Payment methods: what’s new?

02/05/16

3'

Technology is constantly evolving, as is consumer behaviour. The online payment sector is experiencing a real boom and to cope with these aforementioned changes, a range of businesses such as Mastercard, Amazon and Alibaba have taken matters into their own hands.

Smartphones’ role in the world of e-commerce is increasing. According to a RetailMeNot study, 26% of US transactions in 2015 were made using a mobile device, and E-commerce Foundation’s report released revealed that m-commerce represented 20% of all British online sales in the same time period. It is an undeniable fact: m-commerce is thriving. It is therefore crucial that the e-commerce sector adapts to this new trend. Indeed, several key players have invested in m-commerce, putting mobile devices at the heart of the purchasing process. These days, the whole purchasing process can be done on a smartphone, including payment.

Payment by selfie

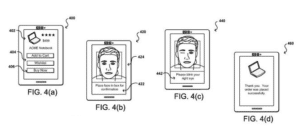

Last year, Alibaba trialed its ‘smile to pay’ payment system, and in February 2016, Mastercard launched Selfie Pay. Now, it is time for the e-commerce giant Amazon to test the selfie system.

Whether you like it or not, selfies are more popular than ever, particularly amongst younger generations. Therefore, integrating selfies into the payment process is great way to appeal to a younger target audience. As well as reaching a new audience, this payment method is simple to use, and doesn’t require users to remember a PIN or password.

During the purchasing process, consumers can opt to pay via selfie. If they decide to do so, they have to take a photo of themselves using the front camera of their smartphone to validate the payment. Unlike passcodes or passwords which can be stolen easily, Amazon guarantees maximum level of security with this system: the customer has to smile or blink so that the recognition system can ensure that they are truly a person, and not simply a photo of the account holder. This reassures shoppers, who are often reluctant to type in or save passcodes on mobile devices.

Talk to Pay

Sight is not the only sense being used to innovate payment methods. To try and strengthen security, one French bank, Banque Postale, has announced the launch of payment using vocal recognition. The bank has been testing the ‘Talk to Pay’ payment system for 3 years, and it works as follows: if the online shopper chooses to pay by vocal recognition, they will receive a phone call during which they have to pronounce a sentence. If approved, the user can then pay by card. The benefit of this payment method is that it can be used on all e-commerce websites. By offering this type of payment method, Banque Postal hopes to reduce the rate of fraud, and provide clients with a new, more secure way of paying.

Over half of all websites do not protect personal data

Payment is still difficult for consumers. Online shoppers are often worried about cybersecurity, and in particular, payment security. Recently, the Boston Consulting Group carried out a study in France, Germany, UK and USA, and consumers judged the following categories as the most important: data confidentiality (78%) and security (72%). Despite these stats, there are still only a few businesses that have put in place security systems. According to Dashlane’s 2016 security barometer, over half of all websites do not protect client personal data adequately.

There are a range of solutions that exist to try and combat this sentiment of insecurity and reassure customers – such as 3D secure. This program works by creating a supplementary security system. During the payment step and after having communicated your bank details, the internet user is redirected towards the site of their bank, where they have to fill in more information to prove their identity.

To sum up, businesses are constantly innovating to be able to offer you the most secure payment systems. The aim? To eradicate barriers to purchase to strengthen and grow customer confidence.

Your e-commerce library

E-commerce for Retailers

Learn moreE-commerce for Brands

Learn moreL'Oréal Luxe Success Story

Learn moreSign up for our newsletter

By submitting this form you authorize Lengow to process your data for the purpose of sending you Lengow newsletters . You have the right to access, rectify and delete this data, to oppose its processing, to limit its use, to render it portable and to define the guidelines relating to its fate in the event of death. You can exercise these rights at any time by writing to dpo@lengow.com

Trending Posts

Marketing channels

Where does Gen Z shop online?

Gen Z online shopping is transforming the digital marketplace, setting trends that redefine what it means to engage with brands…

16/04/24

9'

Marketplaces

The Top 10 Marketplaces in Europe

The e-commerce scene is a vibrant mix of marketplaces in Europe. These aren't just websites; they're bustling hubs where millions…

08/12/23

7'

Marketplaces

Lengow Now Fully Supports Zalando Logistics Solutions ZSS and ZRS

Zalando, one of Europe’s leading fashion marketplaces, continues to raise the bar with its advanced logistics and fulfillment programs. After…

12/12/24

4'

Marketplaces

How to win the Buy Box on Marketplaces (Amazon, Zalando, etc.)

What is the most important thing for marketplace sellers? Exactly, the Buy Box! If you don't have the Buy Box…

02/04/24

10'

Marketplaces

How to Sell on Temu? Best Tips

Emerging under the vast umbrella of PDD Holdings Inc., Temu has skyrocketed in popularity as a shopping sensation from China…

17/08/23

5'