Why Marketplaces in Europe Stand Up Against Competitors Like Temu, SHEIN, etc.

22/07/24

5'

In recent years, Chinese e-commerce giants like Temu and SHEIN have significantly impacted the global market. Their competitive pricing, diverse product ranges, and efficient logistics, coupled with intensive marketing campaigns (Temu spent $2 billion on Meta Ads and was one of top five spender on Google ads in 2023), have enabled them to make substantial inroads into Western markets. However, long-established marketplaces in Europe are not standing idly by. They are ready to meet this challenge. Here’s why European marketplace players are well-positioned to compete with Chinese giants like Temu, SHEIN, and others.

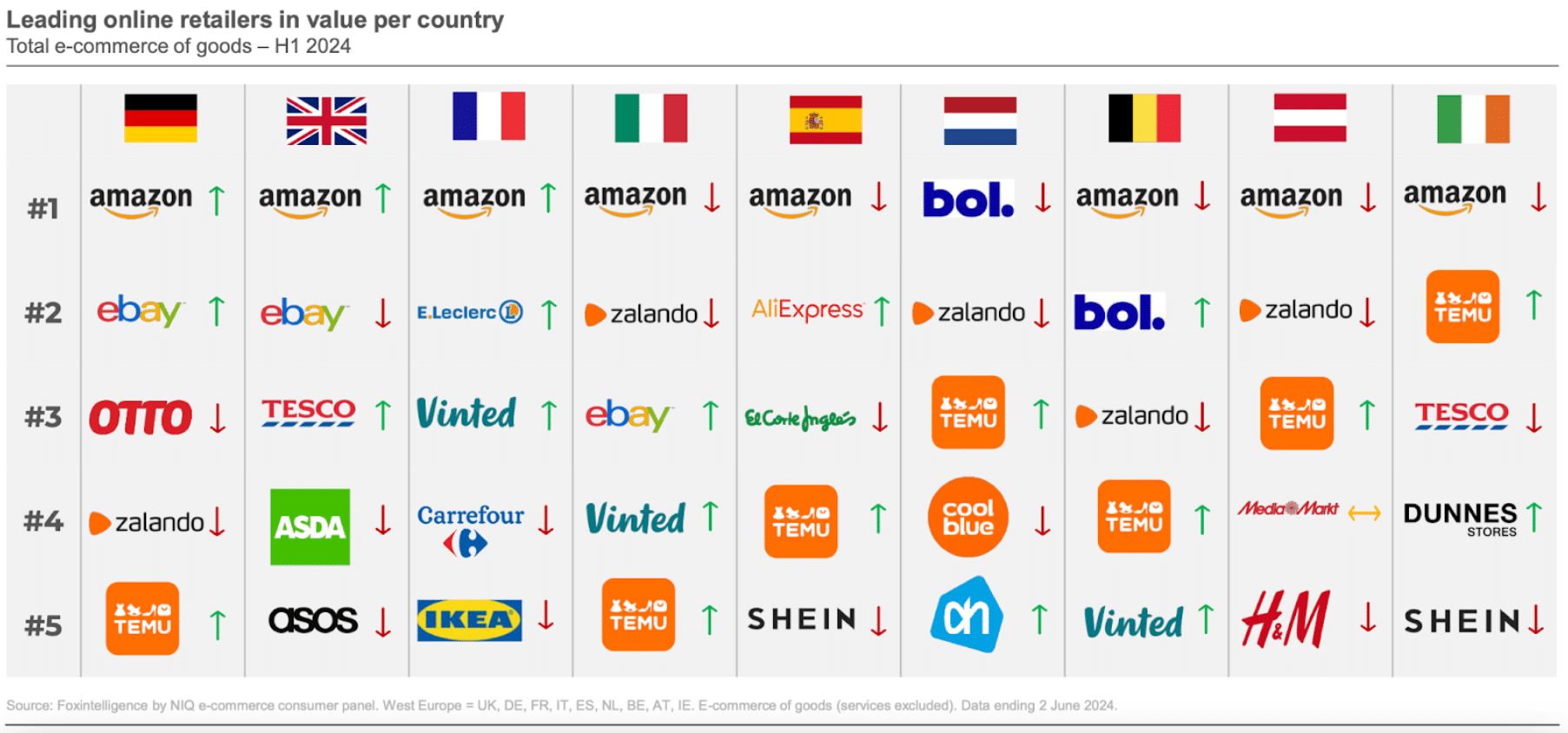

Although Chinese e-commerce platforms such as Temu, SHEIN, and AliExpress have frequently ranked among the top five retailers in Europe during the first half of 2024 (according to Foxintelligence, see chart below), this does not guarantee their long-term dominance.

