How Chinese Marketplaces are Conquering the Western E-commerce Market

18/10/23

6'

The winds of change are sweeping across the global e-commerce arena, fueled predominantly by a robust influx of Chinese third-party (3P) sellers into major European and US online marketplaces. In 2022, a striking 59% of Amazon’s 3P sellers were based in China. This influx led to a Gross Merchandise Value (GMV) of $200 billion on Amazon. As we venture towards 2026, Amazon’s share of China-based 3P sellers is projected to hit 65% (Source: Cross Border Commerce Europe).

But that’s far from all because instead of counting on Western marketplaces, China is trying to establish its own Chinese marketplaces and platforms in Europe and the U.S. more than ever to bypass the regional players there. The dawn of 2023 witnessed a significant 19.9% spike in China’s e-commerce exports, propelled by platforms like Shein and Temu. While general export figures dwindled, e-commerce exports, which constituted 6.4% of total exports in 2022, showcased a substantial ascent. This rising trend, underpinned by China’s vast manufacturing capabilities and direct-to-consumer platforms, is redefining Chinese trade dynamics and amplifying its export strength (Source: South China Morning Post).

This unfolding scenario, set against a canvas of global retail competition and economic aspirations, signifies a narrative of change. The ripple effects of this eastern e-commerce journey are poised to shape the global e-commerce terrain for the foreseeable future. How can Western e-commerce stand up to it and take the fight?

Chinese marketplaces go all-in in the Western world

Chinese marketplaces and retailers are investing heavily in Western e-commerce, especially with huge marketing campaigns and some logistics projects. Here are the three largest at a glance.

AliExpress

AliExpress’s foray into the European market is a testament to China’s e-commerce global ambitions. The platform has managed to carve a significant niche among European consumers, especially in Spain, offering a vast array of products at competitive prices. Its success demonstrates the potential of Chinese marketplaces in integrating seamlessly into the Western e-commerce ecosystem, catering to the diverse consumer demands while driving a competitive pricing structure.

