2026

02/02/26

10'

TikTok Shop enters 2026 with a very different momentum compared to peak Q4.

January marks a reset month across Europe, with post-holiday behavior reshaping what performs best on social commerce.

Rather than impulse gifting or Black Friday spikes, January sales highlight:

-

practical, utility-driven products

-

home equipment and appliances

-

beauty routines and self-improvement

-

fitness and “new year reset” categories

This updated TikTok Shop analysis, based on Kalodata, across five major markets France, Germany, Italy, Spain, and the UK highlights the products and categories that dominated January 2026 and what they reveal about evolving consumer intent.

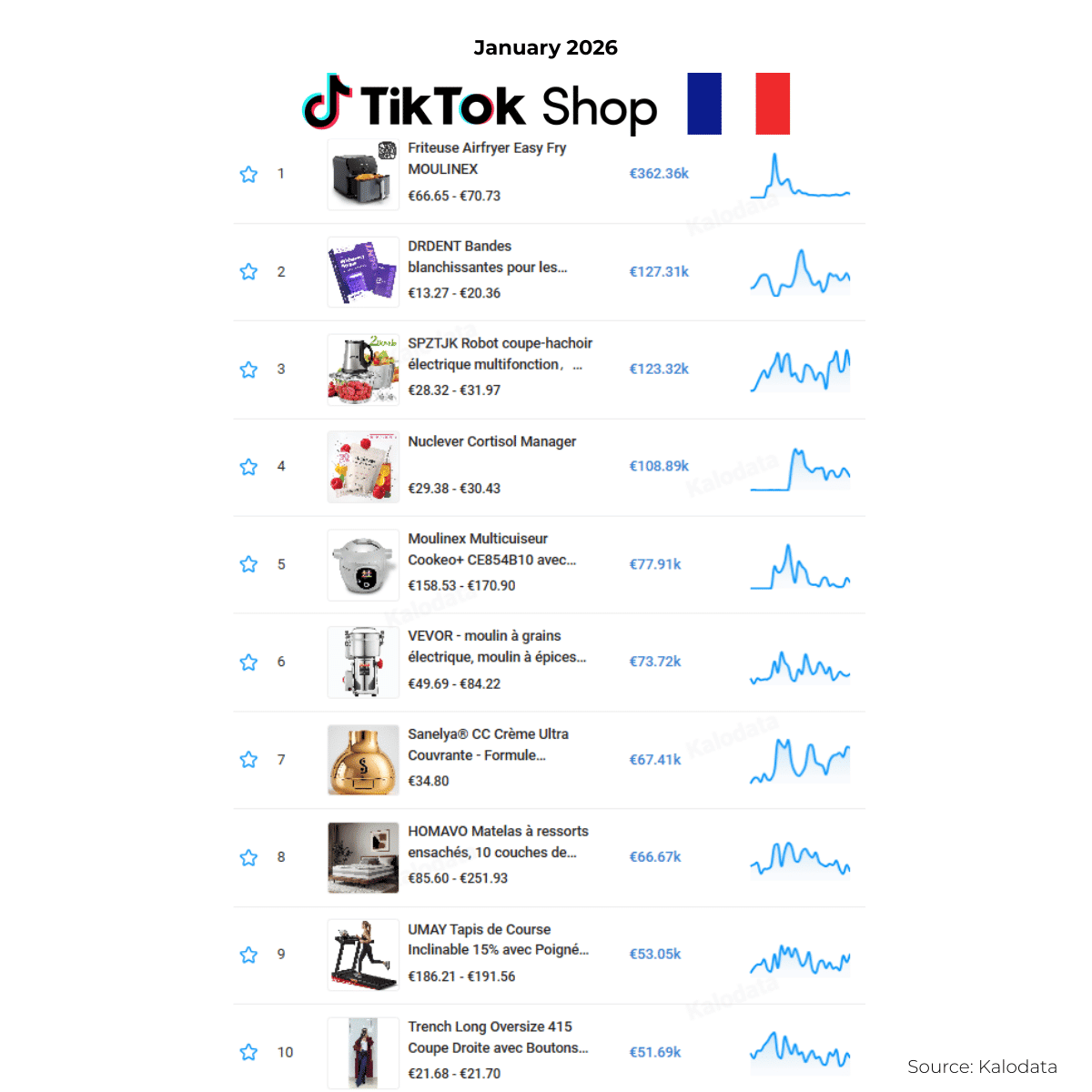

Show 🇫🇷 TikTok Shop France Chart

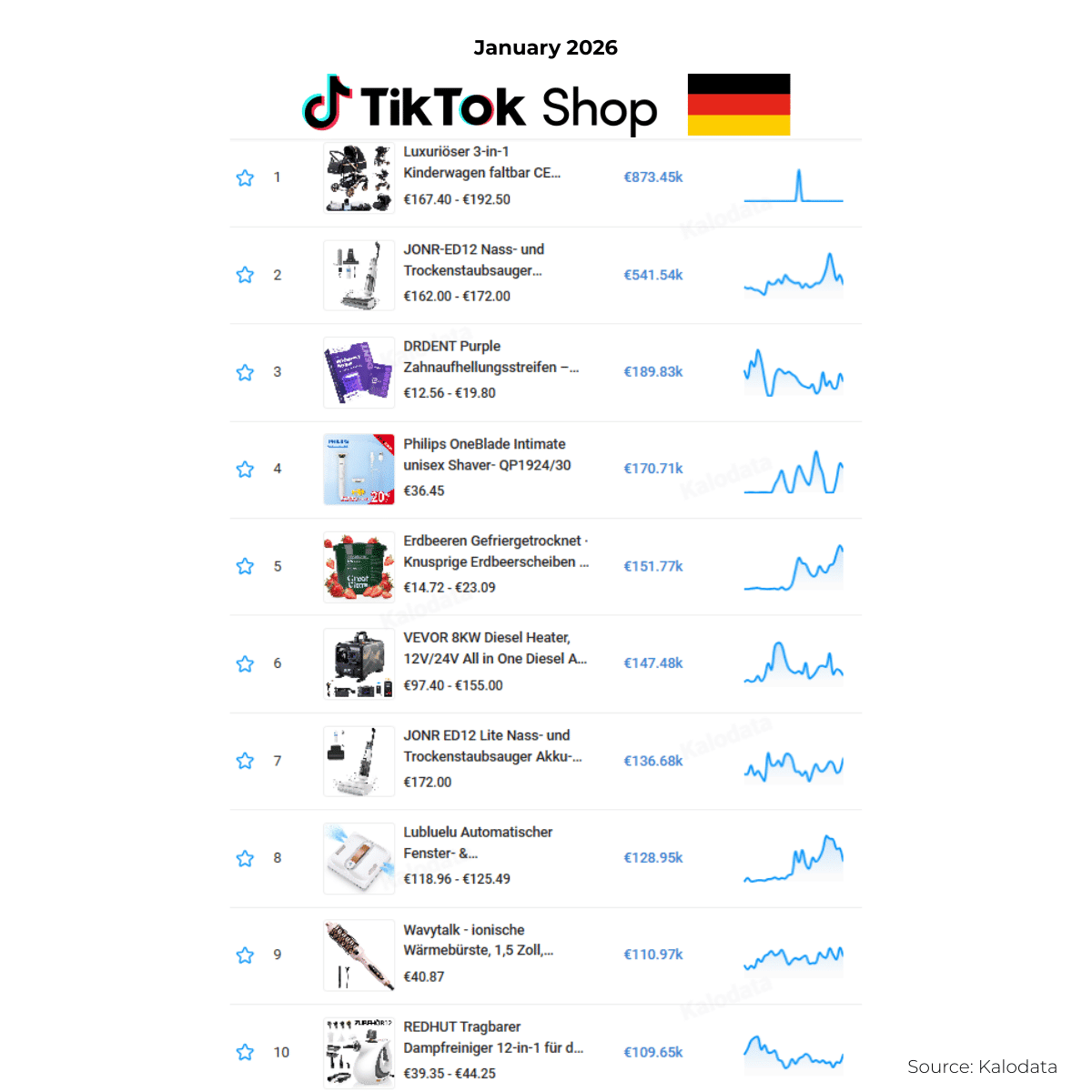

Show 🇩🇪 TikTok Shop Germany Chart

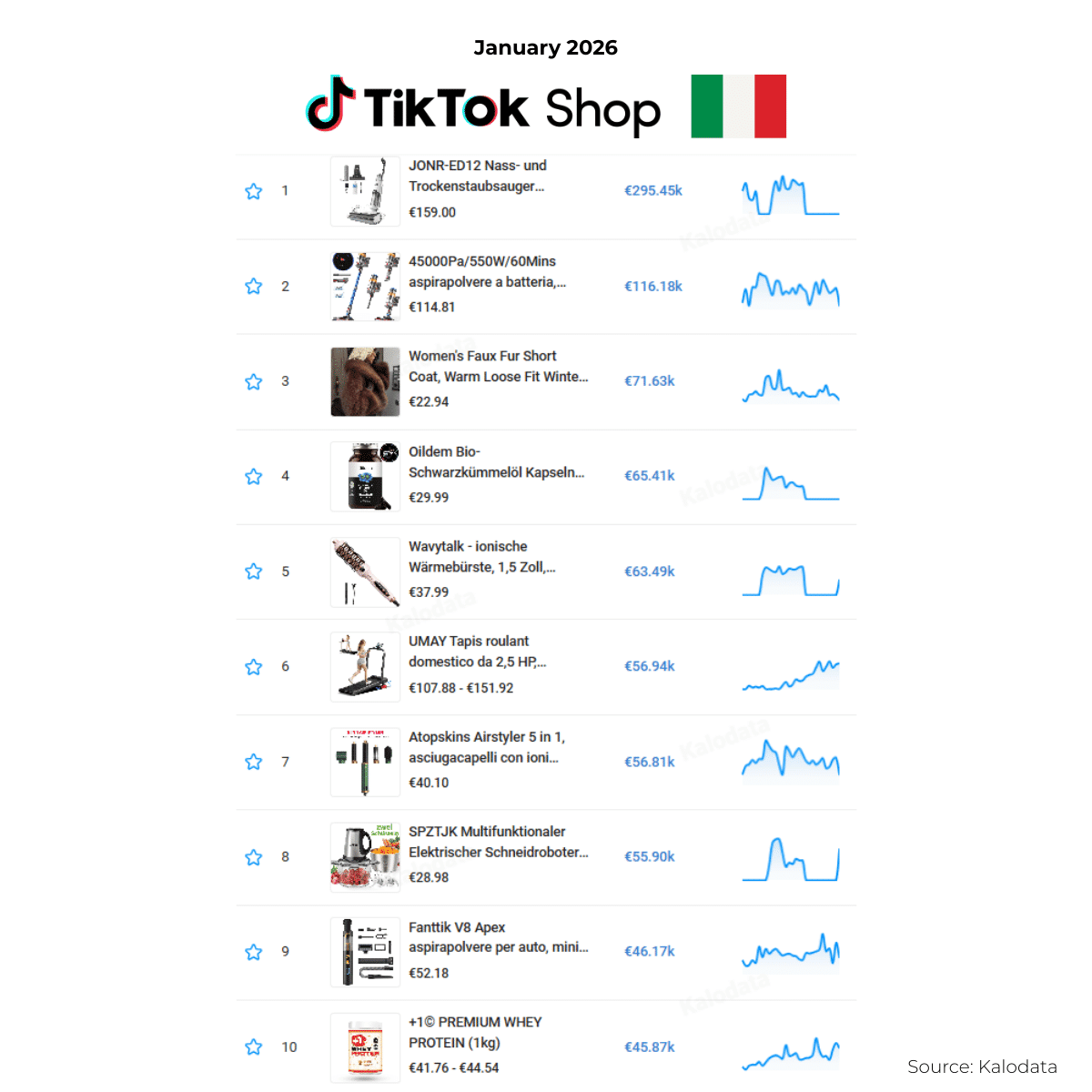

Show 🇮🇹 TikTok Shop Italy Chart

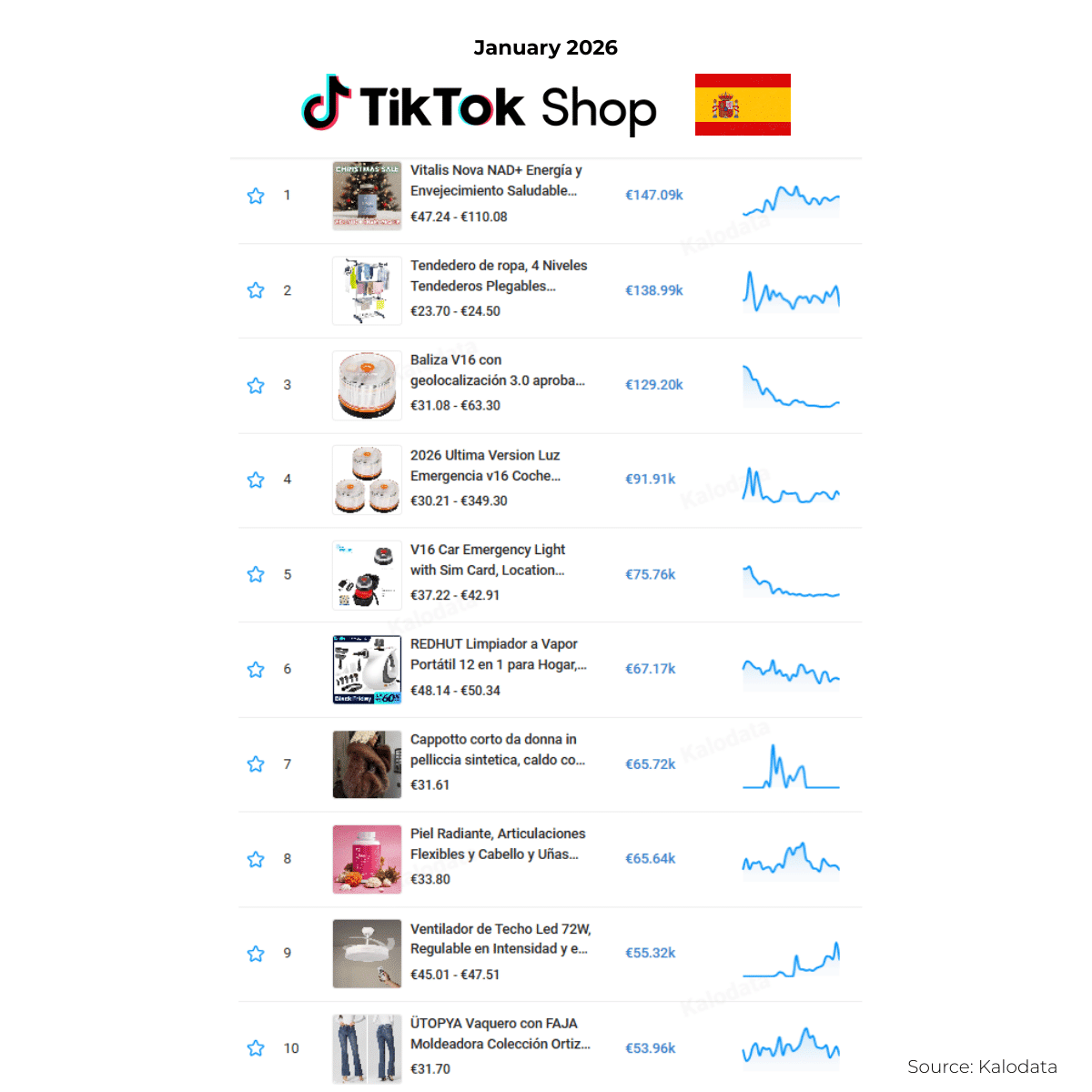

Show 🇪🇸 TikTok Shop Spain Chart

Show 🇬🇧 TikTok Shop UK Chart

Key Findings: TikTok Shop Trending Products Across Europe

January 2026 vs Q4 2025

From Peak Hype to Practical Utility

In November 2025, TikTok Shop was driven by:

-

Black Friday deals

-

gifting behavior

-

high promotional intensity

-

emotional and impulse purchases

January 2026 breaks sharply from that model.

Across all markets:

-

fewer extreme revenue spikes appear

-

utility, durability, and routine-based products dominate

➡️ January reflects intent-driven commerce rather than opportunistic buying.

TikTok Shop Guide for Online Sellers

All you need to know about TikTok Shop TikTok Shop is a unique type of…

Learn moreFrance: From Black Friday Appliances to Everyday Kitchen Essentials

January Leaders

-

Moulinex Easy Fry Airfryer

€362.36k -

DRDENT Teeth Whitening Strips

€127.31k -

SPZTJK Multifunction Electric Food Processor

€123.32k -

Nuclever Cortisol Manager

€108.89k

Compared to November 2025

In November, France saw:

-

tech and fitness overtaking fashion

-

Black Friday pushing Carrefour and appliance brands into the top tier

-

multiple products close to or above €400k GMV

January shows:

-

lower peak GMV, but more stable curves

-

kitchen appliances remain dominant, but without discount-driven spikes

-

beauty and wellness products replace fashion in the mid-ranking positions

➡️ France transitions from deal-driven tech to routine-focused home consumption.

