Germany: Europe’s leader for price comparison engines?

02/07/19

4'

It doesn’t always have to be your online store or marketplaces: price comparison engines are also suitable for advertising (and selling) your products. In Europe there are numerous comparison engines to discover goods online, but in they’re most visited in Germany, and by far – meaning that if you sell in the German market, these platforms are indispensable. Why is that? Let’s take a look at this market.

European price comparison engines in Europe: Germany is ahead by far

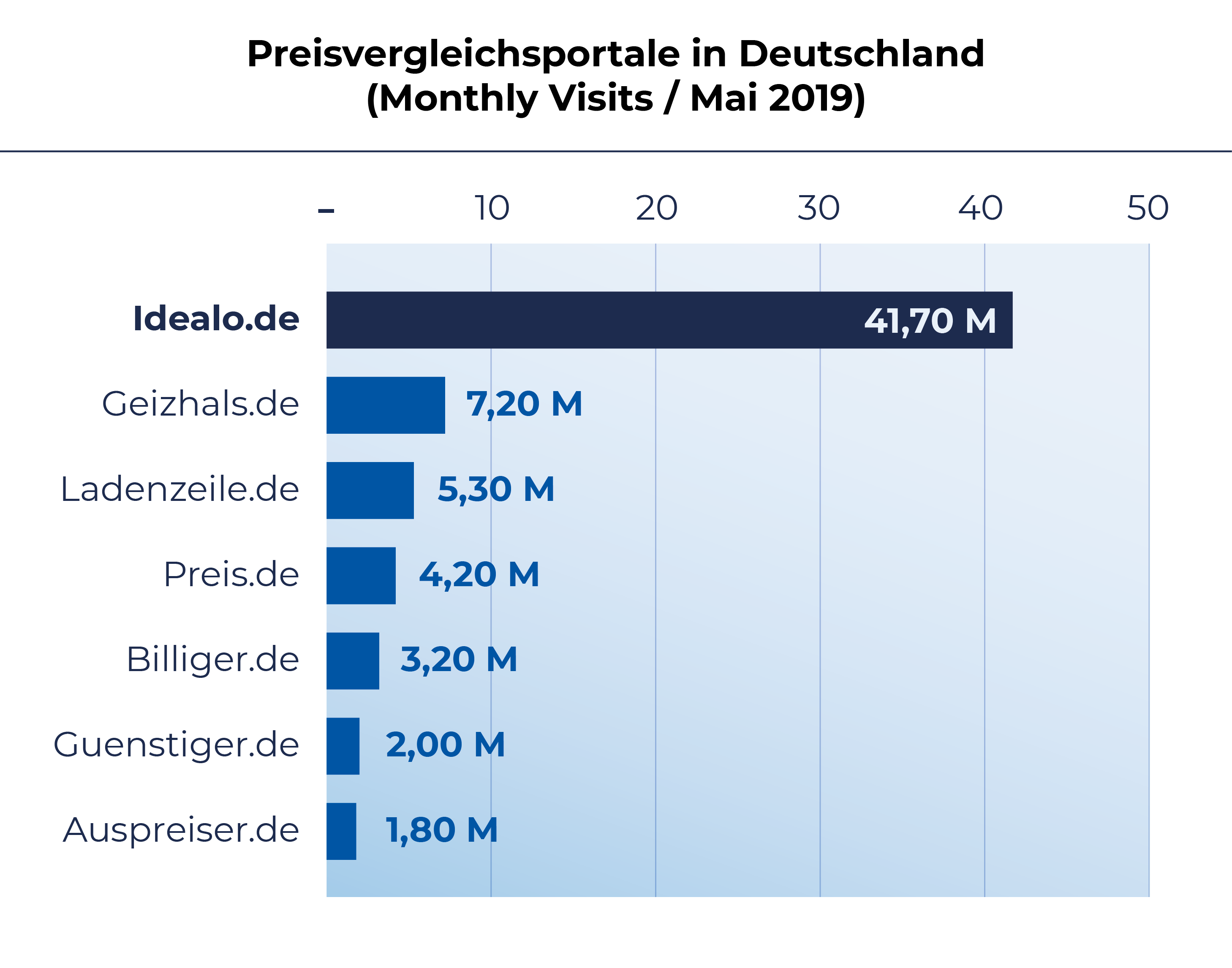

Purchase decisions aren’t immediately made on marketplaces – many e-shoppers inform themselves about products via price comparison engines. If you look at the classic price comparison engines for goods in the three largest e-commerce markets in Europe, i.e. the United Kingdom, Germany and France, it quickly becomes clear that more Germans are using these websites than their European shopping counterparts (data from statistics tool SimilarWeb, May 2019).