Shein

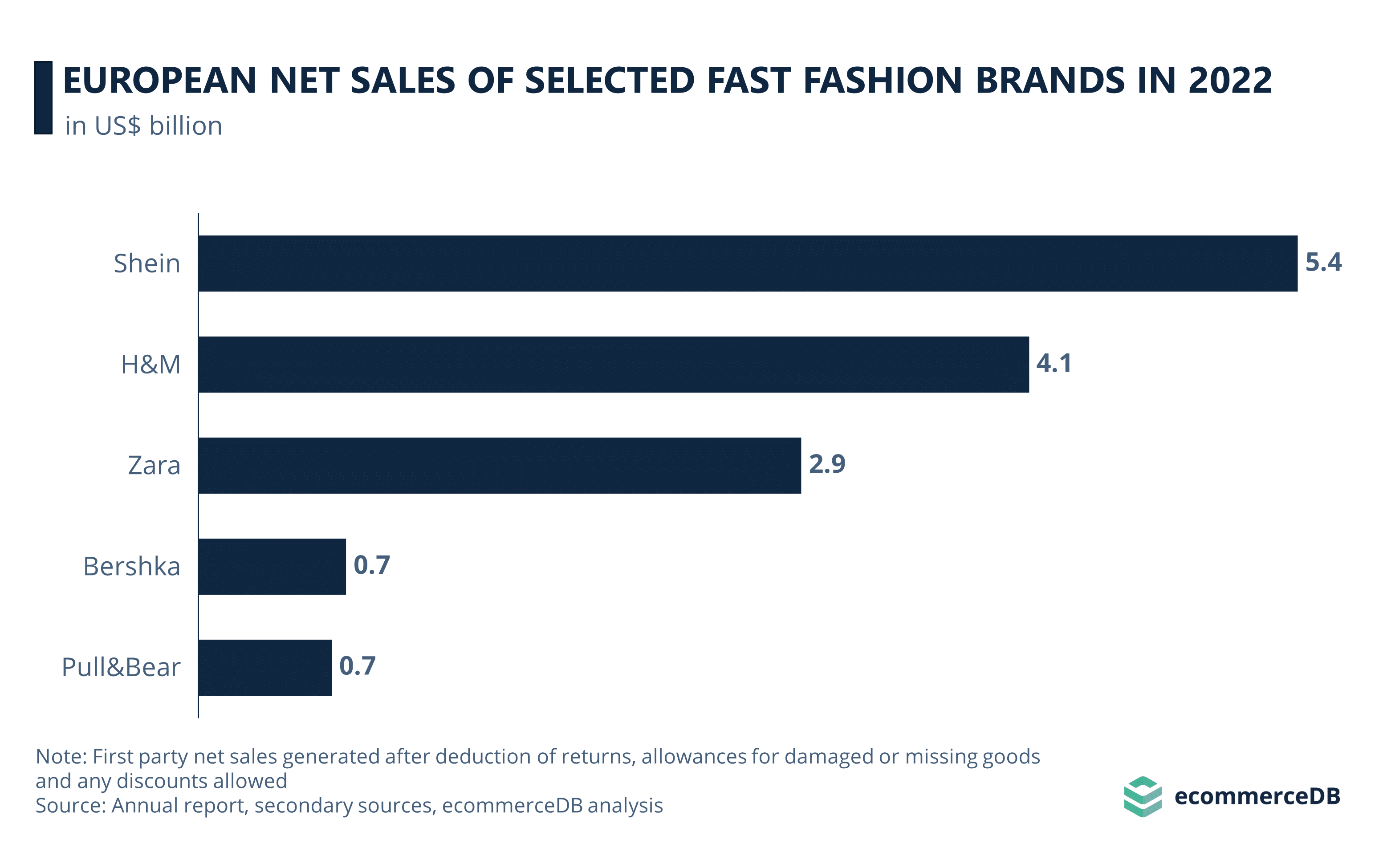

Shein encapsulates a mix of opportunity and challenge. It’s a shining example of China’s fast-fashion export to the western world. However, its rapid ascendancy has also highlighted the sustainability and quality concerns tied to fast-fashion. The “agile supply chain” model of Shein, which boasts a daily influx of new products at low prices, is particularly noteworthy. Partnering with over 5,400 third-party manufacturers, Shein recently broadened its product offerings, further intensifying its penetration into the western market.

Shein’s rapid growth, from $10 billion in sales in 2020 to $100 billion in 2022, was fueled by its low pricing and expansive online marketplace that connects thousands of clothing factories in China. Despite its success, Shein’s business model is criticized for human rights violations and environmental unsustainability, driven by its fast fashion approach. Its aggressive marketing, leveraging influencers, and adding 2,000 to 10,000 new styles daily between July and December 2021, significantly contributed to its domination in the fashion industry.

Temu

Temu, a recent entrant in the e-commerce domain, signifies a bold stride towards global marketplaces by China. Spearheaded by Shanghai’s PDD Holdings Inc, Temu crafts a virtual market square where consumers meet a plethora of China-based 3P sellers. By eliminating the middlemen, Temu envisions a direct commerce route from manufacturers to consumers. Since its debut in August 2022, Temu has climbed the charts to become the most downloaded shopping app in the U.S, courtesy of its aggressive advertising and consumer engagement tactics like offering free items for app promotion. Its business model, distinct from competitors, forbids dropshipping, ensuring faster delivery times and authentic product listings. While its customer base largely comprises price-conscious Generation Z shoppers, skepticism persists around its review system, which seemingly buries negative feedback. Temu’s journey reflects a blend of promising growth and inherent challenges as it navigates the Western e-commerce landscape…

TikTok Shop: the first “real” success in Social Selling?

The launch of TikTok Shop in the UK and the US is emblematic of a burgeoning synergy between social media and e-commerce. This initiative presents a novel paradigm of shopping infused with social media engagement, heralding a new era of social selling that could further bolster China’s e-commerce outreach. Previous attempts by Instagram and Facebook were not conclusive.

With TikTok Shop, the platform has already garnered more than 200,000 sellers and over 100,000 creators have joined the Affiliate program. In the U.K., a new section called “Trendy Beat” has been introduced to compete with giants like Shein and Amazon. TikTok is leveraging trending hashtags ( example #TikTokMadeMeBuyIt), which have amassed billions of views, to further engage the U.S. audience. This move into e-commerce by TikTok is not only a bid to compete with major e-commerce players but also an attempt to capitalize on the shopping trends popularized on their platform.