Germany: Utility Remains King, Even After Q4

January Leaders

-

Luxury 3-in-1 Foldable Baby Stroller

€873.45k -

JONR ED12 Wet and Dry Vacuum Cleaner

€541.54k -

DRDENT Purple Teeth Whitening Strips

€189.83k -

Philips OneBlade Intimate Shaver

€170.71k

Compared to November 2025

In November:

-

Germany already led Europe in functional purchases

-

top tech products ranged between €630k and €700k GMV

-

household devices dominated due to Black Friday

In January:

-

Germany posts the highest single-product GMV in Europe (€873k)

-

fewer products reach the top, but winners are more concentrated

-

baby and household equipment outperform seasonal tech deals

➡️ Germany is the only market where January performance rivals or exceeds Q4 levels for select products.

Italy: From Gifting and Beauty to Household Reset

January Leaders

-

JONR ED12 Wet and Dry Vacuum Cleaner

€295.45k -

Cordless Vacuum Cleaner 45000Pa

€116.18k -

Women’s Faux Fur Short Coat

€71.63k -

Black Seed Oil Capsules

€65.41k

Compared to November 2025

In November:

-

Italy leaned heavily into beauty and giftable lifestyle items

-

Arcamania alone generated over €450k GMV

-

emotional and sensory categories dominated

January brings:

-

a clear drop in peak GMV

-

cleaning appliances replacing cosmetics at the top

-

winter apparel remaining relevant, but secondary

➡️ Italy shows the clearest post-holiday reset from emotional to practical spending.

Spain: From Fashion Comeback to Pure Problem Solving

January Leaders

-

Vitalis Nova NAD+ Supplement

€147.09k -

Foldable Drying Rack

€138.99k -

V16 Emergency Beacon with Geolocation

€129.20k

Compared to November 2025

In November:

-

Spain was the only market where fashion strengthened

-

Utopya and Armonias reclaimed the top spots

-

apparel dominated the podium

In January:

-

fashion drops out of the top 3

-

health, safety, and home organization take over

-

GMV levels normalize below €150k per product

➡️ Spain undergoes the strongest category reversal between Q4 and January.

