TikTok Shop: What’s Selling Across Europe in October 2025

02/10/25

9'

As we close out 2025, TikTok Shop has firmly established itself as a dominant force in European social commerce. With billions in revenue flowing through the platform, understanding what sells best on TikTok Shop has become essential for brands looking to capitalize on this explosive growth channel.

Our analysis of the top-performing shops across five major European markets – France, Germany, Italy, Spain, and the UK – reveals fascinating patterns in consumer behavior, trending product categories, and the strategies behind the most successful TikTok Shop sellers.

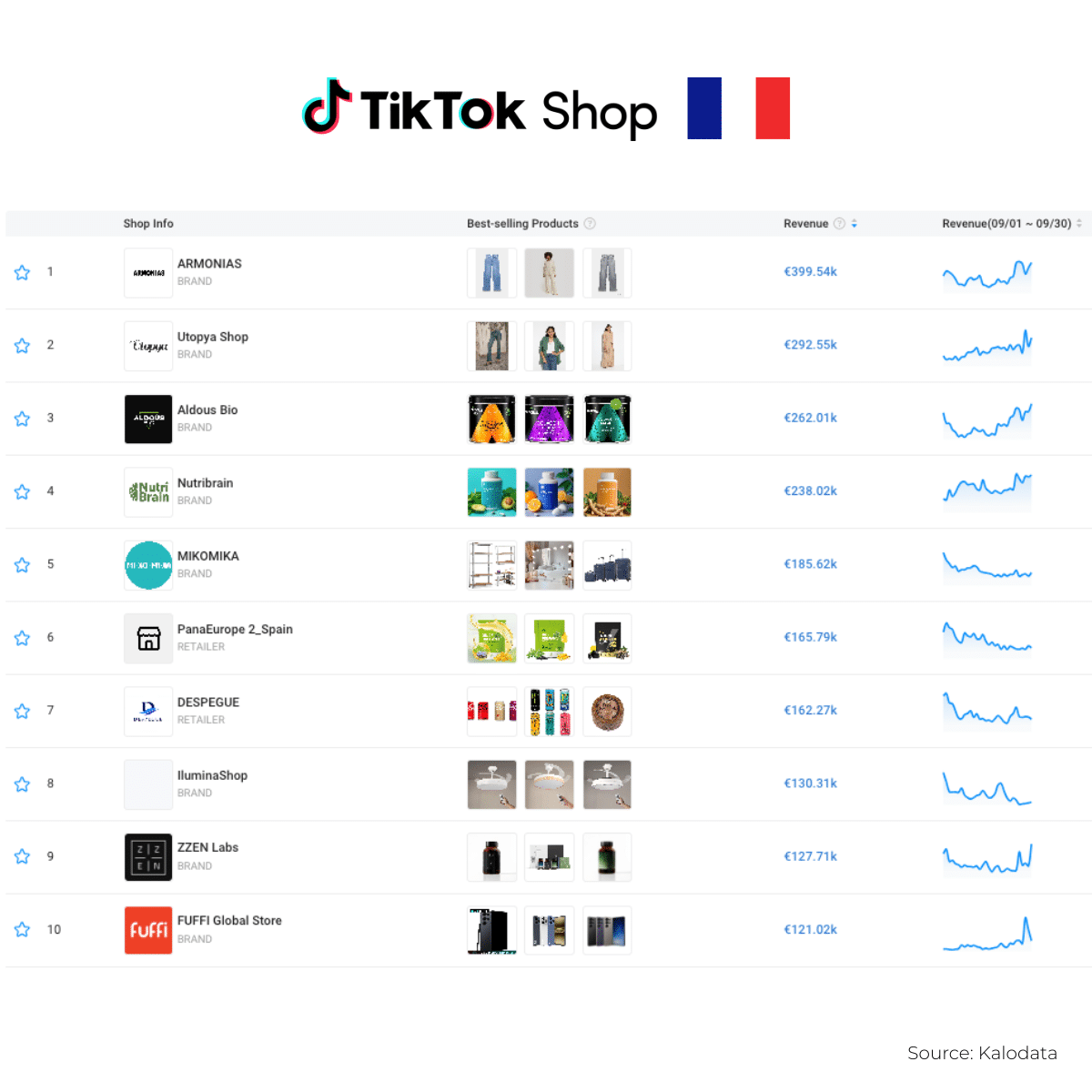

Show 🇫🇷 TikTok Shop France Chart

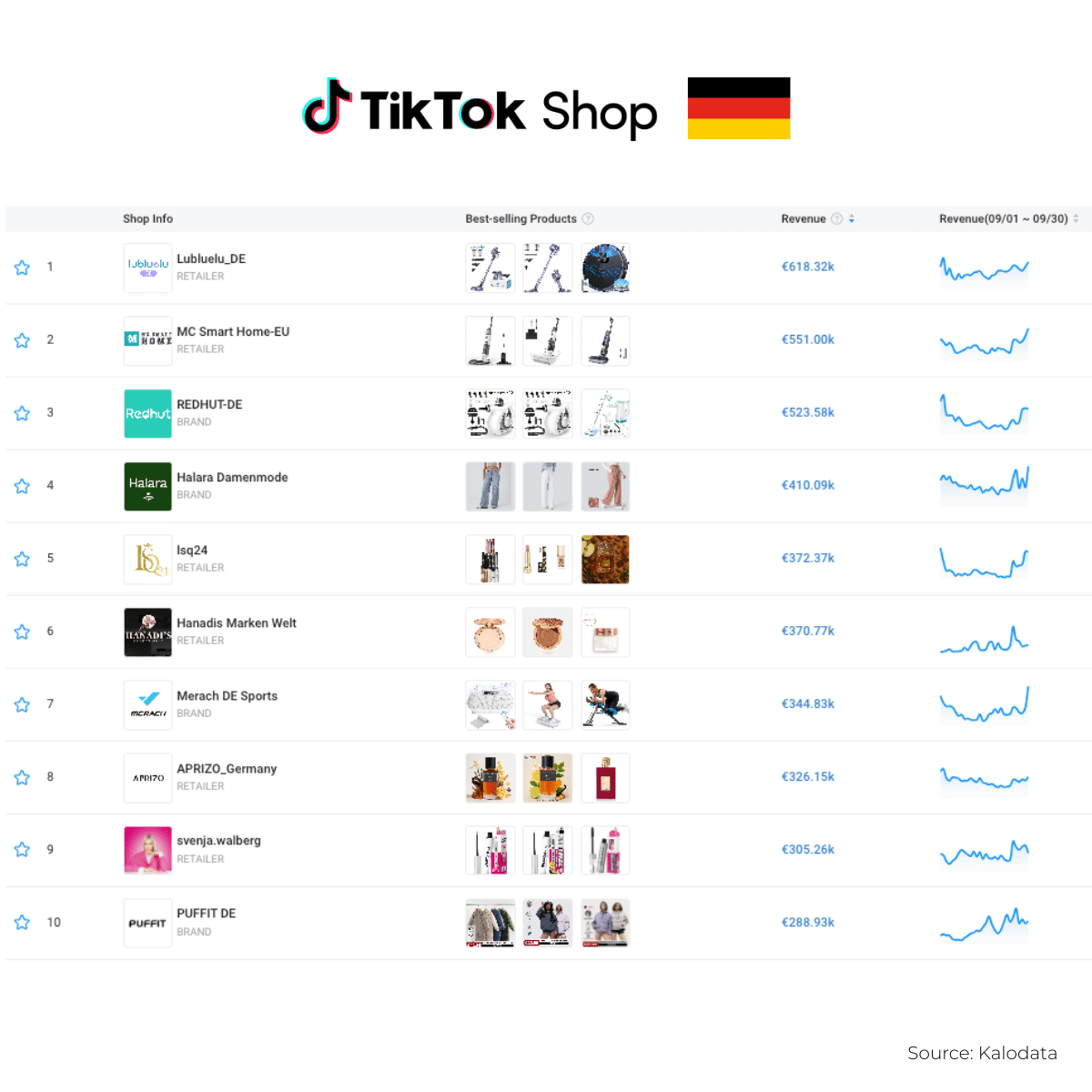

