The Top 10 Marketplaces in Europe (2026)

02/01/26

8'

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren’t just websites; they’re bustling hubs where millions of products find their way to customers across the continent. From well-known giants that stock everything under the sun to niche sites that specialize in specific categories like DIY or electronics, these platforms are more than just shopping destinations.

They’re integral parts of the digital economy, connecting a diverse range of sellers with consumers across Europe, showcasing how shopping has evolved in the digital age. Each marketplace, whether it’s a household name or a regional favorite, plays a crucial role in driving trends and shaping the online retail experience. Discover the top 10 European marketplaces below.

1/ Amazon

In short: generalist marketplace, covers the entirety of Europe, undisputed leader

Unsurprisingly, Amazon is the leading marketplace in Europe. If you want to reach a large number of buyers from all sectors, the best place to start is with this e-commerce giant. In the third quarter of 2025 alone, Amazon’s total net sales reached $180.2 billion globally, reflecting its immense scale. The marketplace is the core of its strategy, with third-party sellers accounting for 62% of all units sold as of Q3 2025, a record high. Amazon’s biggest markets in Europe remain Germany and the UK, and it continues to be a dominant force in France, Italy, and Spain.

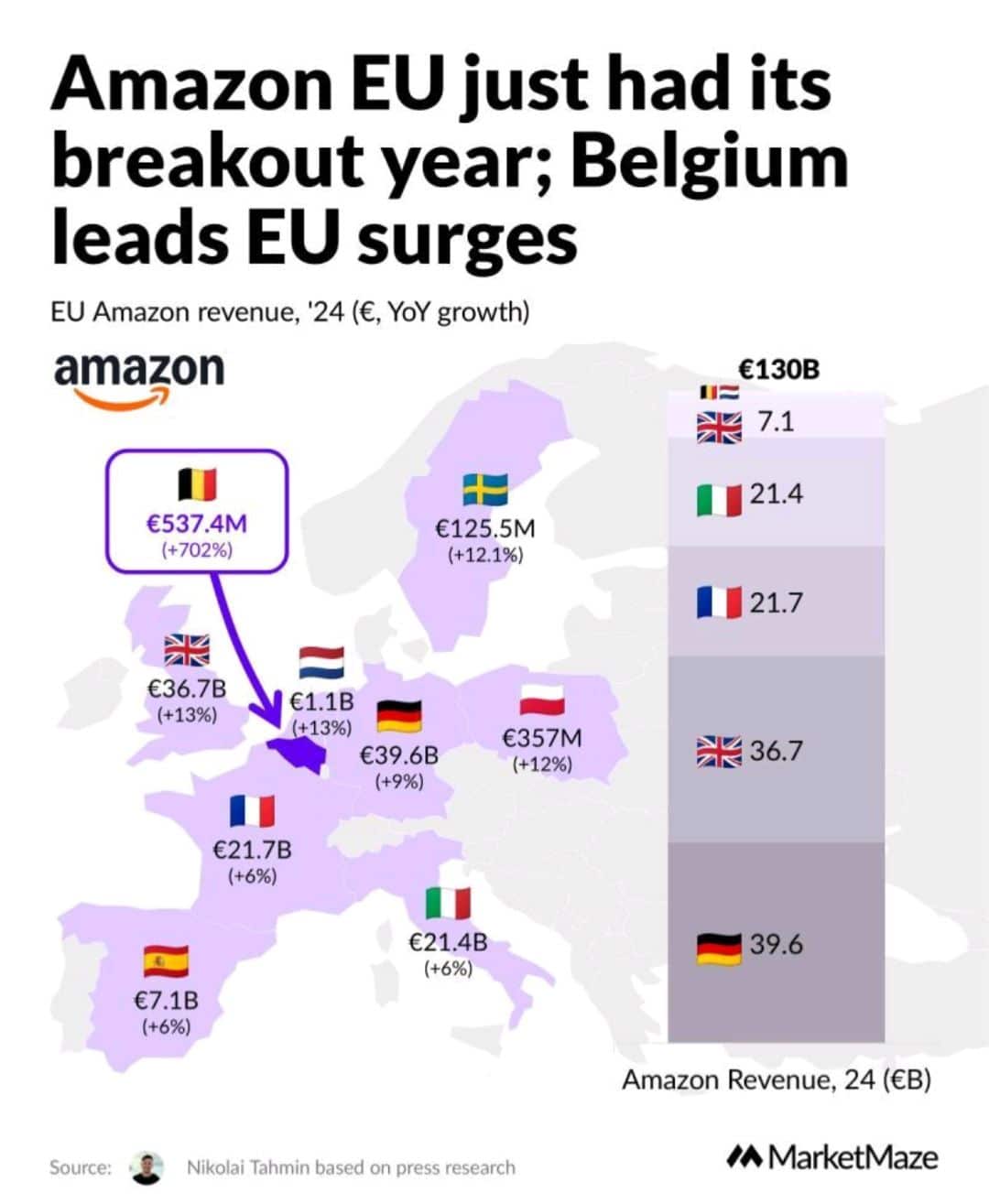

The following chart shows the EU Amazon revenue in 2024 in € and the YoY growth:

Image credit: MarketMaze.

2/ eBay

In short: generalist marketplace, covers the entirety of Europe, very strong in Germany, the UK, and Italy

Together with Amazon, eBay is something of an e-commerce veteran in Europe. Despite facing competition and market fluctuations, eBay’s enduring presence in Europe highlights its resilience. As of its Q3 2025 report, the platform reported a global Gross Merchandise Volume (GMV) of $20.1 billion for the quarter, an increase of 10% year-over-year. The marketplace counts 134 million active buyers over the trailing twelve months and remains a key destination in its core European markets of Germany, the UK, and Italy.