Price comparison engines in Germany (Monthly visits / May 2019)

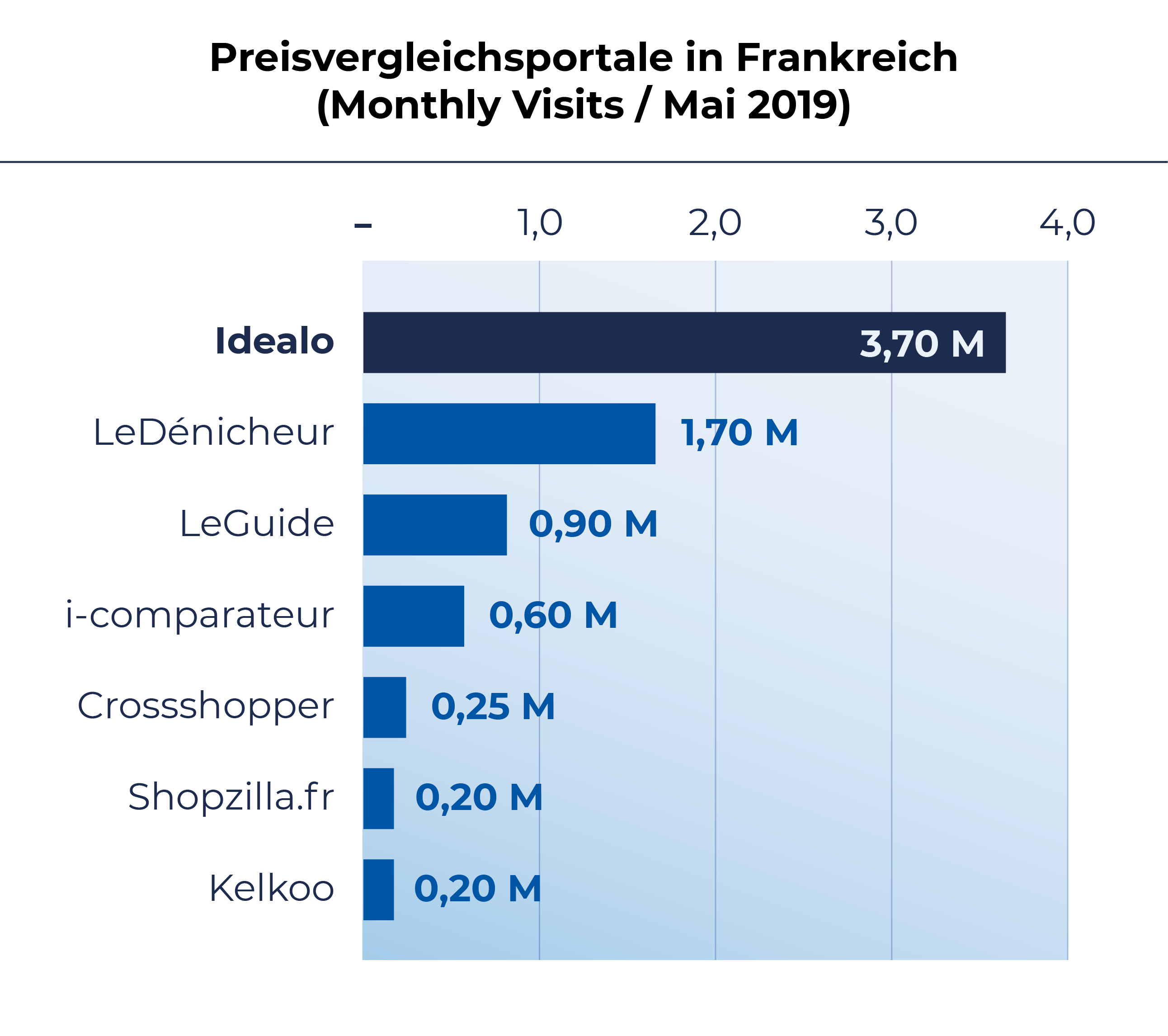

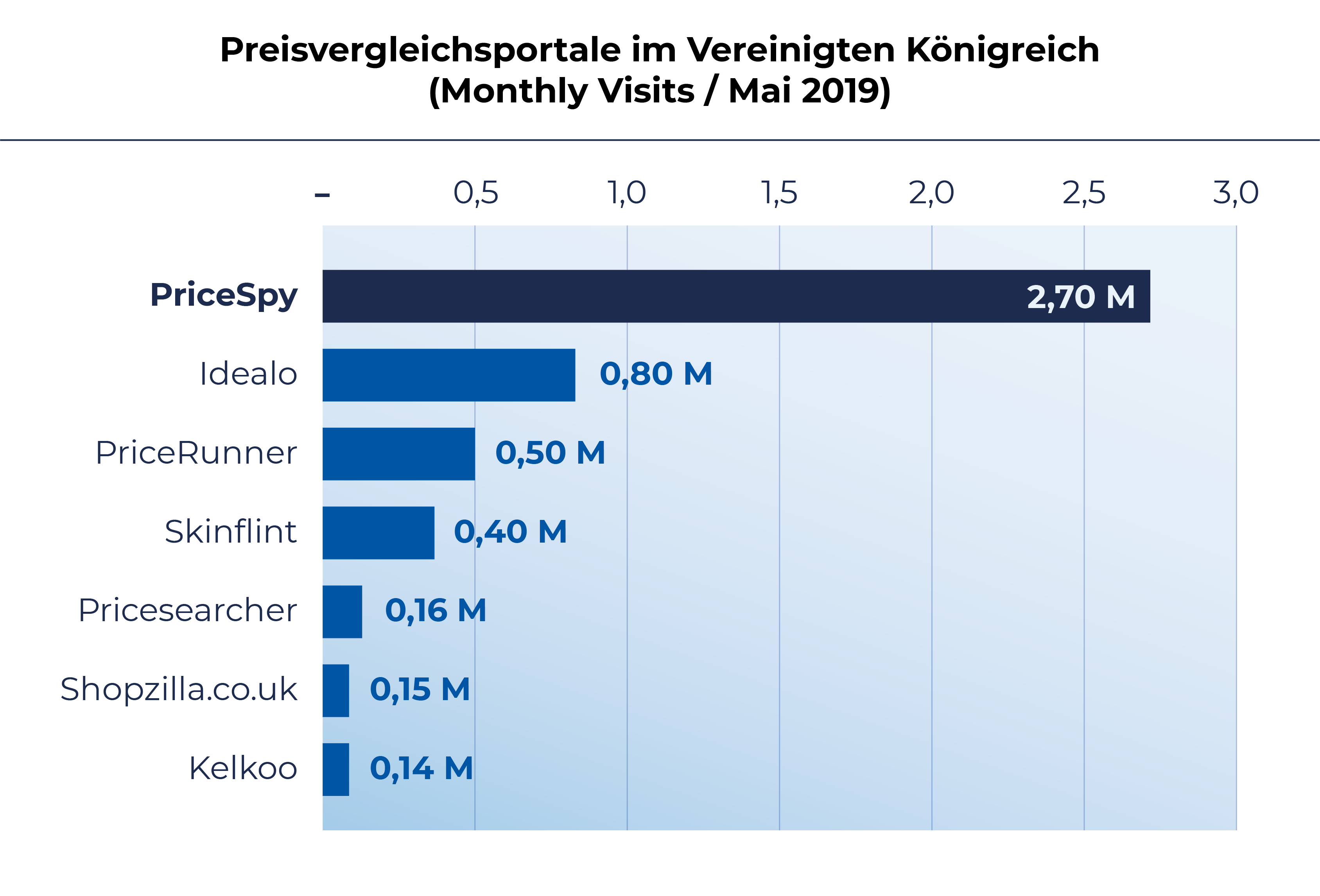

German price comparison platform idealo receives an incredible 41.70 million monthly visits in Germany and is thus far ahead Geizhals.de which comes in at second places with 7.20 million monthly hits. Surprisingly, idealo also finds itself at first place in France, but with “only” 3.70 million visits per month. In the UK idealo is the second most popular choice, meaning it can establish itself as the leading European price comparison engine.

In France, leDénicheur and leGuide.com are particularly noteworthy, in the UK the leading price comparison engine is PriceSpy.

Price comparison engines in France (Monthly visits / May 2019)

Price comparison engines in the UK (Monthly visits / May 2019)

Why are price comparison engines so popular in Germany?

In 2018, 67% of German consumers used price comparison engines as a money saving method. Overall, savers find shopping online more cost-efficient than brick-and-mortar retail: it’s where all the most interesting deals are.

Saving seems to be almost a lifestyle for Germans. A study by idealo showed that 9 out of 10 Germans generally don’t want to spend more than necessary and that 7 out of 10 actually have fun(!) saving. Germans also like to be recognised as “the champions of saving in Europe”, which has an effect on behaviour in e-commerce. Consumers look for the cheapest price and like to compare prices, either via price comparison engines or by making comparisons via various websites themselves.

Why are comparison portals less popular in the UK and France?

Firstly, this may be down to the fact marketplaces in both of these countries are more widespread – France is considered the land of marketplaces in Europe. E-shoppers compare prices directly between the various dealers within the marketplace. On the other hand, the decline in the number of visitors to