Show 🇩🇪 TikTok Shop Germany Chart

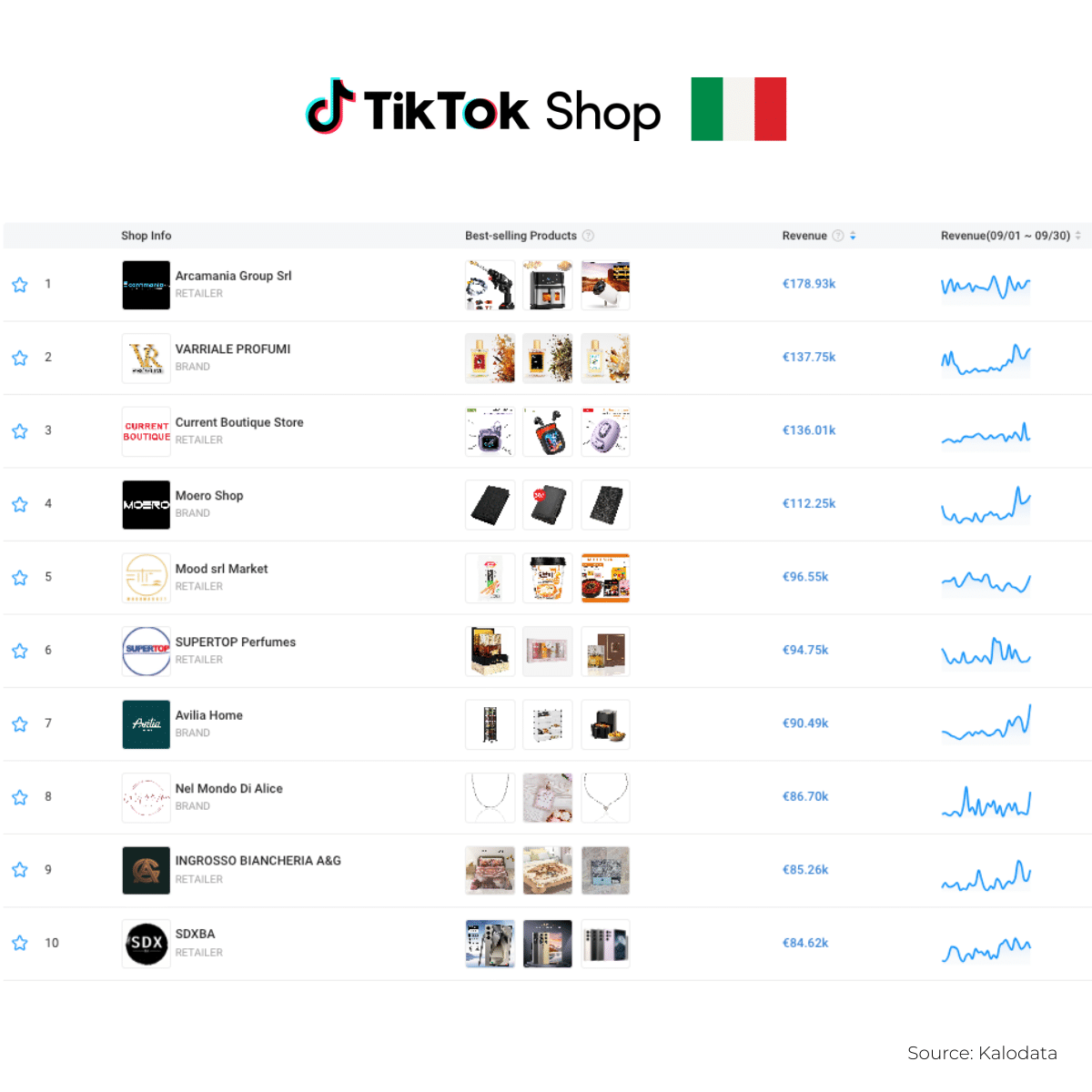

Show 🇮🇹 TikTok Shop Italy Chart

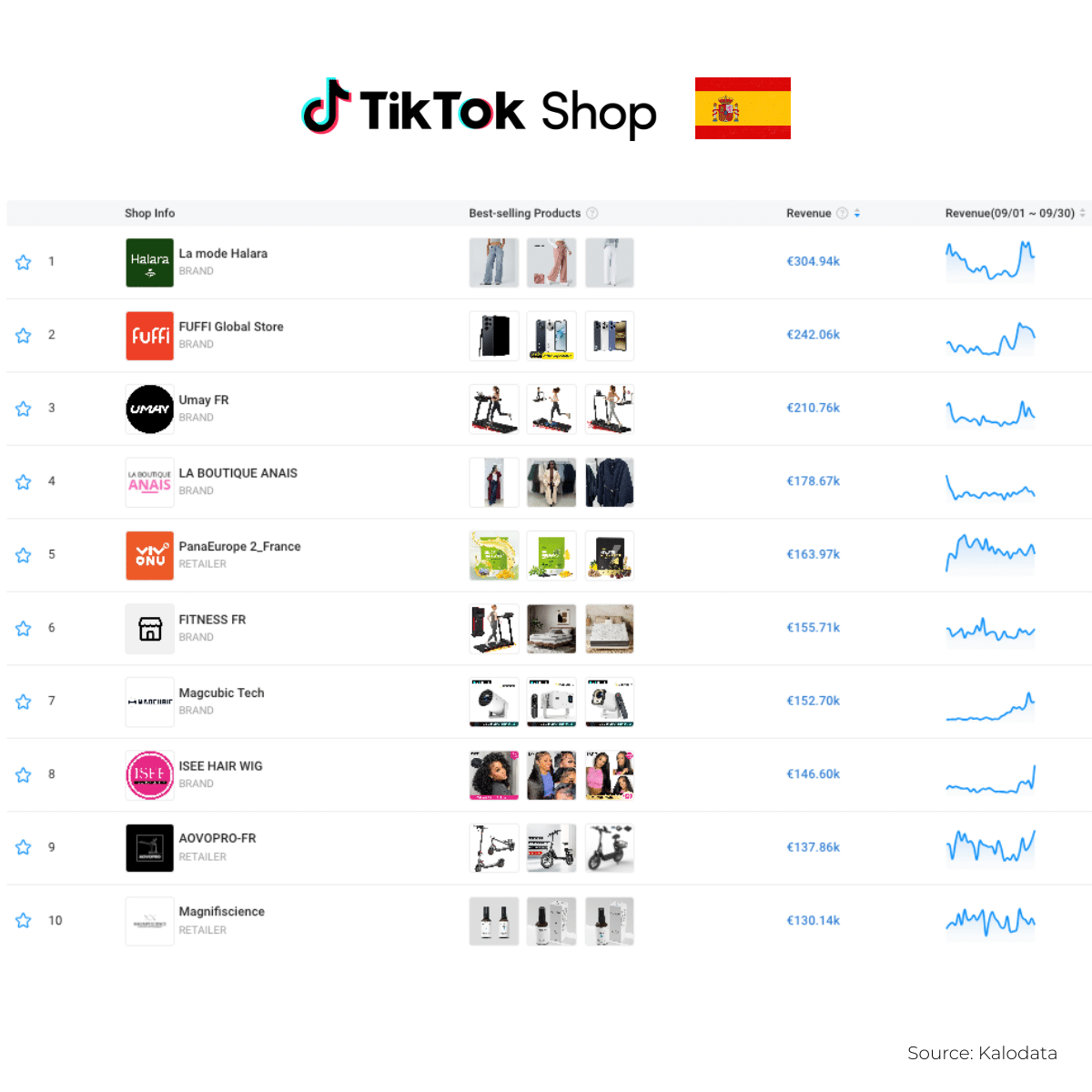

Show 🇪🇸 TikTok Shop Spain Chart

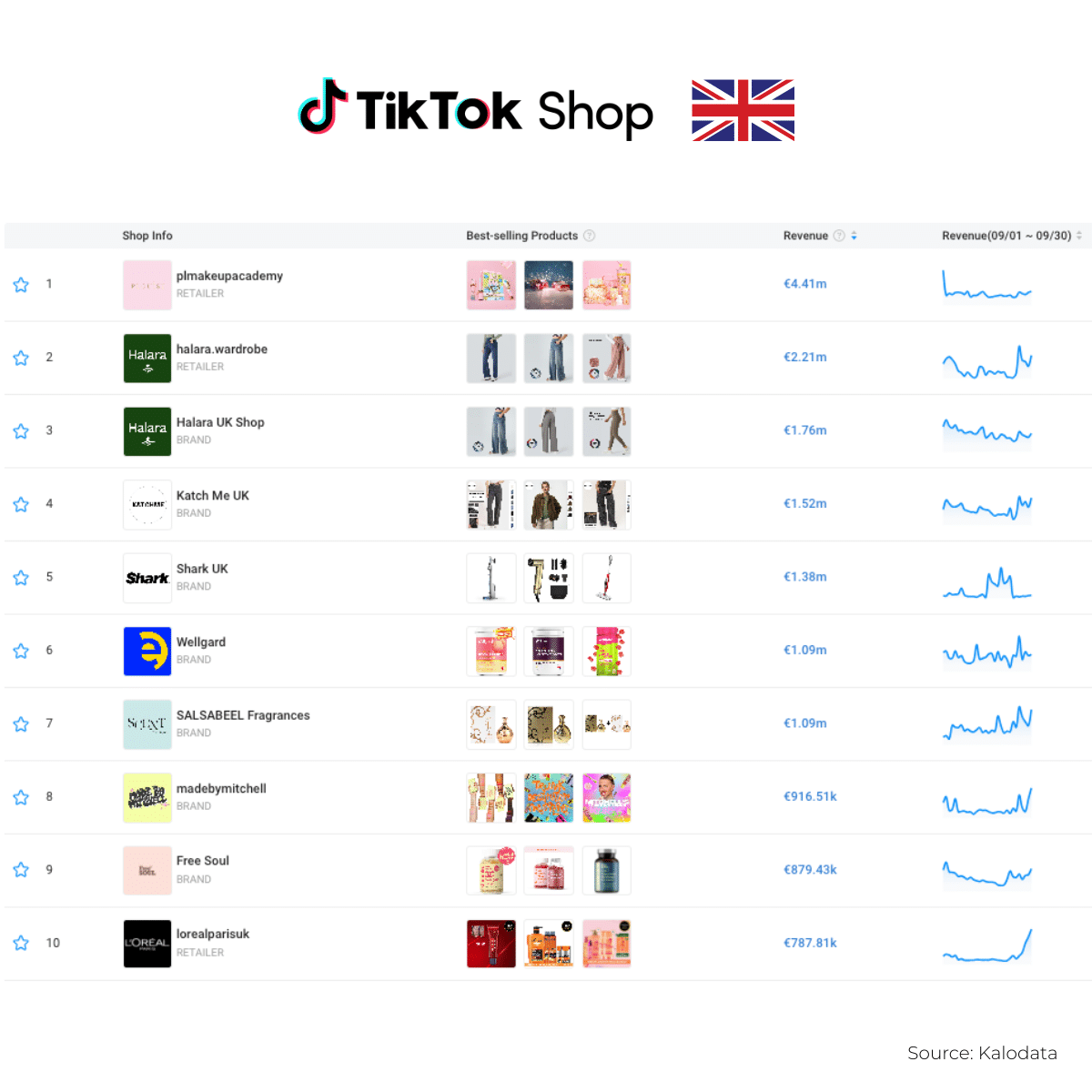

Show 🇬🇧 TikTok Shop UK Chart

Key Findings: TikTok Shop Trending Products Across Europe

Fashion Dominates, But Not Everywhere

One of the most striking patterns across European TikTok Shops is the dominance of fashion and apparel brands, though with significant regional variations.

