CB Commerce Europe report: Top 500 Europe cross-border brands and retailers

05/04/22

4'

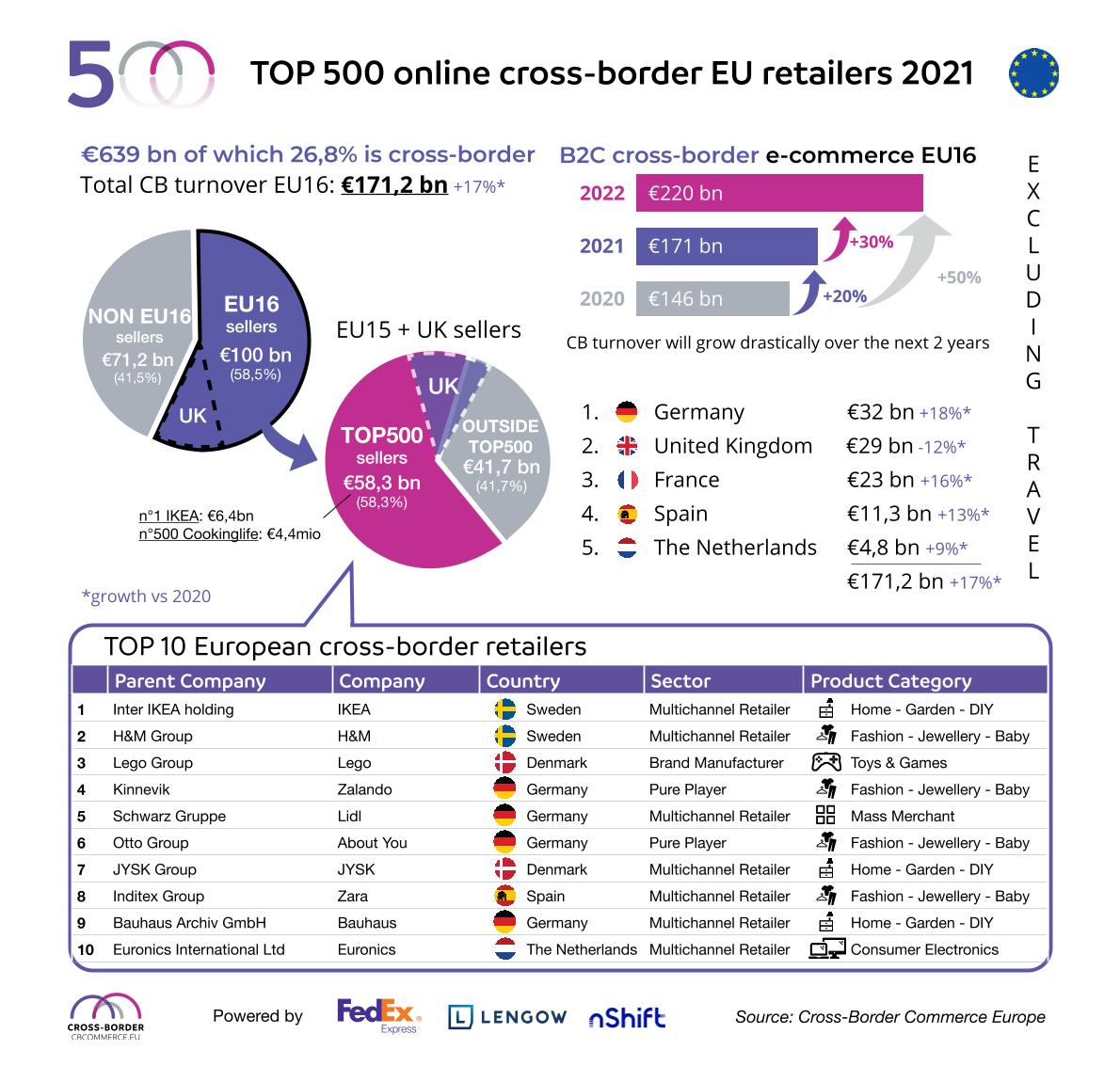

In 2021, the European online cross-border market will generate €171.2 billion in revenue (excluding travel), up 17% year-over-year. The cross-border turnover of European online shops reached €100 billion.