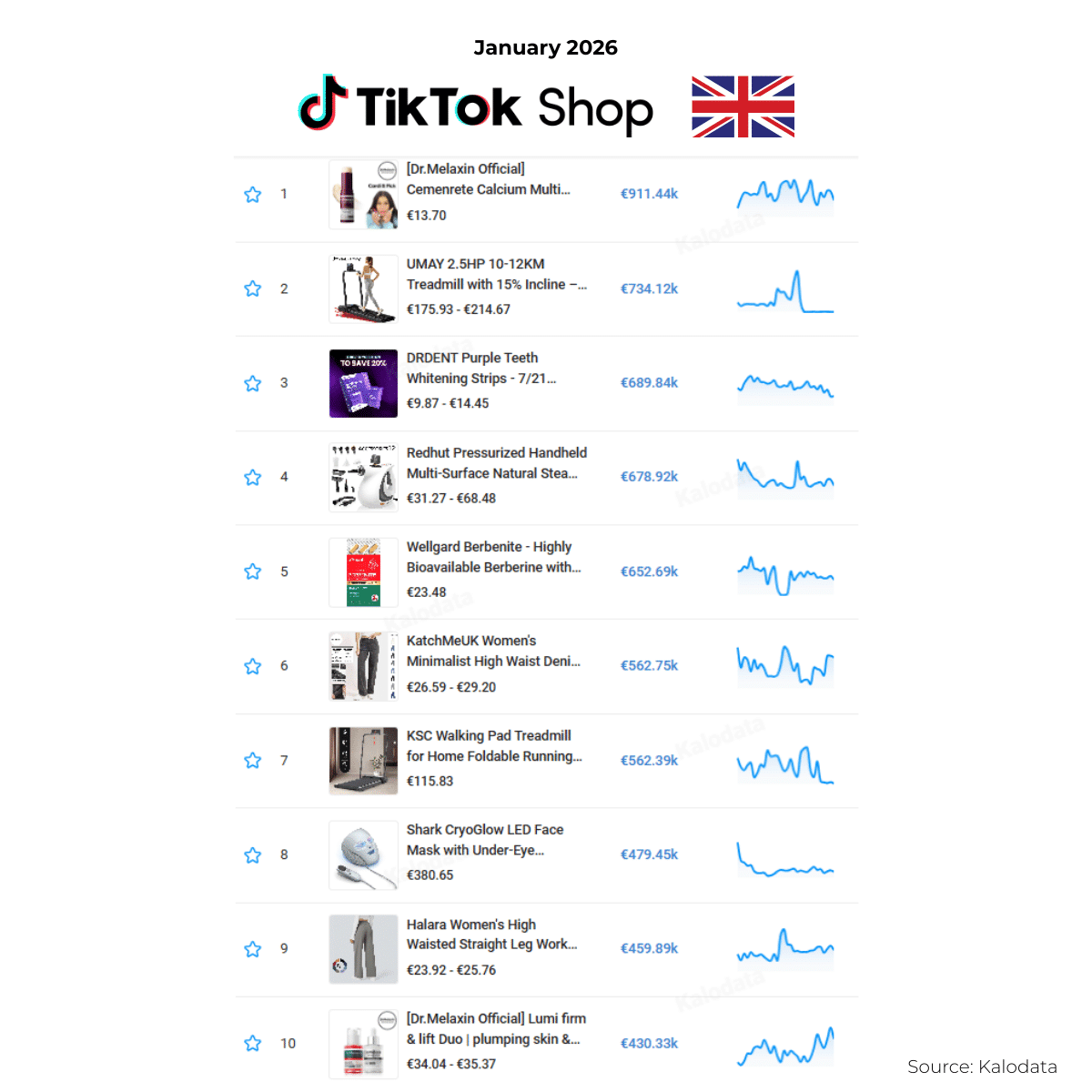

United Kingdom: From Record-Breaking Q4 to Controlled Scale

January Leaders

-

Dr. Melaxin Calcium Multi Serum

€911.44k -

UMAY 2.5HP Treadmill

€734.12k -

DRDENT Teeth Whitening Strips

€689.84k

Compared to November 2025

In November:

-

P.Louise reached €11.85m GMV

-

the UK operated at a completely different scale

-

beauty and appliances exploded simultaneously

January shows:

-

normalized revenue levels below €1m per product

-

fitness and beauty remain dominant, but without extreme spikes

-

high-ticket products still convert when positioned as long-term investments

➡️ The UK remains Europe’s largest TikTok Shop market, but January resets expectations after Q4 excess.

Country-Level Summary: January vs November

| Country | Q4 Trend (2025) | January 2026 Trend | Key Shift Observed |

|---|---|---|---|

| France | Black Friday driven tech and appliance surge | Kitchen appliances and routine-based products | Shift from promotional spikes to everyday home usage |

| Germany | Tech and household devices boosted by Q4 deals | Fewer products with very high individual GMV | Concentration on high-value, utility-first purchases |

| Italy | Beauty, gifting, and emotional seasonal products | Cleaning appliances and household reset products | Clear move from gifting to practical daily needs |

| Spain | Fashion comeback led by apparel brands | Health, safety, and home convenience products | Strong reversal from fashion to problem-solving items |

| United Kingdom | Record-breaking GMV driven by beauty and appliances | Normalized scale with fitness and beauty devices | From extreme Q4 peaks to controlled but dominant demand |

Lessons for Brands After Q4

-

Q1 is not about volume, but intent

January buyers convert when value is clear, not when urgency is artificial. -

Creator education replaces promotion

Demonstration content outperforms deal-driven messaging. -

Category hierarchies reset fast

What wins in Q4 does not automatically carry into January. -

Operational efficiency matters even more post-peak

Without promotions, catalog accuracy and availability become decisive.

This is where platforms like Lengow help brands adapt from peak to steady-state TikTok Shop performance:

-

feed optimization

-

cross-market distribution

-

stock synchronization

-

performance monitoring

Darty Success Story

How Darty became a pioneer of social commerce by launching on TikTok S…

Learn moreAbout the Data:

This analysis is based on Kalodata’s tracking of TikTok Shop performance across France, Germany, Italy, Spain, and the United Kingdom for the period December 31 2025-January 30, 2026. Revenue figures represent estimated gross merchandise value (GMV) in euros.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'