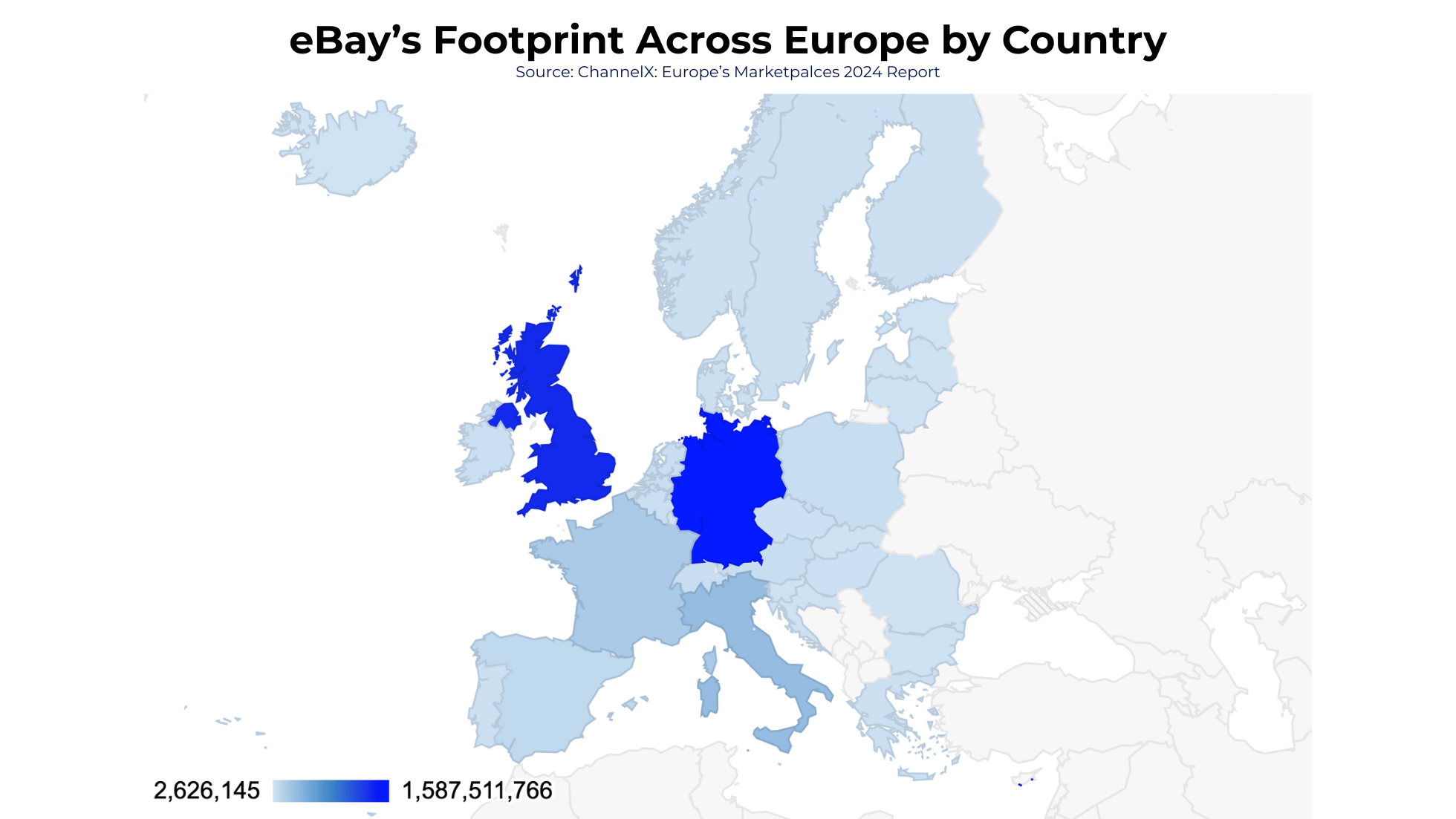

The following map shows eBay’s footprint across Europe by country in 2024:

3/ Allegro

In short: generalist marketplace, covers the east of Europe, very strong in Poland

Allegro is highly popular in Poland and is expanding its influence across Central Europe. In the third quarter of 2025, its Gross Merchandise Value (GMV) grew by 9.8% year-over-year, reaching nearly 17 billion zloty. For the first nine months of 2025, revenue reached 8.54 billion zloty. The platform was originally an auction site when it started in 1999 and has evolved significantly since then. Allegro now forecasts its full-year 2025 GMV growth to be between 8% and 9%.

In terms of visitor traffic, Allegro receives around 157.9 million visitors per month (source: Similarweb), making it one of the top marketplaces in Europe.

4/ Zalando

In short: fashion & beauty marketplace, covers the entirety of Europe, strongest market is still Germany

Sellers and shoppers alike can’t do without Zalando, Europe’s top fashion marketplace. As of mid-2025, the platform reached a new high of 52.9 million active customers. A strategic acquisition of competitor About You significantly scaled its operations; Zalando’s revenue in Q3 2025 surged by 26.5% to hit €3.02 billion. For the full 2025 fiscal year, the newly combined group projects a GMV between €17.2 billion and €17.6 billion, cementing its status as an undisputed fashion e-commerce titan.