Cross-Border Commerce Europe’s annual report ranking the top 500 brands and retailers operating cross-border in Europe has just been released, with the support of Lengow, alongside FedEx Express and nShift. A preview of some key learnings from the annual report.

B2C online turnover from goods grew by 11.5% to €639 billion in 2021. In 2021 cross-border e-commerce revenues (excluding travel) reached €171 billion in Europe, growing 17% year-over-year. Cross-border online sales outperformed total online sales. A key driver is Covid-19, influencing consumers to move online for their purchases.

B2C online cross-border sales through European (incl. UK) sellers reached a record high of €100bn in 2021. This was €87.2bn in 2020, so a YTD increase of 14.6%.

An overview of the study

The study titled TOP500 EU Retailers Cross-Border Analysis Report 2022 is a comprehensive compilation of cross-border information gathered from European retail websites. Four elements are balanced to determine the ranking:

- Cross-border online sales in Europe (15 countries within Western Europe, Scandinavia, and the United Kingdom)

- SEO performance elements that cross borders

- The cross-border score is determined by the number of active nations

- Cross-border tourists (number and proportion)

Six additional secondary weighted parameters fine-tune this ranking: brand authority, organic search appearance, availability of local supply (transport and stock services), and number of languages, currencies, payment methods in operation.

Top 10 European cross-border brands and retailers

The top 10 brands and retailers in 2021 were IKEA, H&M, Lego, Zalando, Lidl, About You, Jysk, Zara, Bauhaus and Euronics.

Retailers, pure players, marketplaces and brand manufacturers make up the TOP10. IKEA, H&M, Lego, Zalando, Lidl, About You, Jysk, Zara, Bauhaus and Euronics are the 10 “best-in-class” brands and retailers for 2021. IKEA retains its leading position in the TOP10, accounting for 20.9% of TOP500 sales, with cross-border sales of €5.5 billion, up 8% compared with 2020. In the fourth edition of the “Top 500 Cross-Border Retail Europe”, IKEA maintains its dominance. LEGO establishes a strong global strategy as a direct-to-consumer (DTC) brand.

New entrants include Zalando, Lidl, About You, Jysk, Zara, Bauhaus and Euronics.

Trends and analysis

Fashion and jewellery remains the first category with a 41% share, followed by home, garden and DIY with an increase of 15% due to the pandemic. The category of personal care increased by 100%.

In the TOP500, the number of multichannel retailers has decreased, while the number of brand manufacturers intending to build their direct-to-consumer (DTC) channels has increased by 50%. Brand names include Lego, Nespresso, Adidas and Philips. Luxury brands including Richemont, LVMH, and Kering, are investing in a stronger direct-to-consumer strategy to lessen their reliance on larger markets.

Promising new challengers such as NA-KD (position 26) and Gymshark (position 105) are digital-native vertical brands (DNVBs) operating as pure players, in other words, “made on the Internet”. In future editions, there are more challengers set to join the list. Looking to the United States, the market now counts over 700 DNVBs, some of which will be eager to start cross-border operations in the coming years in Europe.

Pure players, which include marketplaces, account for 47% of the TOP 500; the number of marketplaces has expanded from 28 to 42, with record sales of €20 billion (+45% YTD). The extraordinary revenue rise of European marketplaces also strengthened positions against American marketplaces.

The impact of Brexit

Cross-border sales in the UK fell by 12%, resulting in €29 billion in cross-border sales, down from €33 billion in 2020. This is due to Brexit and its impacts on VAT regulations, import duties, logistics and returns.

Consequently, Germany has surpassed the United Kingdom as the leading European cross-border country. The presence of UK retailers in the TOP500 has dramatically decreased, 32 retailers dropping from the ranking (100 were counted in 2020, compared with 68 in 2021).

In 2022, the TOP500 counts 1.4bn monthly cross-border visitors–up from 40% year-over-year. It’s clear that cross-border e-commerce will continue to grow quickly over the coming years. For more insights and key learnings, download the report today.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'