Established marketplaces like Amazon, eBay, Zalando, and bol.com continue to hold strong positions and possess significant advantages. Let’s explore these advantages in detail.

1/ Quality assurance and authenticity

One of the critical differentiators for established marketplaces in Europe is their commitment to quality assurance and authenticity. European consumers have high expectations regarding product quality and safety standards. To meet these expectations, European marketplaces adhere to stringent quality control measures and regulatory standards, ensuring products are safe, durable, and authentic.

This commitment to quality is exemplified by platforms like Amazon, which has implemented robust measures to combat counterfeit goods. For instance, Amazon’s Project Zero, launched in Europe, empowers brands to directly remove counterfeit listings from the platform. Additionally, the company uses advanced machine learning technology to proactively prevent counterfeit products from being listed.

In contrast, some Chinese marketplaces are perceived as prioritizing cost over quality, which can lead to issues with counterfeit goods or subpar products. A notable example is the frequent reports of counterfeit electronics and luxury goods on platforms like AliExpress, which have sometimes resulted in consumer distrust. This disparity in quality assurance and authenticity gives European marketplaces a significant advantage, as they can build and maintain consumer trust through their rigorous quality standards and commitment to genuine products.

2/ Localized & trusted customer experience

European marketplace players have a profound understanding of their local markets, enabling them to tailor their offerings to specific tastes, preferences, and cultural nuances. This localized approach extends to customer service, where European companies provide support in local languages and adhere to local customer service norms. These personalized experiences foster trust and loyalty, offering a significant competitive advantage over Chinese platforms that may adopt a one-size-fits-all strategy.

A study by ECC Köln and Lengow examined the perception of Asian retailers in the German e-commerce market. It found that German consumers are particularly skeptical of Asian online marketplaces. Well-known European names like OTTO, Amazon, and Zalando are far more trusted, especially regarding returns, data protection, and confidence in the product range. For around two-thirds of German consumers (66%), checking the supplier’s origin becomes unnecessary when purchasing through these trusted platforms, highlighting the critical importance of the trust factor.