France’s Fashion-Forward Market: France leads with ARMONIAS capturing the top spot at €399.54k in monthly revenue, followed by Utopya Shop at €292.55k. Both brands showcase casual wear and contemporary fashion, demonstrating French consumers’ appetite for accessible, trend-driven clothing on TikTok Shop.

UK’s Beauty and Fashion Blend: The UK market shows exceptional diversity, with plmakeupacademy (P.Louise) leading at an impressive €4.41m – ten times higher than most top performers in other markets. This cosmetics retailer’s success highlights the UK’s strong affinity for beauty content on TikTok. Fashion brands halara.wardrobe (€2.21m) and Halara UK Shop (€1.76m) follow, proving that modest fashion resonates strongly with British TikTok audiences.

Germany’s Tech-Savvy Approach: Germany presents a different story. Lubluelu_DE, a retailer specializing in smart home cleaning devices, leads at €618.32k, followed by MC Smart Home-EU at €551.00k. This tech orientation reflects German consumers’ preference for practical, innovation-driven products over pure fashion plays.

Home, Health, and Lifestyle Products Are Universal Winners

Beyond fashion, several product categories show consistent performance across multiple markets:

Supplements and Nutrition

- Nutribrain (France, €238.02k) sells brain health supplements

- Free Soul (UK, €879.43k) offers wellness products

- These brands leverage TikTok’s educational content format to explain product benefits

Home Goods and Fitness Equipment

- MIKOMIKA (France, €185.62k) sells home organization products

- Shark UK (UK, €1.38m) dominates with cleaning appliances

- Umay FR (Spain, €210.76k) offers fitness equipment

Fragrance and Personal Care

- VARRIALE PROFUMI (Italy, €137.75k)

- SUPERTOP Perfumes (Italy, €94.75k)

- SALSABEEL Fragrances (UK, €1.09m)

- Perfume brands perform exceptionally well, benefiting from TikTok’s visual and sensory storytelling capabilities

TikTok Shop Guide for Online Sellers

All you need to know about TikTok Shop TikTok Shop is a unique type of…

Learn moreWhat Sells Best on TikTok Shop: The Winning Formula

1. Visual Products with Transformation Potential

The best shops on TikTok Shop share one critical trait: they sell products that create visual before-and-after moments. Whether it’s a makeup transformation (plmakeupacademy), a cleaning demonstration (Shark UK), or a fashion try-on (Halara brands), these products naturally lend themselves to TikTok’s video format.

2. Mid-Range Price Points Dominate

Analyzing revenue alongside product types reveals that most successful shops operate in the €20-€150 price range per item. This sweet spot allows for:

- Impulse purchases driven by viral content

- Perceived value without major financial commitment

- Easy returns management

3. Consistent Brand Presence Across Markets

Several brands appear in multiple country rankings:

- Halara (fashion) operates successfully in Germany, Spain, and the UK

- FUFFI Global Store appears in both France and Spain

- PanaEurope 2 operates in both France and Spain

These multi-market players demonstrate the scalability of TikTok Shop success when brands adapt their approach to local preferences while maintaining core positioning.

Country-Specific Insights: Understanding Regional Differences

France: The Niche Specialist Market

French consumers gravitate toward specialized brands. Aldous Bio (€262.01k) sells graphic tees with unique designs, while ZZEN Labs (€127.71k) offers tech accessories. The presence of retailers like PanaEurope 2_Spain (€165.79k) and DESPEGUE (€162.27k) suggests French shoppers are open to discovering international sellers.