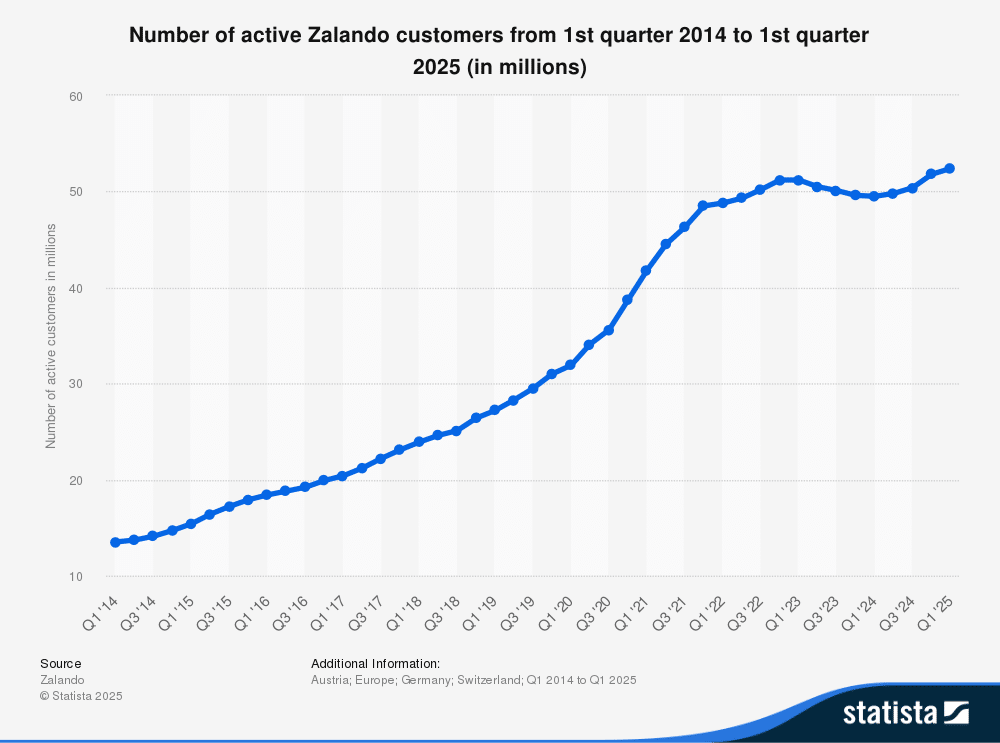

The following chart shows Zalando’s active customers rising steadily from about 14 million in Q1 2014 to just over 52 million in Q1 2025 (source: Statista):

5/ Bol.com

In short: generalist marketplace, covers Benelux, regional leader

Bol.com is the leading online retailer in the Netherlands and Belgium. Its parent company, Ahold Delhaize, reported a strong performance for its online activities in the third quarter of 2025, with European online sales growing by 9.7%. This growth was explicitly driven by the “strong performance at bol,” confirming its continued positive momentum through 2025.

Since its launch in the region, Amazon has been competing with bol.com. For now, bol.com, also because of its heritage and strong local logistics, is leading the game. Selling products in the Netherlands and Belgium only through Amazon is not the best way, look at the regional big players!

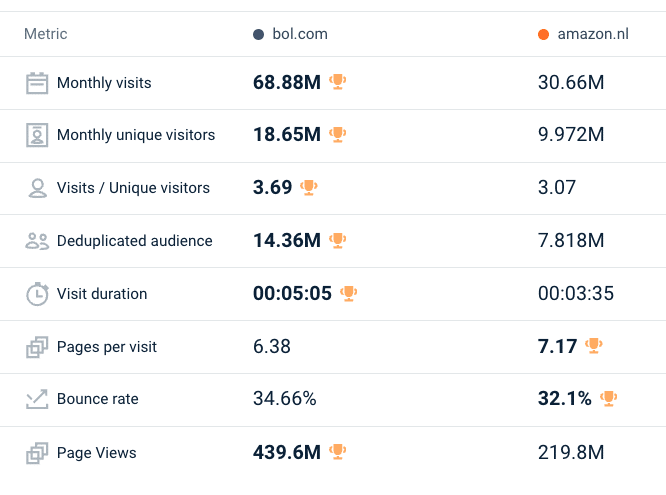

Comparaison between amazon.nl and bol.com in November 2025 (source: Similarweb):

6/ OTTO

In short: generalist marketplace, covers Germany, regional leader after Amazon

In its 2024/25 fiscal year (ending February 2025), the Otto Group demonstrated a strong turnaround, with the OTTO marketplace platform at its core. The platform’s Gross Merchandise Value (GMV) rose by 9% to surpass €7 billion. This performance helped OTTO grow its active customer base by 4% to 12.2 million. The marketplace has successfully refined its strategy by focusing on higher-quality partners, which now number around 6,200, driving marketplace sales up by 24%.

