11.11 Global Shopping Festival: how and why do brands participate?

10/12/19

4'

Another year running, the Global Shopping Festival (also known as Single’s Day or Double 11) attracted millions of consumers motivated by good deals and new products. Spending $38.4 billion this year (+26% compared to 2018), the Chinese giant Alibaba has broken a new record with 1.3 billion orders placed and 1 million new products launched.

From high tech, to luxury, to automobiles… many industries got involved on November 11. L’Oréal Paris and Nestlé were the stars of 2019’s 11.11 among the 200,000 participating brands. Read on to find out more about the strategies adopted by brands for this year’s Global Shopping Festival.

Create a brand community

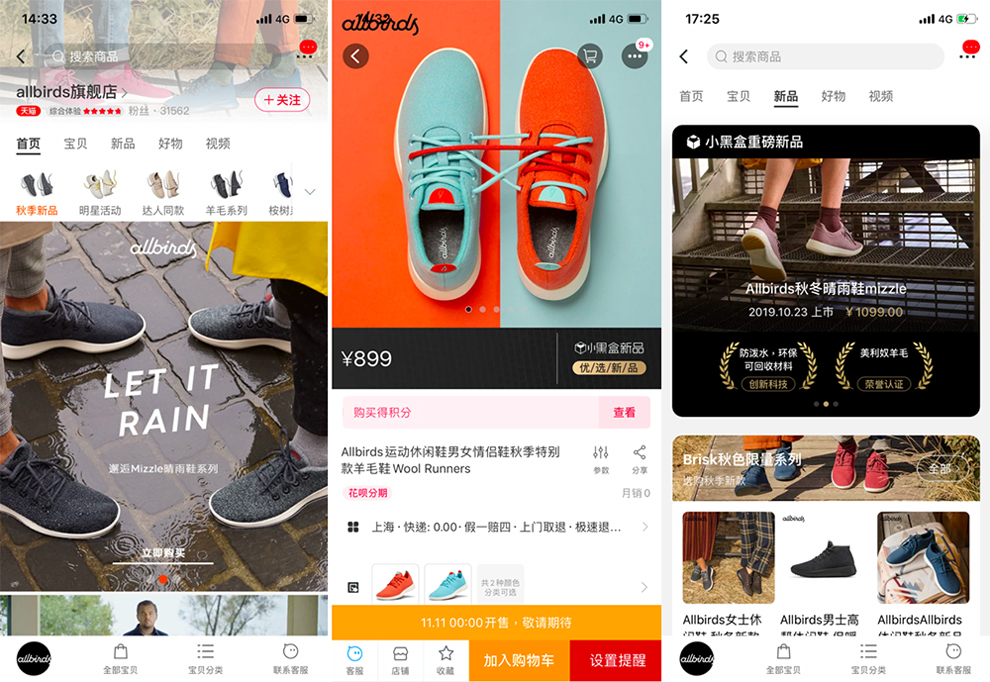

Although 2018 marked Alibaba’s Global Shopping Festival’s 10th anniversary, some brands (such as the American brand Allbirds) have only just started participating this year.

To make a lasting impression, the “Direct to Consumer” brand released two special editions of its signature sneakers, after opening its flagship store on Tmall last April. Allbirds succeeded in simultaneously selling products and improving brand awareness by offering an exclusive offer for Double 11.

To attract Chinese consumers and build a community, many brands use live streaming and use Key Opinion Leaders (KOLs) to promote their products and improve brand engagement. The craze is so popular in China that some live streaming sessions went on for 24 hours non-stop. Among the many live streams broadcast during the day, Kim Kardashian’s was one of the most popular, with 12 million visitors. The objective of the session was to announce the launch of Kardashian’s new fragrance and at the same time her brand’s entry into Chinese e-commerce.

Conquer new geographical areas

While some brands are already well known in China, others take advantage of 11.11 to increase their visibility and reach a new target group of buyers. On Singles Day 2019, Unilever and L’Oréal Paris set out to conquer a new geographical area in China: “lower tier cities”. To appeal to this new consumer demographic, the two brands decided to offer personalized special offers at more affordable prices.

Launch new products on the market

For 11.11, some brands partnered with Alibaba’s Tmall Innovation Center to create new products to match Chinese consumers’ expectations. L’Oréal Paris, which this year was in the top sales of beauty brands, launched a facial night cream for younger generations. This was made possible by the demographics and buyer aspirations collected on Tmall. The product was launched via L’Oréal’s Tmall Hey Box incubator, after only 59 days of development. 80% of purchases were made by new customers.

Engage Chinese consumers

Long fascinated by Western products, Chinese consumers continue to appreciate these products but are becoming more and more demanding when it comes to buying them. They take into consideration product quality, its composition, the packaging and the technology provided. For the Global Shopping Festival, L’Oréal Paris unveiled La Maison L’Oréal Paris. This space allows you to discover how the brand’s products are manufactured, meeting the expectations of consumers who want to understand a product’s history before making a purchase.

Kendo, the LVMH group’s beauty brand incubator, put a spotlight on how its products should be used during the the brands first participation in 11.11. By doing this, Kendo introduces its products and educates consumers, encouraging consumers to buy a brand they may not already know.

Finally, the brand Nestlé took advantage of 11.11 to localize its offer by proposing new Dolce Gusto machines and flavours adapted to the expectations of Chinese buyers.

According to Daniel Zhang (CEO – Alibaba), the success of this 2019 edition can be explained by “new consumption patterns, new brands and new shopping experiences” that are now evolving in the ‘New Retail’ universe developed by Alibaba in 2016.

Chinese Ecommerce Outlook

A full review of the Chinese ecommerce market by Lengow Global industr…

Learn moreYour e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'