these engines may also be due to the presence and strategy of Google Shopping, many portals lost a lot of visibility and traffic after the new platform was introduced. However, following the intervention of the European Commission, Google Shopping has also been opened for comparison engines. Google’s new comparison ads should help price comparison sites to receive significantly more traffic. However, since price comparison sites have long been traditionally used in Germany and by German savers, even after looking on Google Shopping, they are more resistant there.

Product feeds for price comparison sites

Price comparison engines are very worthwhile if listing your products in Germany: the conversion rate here is often very high. The best platform for the retailer must be decided on an individual basis, regardless of a platform’s number of visits. Some platforms specialise in certain product categories, some are more generalised.

A feed is required to list on price comparison portals – as is the case with Google Shopping. Often, however, not all products are correctly recognized and classified by the portals despite exact information. A more precise alignment of the product categories and other features with the platform’s specifications leads to significantly more traffic: this works best with feed management tools like Lengow, which make it possible to optimise your product information in order to achieve the best search results. In addition, each price comparison engine has its own algorithm and quality score. It is imperative that retailers know these before they put their products online. Every product data sheet should contain as much information as possible to make the listing detailed and attractive: availability, shipping costs, title, image and price must be specified succinctly and accurately.

Contact Lengow to learn more about price comparison engines and to list your products there:

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'