Key data for Otto’s marketplace (Otto Market):

7/ Cdiscount

In short: generalist marketplace, covers France, regional leader after Amazon

Cdiscount remains a big player in France, with a clear focus on its marketplace model. In the third quarter of 2025, the platform’s overall GMV grew by 1%, a performance entirely driven by its third-party marketplace, which saw its own GMV grow by 5.5%. The marketplace now accounts for a record 69% of all product sales on the platform. This strategic shift prioritizes profitability and leverages Cdiscount’s strong position in the Home and Hobby & Leisure categories.

8/ Decathlon

In short: Sports marketplace, covers the entirety of Europe, undisputed leader in sports

As Europe’s number one on the sports market, Decathlon is a powerful marketplace for sellers in the “Sports & Outdoor” category. The company is progressing through 2025 on the back of a strong 2024, where it generated €16.2 billion in revenue and saw its digital sales reach 20% of the total.

Decathlon is actively expanding its marketplace model, which is now open to third-party sellers in over 10 European countries. This makes it the best way to reach active shoppers across the continent in the sports vertical.

Decathlon Webinar

Winning the Game: How to Launch and Scale Your Sports Brand on Decathl…

Learn more9/ Leroy Merlin

In short: DIY marketplace, covers the south of Europe, undisputed leader

Leroy Merlin is one of Europe’s leading DIY and home improvement players, with a strong omnichannel and marketplace presence across Southern Europe, notably in France, Spain, Italy, and Portugal. In the first half of 2025, the platform reported an average of 12.6 million monthly active users across the EU, confirming its sustained digital reach in the home and garden category. Its marketplace, which became profitable in early 2024, now counts 500+ third-party sellers, supporting continued growth into 2025.

While Leroy Merlin does not operate in the UK or Germany, it remains an undisputed reference for DIY shoppers in Southern Europe. For sellers targeting these markets, relying solely on Amazon means missing out on a highly specialized audience. Regional category leaders like Leroy Merlin remain essential channels for scaling DIY and home improvement sales in Europe.

The power when combining Leroy Merlin with Lengow is shown in the video below:

10/ ManoMano

In short: DIY marketplace, covers the entirety of Europe, Leroy Merlin challenger

ManoMano, a specialized online marketplace for DIY, home improvement, and gardening products, has established a significant presence in the European market. The company’s business volume reached the billion-euro range a few years ago and has continued to grow, notably by expanding its B2B offer “ManoManoPro” in markets like France, Spain, Italy, and the UK.

Although ManoMano does not disclose detailed 2025 GMV figures publicly, recent analyses still estimate its marketplace volume in the multi‑billion‑euro bracket, supported by investments in logistics and retail media. For sellers in DIY and garden categories, ManoMano is a key online destination across Western Europe.

Your e-commerce library

Clarins x NetMonitor Success Story

Learn moreSuccess on Marketplaces

Learn moreCompetitive Intelligence

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketplaces

The Top 10 Marketplaces in Europe (2026)

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

02/01/26

8'

Marketing channels

ChatGPT Ads and advertising on GenAI Search Engines: what you need to know

Advertising on generative AI-based search engines (GenAI) marks a new era in digital marketing. After two decades dominated by traditional…

18/01/26

8'

Marketplaces

The French Marketplace Landscape: What Brands Need to Know

France has quietly become Europe's marketplace laboratory. Lengow's exclusive ranking reveals why traditional retailers, not tech giants, dominate the game.…

08/01/26

6'

E-commerce Trends

Google’s Universal Commerce Protocol: The End of E-Commerce as We Know It?

On January 11, 2026, at the NRF Retail's Big Show in New York, Google unveiled the Universal Commerce Protocol (UCP),…

16/01/26

6'

Marketing channels

What the World Is Unboxing on TikTok and Instagram (Haul & Unboxing Index 2025)

Opening a package on camera has become much more than simple entertainment. In 2026, "haul" and "unboxing" videos serve as…

20/01/26

7'