Why the Chinese platforms could be a problem for Western e-commerce

Temu’s proposition is revealing of China’s strategy and echoes a broader narrative — eliminating the retail intermediaries in the US and Europe. This “Made in China,” “Sold by China,” and “Marketed by China” approach seeks to revamp the traditional retail structure, potentially sidelining domestic manufacturing and sellers. Moreover, the influx of low-priced goods into the European market is flooding consumers with affordable options at the expense of local manufacturing and environmental sustainability.

The German media Internet World argues that the expansion of Chinese e-commerce entities into Western markets is not just a matter of business competition. The strategies and actions of these players likely have the backing of the Chinese government, aligning with broader political and economic goals.

Are domestic e-commerce platforms sufficiently robust to compete with the emerging Chinese entrants?

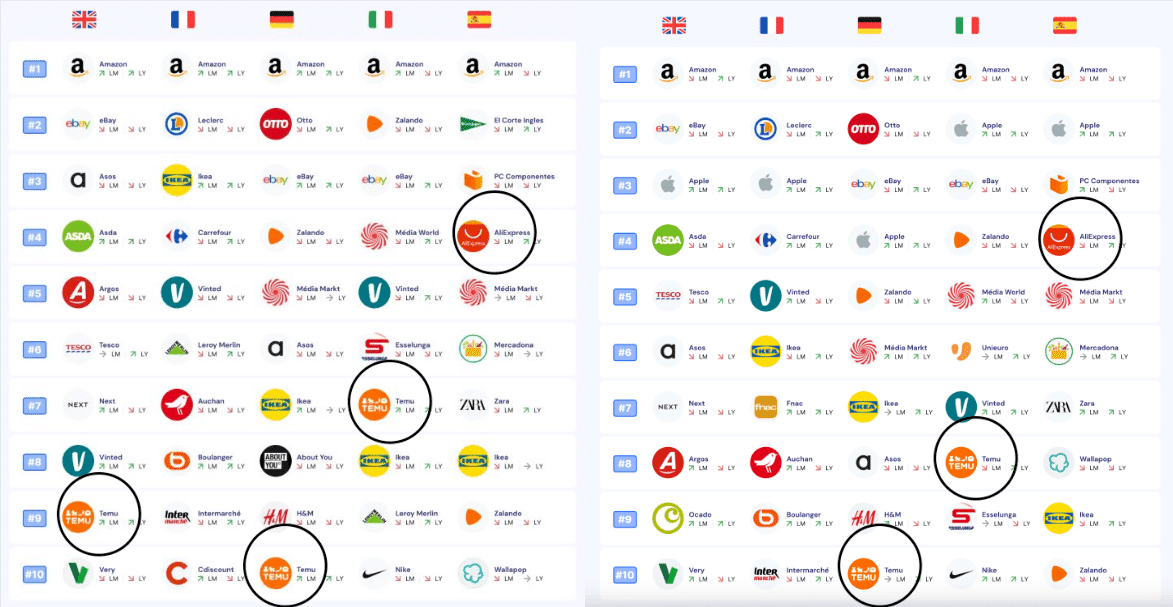

Top 10 retailers in Europe, August vs. September 2023 (source: Foxintelligence)

The surge of Chinese e-commerce platforms in Western markets unveils a competitive landscape where domestic players must fortify their standing. In the U.S and Europe, Amazon’s revenue of $514 billion in 2022 exemplifies its formidable presence. Similarly, regional marketplaces like Otto (Germany), Fnac (France), and PC Componentes (Spain) have established a loyal customer base, courtesy of their localized approach.

These platforms’ core strength lies in their understanding of local consumer preferences, which is mirrored in their tailored offerings and customer-centric services. They have the advantage of established relationships with local suppliers and a well-knit logistical network, ensuring timely deliveries and a range of product offerings that resonate with local tastes and standards.

Moreover, these marketplaces have invested in building trust and providing quality customer service. Their return policies, warranty assurances, and responsive customer service departments have often been cited as factors that contribute to customer loyalty.

On the other hand, Chinese platforms leverage aggressive pricing strategies and a vast product range to entice consumers. However, concerns surrounding product quality, sustainability, and long delivery times can be deterrents for some shoppers.

In the face of cut-throat pricing and a deluge of product options presented by Chinese e-commerce platforms, the focus on quality, community engagement, and localized services could be the linchpin for domestic e-commerce platforms to maintain a firm footing in their respective markets.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'