Germany: Function Over Fashion

Germany stands out as the most practically minded market. Beyond the top smart home brands, REDHUT-DE (€523.58k) and even fashion brand Halara Damenmode (€410.09k) emphasize functional benefits in their positioning. German TikTok Shop success requires demonstrating clear utility and value.

Italy: Artisanal and Lifestyle Focus

Italy’s chart reflects cultural priorities: food products (INGROSSO BIANCHERIA A&G, €85.26k, appears to sell gourmet items), jewelry (Nel Mondo Di Alice, €86.70k), and artisanal perfumes. Arcamania Group Srl leads at €178.93k with a curated selection reflecting Italian taste for quality and craftsmanship.

Spain: Fashion and Fitness

Spain blends fashion leadership (La mode Halara, €304.94k) with strong fitness equipment sales (Umay FR, €210.76k) and practical lifestyle products. The presence of FUFFI Global Store (€242.06k) and multiple local retailers shows a balanced, diverse market.

United Kingdom: The Mega-Market

The UK’s dramatically higher revenue figures – with the top performer exceeding €4 million monthly – indicate the market’s maturity and scale. Beauty dominates (plmakeupacademy, ISEE HAIR WIG at €146.60k), but established consumer brands like Shark UK and L’Oreal (lorealparisuk, €787.81k) demonstrate that traditional retailers can thrive on TikTok Shop with the right approach.

Lessons for Brands: How to Succeed on TikTok Shop

Before diving into product and content strategies, it’s critical to understand the single most important factor behind TikTok Shop success: affiliate creators. The top-performing shops in our analysis derive 80-90% of their revenue from affiliate partnerships, where creators promote products to their audiences in exchange for commission. This creator-driven model is what fundamentally differentiates TikTok Shop from traditional e-commerce channels.

For brands entering TikTok Shop, building and nurturing creator relationships should be your primary focus. That said, here are other critical success factors:

1. Product-Market Fit Is Everything

Success on TikTok Shop requires products that naturally fit the platform’s strengths:

- Visually demonstrable benefits

- Suitable for short-form video education

- Shareable and discussion-worthy

- Priced for social-driven impulse purchases

2. Localization Matters

While some brands succeed across borders, the differences between country charts are striking. Brands must:

- Adapt content to local preferences and humor

- Consider regional payment and shipping expectations

- Understand cultural attitudes toward social commerce

- Tailor product selection to market-specific demands

3. Content Velocity Drives Revenue

The shops with the most consistent revenue growth likely maintain aggressive content calendars. TikTok’s algorithm rewards frequent, engaging posts that drive traffic to shop pages.

4. Category Selection Impacts Ceiling

While fashion and beauty dominate by volume, the UK data shows that established categories can achieve significantly higher revenue than emerging ones. Brands should consider both competition and market maturity when planning their TikTok Shop strategy.

The Role of Technology Partners in TikTok Shop Success

Launching and scaling on TikTok Shop presents unique challenges: catalog management across multiple markets, real-time inventory synchronization, pricing optimization, and performance analytics across different regional platforms.

This is where technology partners become essential. Platforms that specialize in multi-channel e-commerce can dramatically accelerate TikTok Shop success by automating complex processes and providing unified control across markets.

Note: Leading brands have already discovered the power of specialized e-commerce solutions for social commerce expansion. For example, Darty, a major French retailer, leveraged Lengow’s platform to successfully scale their presence across multiple online channels, including emerging social commerce platforms. Such partnerships enable brands to focus on content and community while technology handles the operational complexity.

Darty Success Story

How Darty became a pioneer of social commerce by launching on TikTok S…

Learn moreAbout the Data: This analysis is based on Kalodata’s tracking of TikTok Shop performance across France, Germany, Italy, Spain, and the United Kingdom for the period September 1-30, 2025. Revenue figures represent estimated gross merchandise value (GMV) in euros.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'