Which trends are set to emerge in 2019? (Part 1)

03/01/19

3'

2018 is now behind us, and 2019 promises to be another great year for e-commerce. In the first part of this series, we’ll be taking a look at 5 trends that are set to be big this year.

1/ Reinforcing robot and human connections

As discussed by Jean-Philippe Desbiolles (IBM Watson’s Vice-President Watson / Cognitive Transformation) at the 6th annual Lengow Day, “intelligence is not magic and it takes time to set up”.

The main categories of AI applications are personalisation and improvement of the customer experience, robotic and intelligent logistics, visual research, management of marketplace databases, chatbots and personal assistants.

Once again this year, artificial intelligence will continue to be used by online retailers and consumers. Investments in this area will continue to grow, as will its learning and cohabitation with humans.

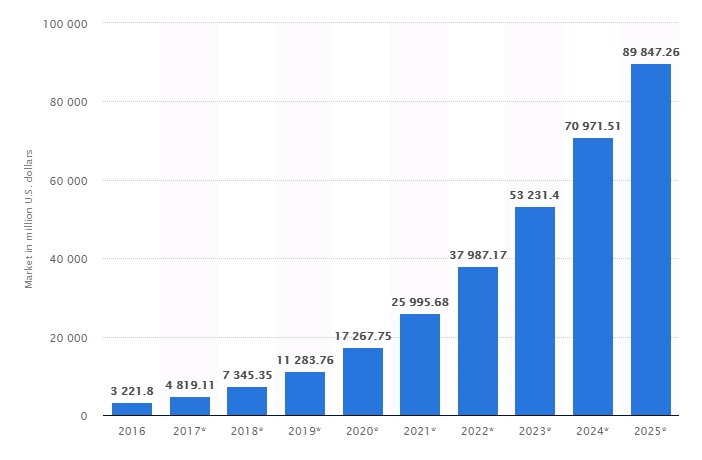

The market represented $4.8 billion in 2017, and is set to generate a turnover of nearly $90 billion by 2025. However, there are still many challenges for online retailers in 2019.

2/ Converting on social media

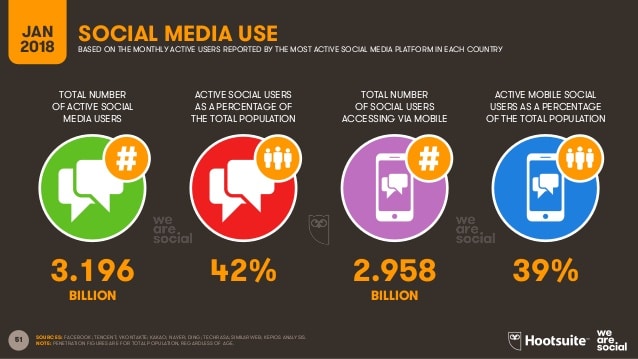

Social networks are becoming an essential way to connect supply and demand. With nearly half of active users worldwide (42%), social media is becoming a reflex for many companies wishing to share their brand and their products.

Between the “Dynamic Ads”, “Collection”, “Canvas”, “Marketplace”, Instagram “Shopping”, Pinterest “Shop The Look” or the Visual Search on Snapchat … there’s a huge amount of choice and the potential is still great.

Conscious of this growing demand, social platforms are constantly improving their service. The challenge is for them to follow in the steps of the Wechat (Tencent) messaging application in China, to offer their users a multitude of services, such as online shopping, to keep them connected to their platform for as long as possible.

See also > [Guest Article] 5 practical social media advertising options for retail business.

3/ A more fun and interactive way of shopping

Consumers now want a unique shopping experience. Always looking for the best price, savvy buyers are now focusing on entertainment as the price they will put on a product.

For example, entertainment and online shopping go hand in hand in China. Shopping is a way of life in which interaction between brands and buyers is essential.

At the 6th annual Lengow Day, Laura Pho Duc (Marketing Manager, Alibaba France) said that “consumption habits in China will be European consumers tomorrow”.

See also > Interview: Alibaba, a key player in the Chinese market.

This combination of shopping and entertainment is already well anchored in China, and is gradually developing in Western countries. A few months ago, we talked to you about augmented reality applications implemented by IKEA and Amazon.

Virtual reality is attracting more and more consumers. According to a study by Facebook*, 63% of respondents are interested in using virtual reality to see products without the need to move into physical stores.

*This study took place in 11 countries: Australia, Brazil, Canada, France, Germany, India, Indonesia, Nigeria, South Korea, the United Kingdom and the United States.

4/ Cleaning up and uniting the market

2018 saw two new European regulations: GDPR and the end of geo-blocking. On May 25th, the General Data Protection Regulation (GDPR) came into effect, with the aim of uniting the regulation of personal data in all EU countries. December 3rd then saw the banning of unjustified geographical blocking in Europe.

In 2019, it is likely that new regulations will come under discussion to help clean Europe up, but also to help unify and stimulate European e-commerce.

5/ Digitalising fast-moving consumer goods (FMCG)

A long time lagging behind, the FMCG sector is slowly catching up and is now at the forefront of the e-commerce scene. With a share of nearly 60%, it is the pure players who occupy the majority of this market online, such as Amazon, Alibaba or JD.com, who are constantly multiplying repurchasing and collaborations to boost this market. According to Kantar Worldpanel, online will represent over 10% of global FMCG sales by 2025.

However, traditional distributors are not exempt from this either. Carrefour has accelerated its digital projects with its 2022 transformation plan, and Lidl now has an online store. If the road is still long, the expertise of these brands in their field may one day give them the advantage.

Check back next week for part 2 of our 2019 trends!

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'