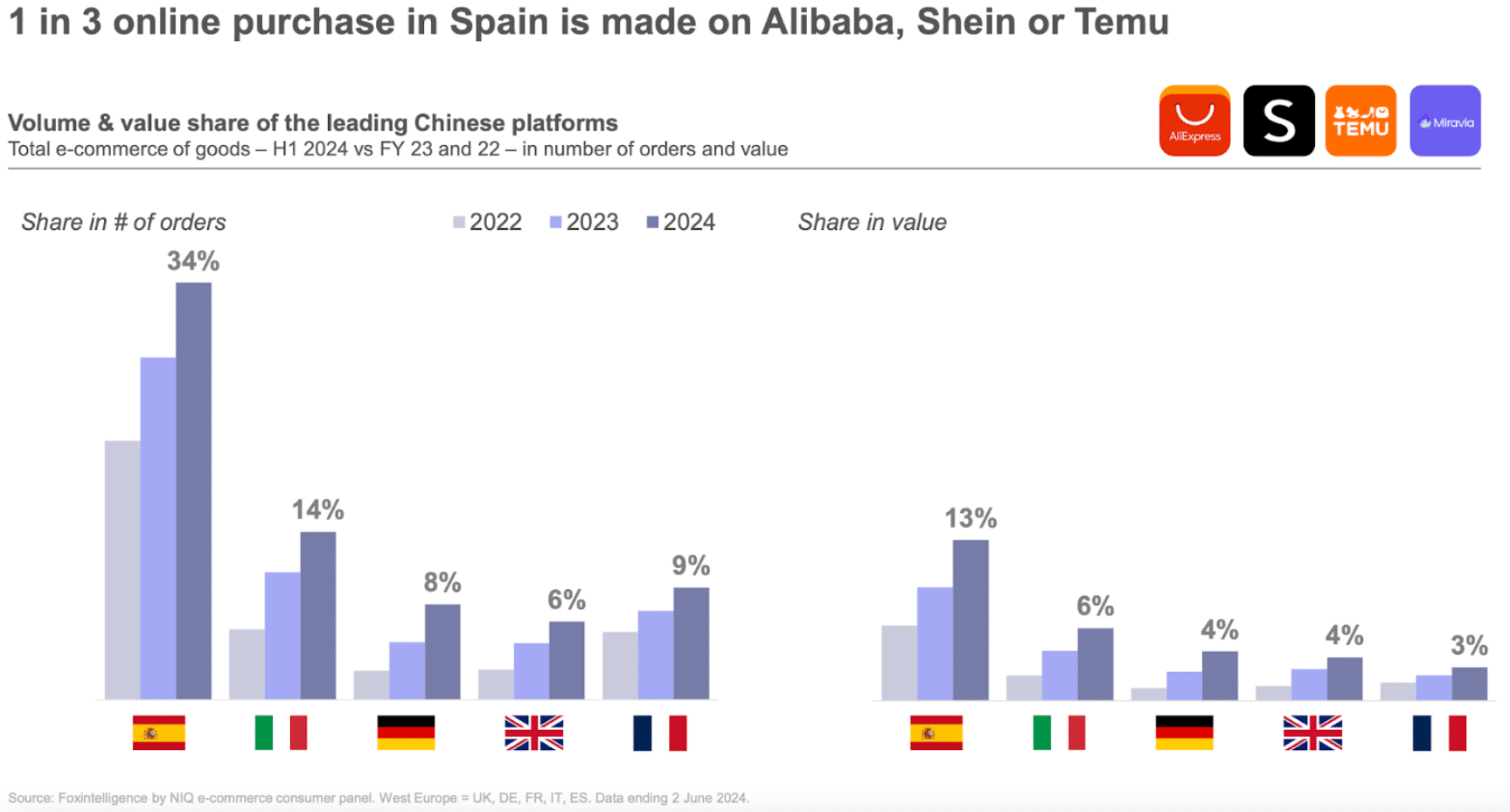

Chinese retailers have varying levels of representation across Europe. For example, they dominate the market in Spain but are less strong in other countries such as Germany, according to Foxintelligence data (see chart below).

3/ Sustainability and ethical practices

Sustainability has become a critical factor for consumers, particularly in Europe, where there is an increasing demand for eco-friendly and ethically produced goods. European marketplace players are increasingly focusing on sustainable practices, such as reducing carbon footprints, promoting fair trade, and offering products made from recycled or sustainable materials. These efforts resonate well with European consumers who are becoming more conscious of the environmental and social impact of their purchases. In contrast, Chinese competitors may struggle to match these sustainability credentials, giving European players a distinct advantage.

The Consumer Compass survey by Savanta, conducted across six European markets, revealed that over half of Italian and Dutch consumers consider sustainability an important factor when buying a product or service (54% and 51%, respectively). To fit these expectations eBay for example has made a strategic shift to fully embrace recommerce, incorporating it into its marketplace and marketing strategy.

4/ Strategic local partnerships and collaborations

European marketplaces are increasingly forming strategic partnerships and collaborations to strengthen their positions. These alliances, which can be with local businesses, logistics providers, and even other retailers, help enhance supply chain efficiency, expand product ranges, and improve customer service. By building a robust network of partnerships, European players can scale more effectively and compete on a global stage.

For example, Zalando‘s Connected Retail program allows local physical stores to sell their products directly to online customers via the Zalando marketplace, one of Europe’s leading online fashion platforms. This program provides retailers with tools to manage orders, set prices, and handle logistics while benefiting from increased visibility and sales through access to Zalando’s extensive customer base.

Additionally, the marketplace MediaMarktSaturn has teamed up with Uber Eats to offer immediate delivery services for electronic products in Germany. This collaboration aims to enhance the convenience of shopping for electronics by allowing customers to receive their purchases quickly, often within 30 to 90 minutes. This initiative is part of MediaMarktSaturn’s broader strategy to innovate and improve customer satisfaction in the competitive e-commerce market.

5/ Cultural and heritage appeal

Europe is renowned for its rich cultural heritage and unique craftsmanship, which European marketplaces can leverage by promoting locally made products that carry distinct cultural appeal. Items with geographical indications, traditional craftsmanship, and unique designs attract consumers seeking authenticity and exclusivity. According to Eurostat, products labeled “Made in Europe” have experienced a significant increase in sales, underscoring the demand for local and authentic goods. This cultural edge is something that Chinese marketplaces, despite their extensive product ranges, may struggle to replicate.

For example, Amazon frequently highlights local European sellers on its marketplaces. In 2021, Amazon France launched a dedicated page for products made in France, tapping into the trend toward local consumption accentuated by the pandemic. This page features around 230,000 products across various categories, from toys and stationery to DIY and hygiene, emphasizing the appeal of locally made goods.

While Chinese competitors like Temu and SHEIN have significant advantages in terms of scale and cost efficiency, established marketplace players in Europe have their own set of strengths that can help them stand up to the competition. By focusing on quality, local expertise, sustainability, regulatory support, innovation, strategic partnerships, and cultural appeal, these marketplaces are well-equipped to carve out their niche and thrive in the competitive European e-commerce landscape.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'